International shipping and logistics market update - Week 46/2024

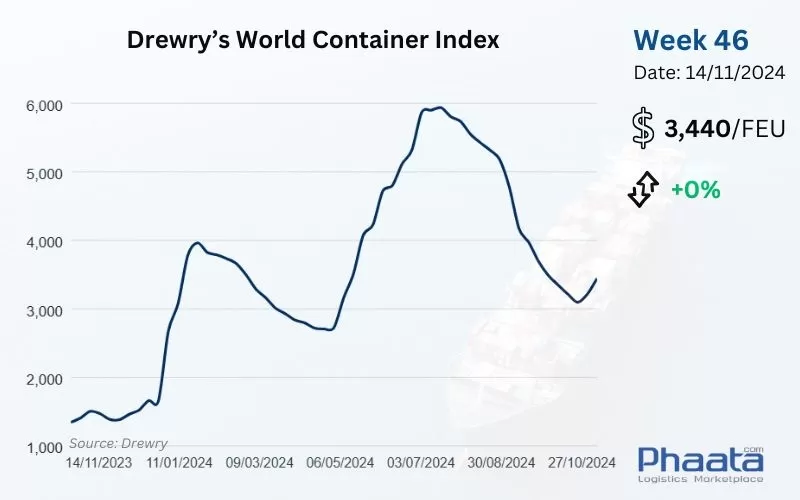

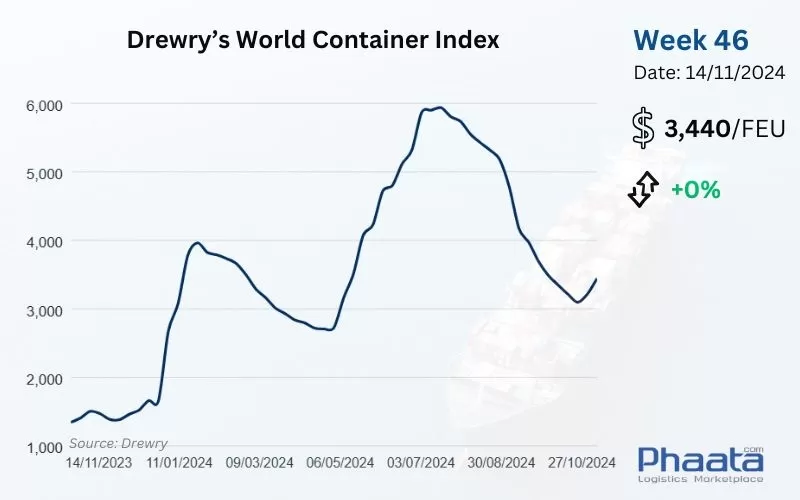

Drewry’s World Container Index for the week of 46/2024 remained stable compared to the previous week, at USD 3,440/FEU. This freight rate index is 142% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 46/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 46/2024 to $5,060/FEU, down 1.58% week-on-week and 8.23% month-on-month, according to Xeneta data.

Voyage volumes from Asia remained high in the first two weeks of November, partly due to anticipated rate hikes and a potential ILA strike expected in early January, along with the 2025 Lunar New Year. Rates continued to fluctuate on routes between China and Southeast Asia, putting increased price pressure on routes to the US West Coast.

East Coast sailings are at normal levels, but some carriers and service lines are full or facing capacity constraints through November.

Flat rates and Peak Season Surcharges (PSS) remained stable in the first half of the month, although some PSS adjustments are likely due to short-term market volatility.

Canada:

Canadian ports in Montreal and Vancouver are reopening after Canadian Labour Minister Steven MacKinnon took decisive action to end the strike on November 12.

Meanwhile, the British Columbia Port Workers Union has announced plans to challenge both the Canada Labour Relations Board’s order ending the strike action and the Minister’s forced arbitration.

In the United States, ILA announced on Wednesday (November 13) that it had ended negotiations with USMX after talks on Tuesday in New Jersey stalled over proposals related to automation and semi-automation at ports. The two sides had aimed to reach an agreement on a new six-year main contract.

Asia-US West Coast Freight rate | Week 46/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 46/2024 fell to $4,048/FEU, down 1.22% from the previous week, up 15.49% from the previous month, according to Xeneta data.

Space is limited in the second half of November due to many canceled sailings and the number of containers being transferred to later sailings. Carriers are expected to cut 15-18% of capacity in November, with ten sailing cancellations announced so far, which will continue to impact market supply.

With bookings postponed to avoid arrivals during the Christmas and New Year holidays in Europe, the November GRI may not materialize and carriers are instead preparing for the December GRI, which is expected to be at USD3,900/20'GP and USD6,000/40'GP.

Along with the expected price increase, SCFI increased by USD100/TEU to USD2,541/TEU in week 46. Another small increase is expected next week, with rates likely to stabilize or decline based on the December GRI developments.

There are sporadic equipment shortages at major ports in China but they are still manageable. For shippers who need to secure space and an expected time of departure (ETD) can consider choosing the "premium" service of the shipping lines.

Asia-Northern Europe Freight rate | Week 46/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia in week 46/2024 continued to increase slightly by 1.70% compared to the previous week, reaching USD 718/FEU, a price increase of 2.43% compared to the previous month, according to Xeneta data.

US West Coast - Asia Freight rate | Week 46/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 46/2024 decreased slightly to USD 352/FEU, down 0.56% compared to the previous week, and down 9.97% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 46/2024 (Image: Phaata.com)

Read more:

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp) Drewry’s World Container Index Week 45/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 45/2024 (Photo: Phaata | Source: Drewry).webp)

.webp)

.webp)

.webp)