International shipping and logistics market update - Week 44/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 44/2024.

International shipping and logistics market update - Week 44/2024

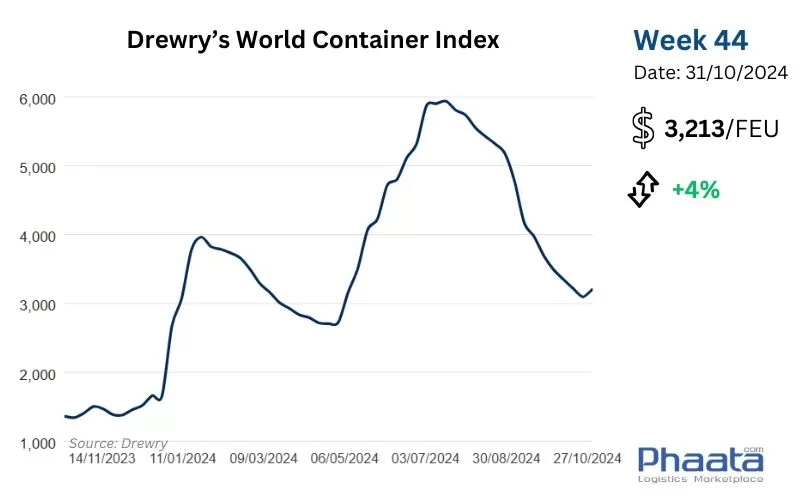

Drewry’s World Container Index for the week of 44/2024, reversed up 4% from the previous week, to $3,213. This freight rate index is 126% higher than the average of 2019 before the pandemic ($1,420).

Drewry’s World Container Index Week 44/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 44/2024 decreased slightly to USD 5,190/FEU, equivalent to a decrease of 0.17% compared to the previous week, down 10.67% compared to the previous month, according to Xeneta data.

Demand in early November recovered significantly after a lull following the Golden Week in China. East Coast arrival volumes are returning to normal levels, with some carriers and service lines either fully booked or limited in capacity through the end of November.

Contracted fixed rates remain stable, and the Peak Season Surcharge (PSS) remains in place and is expected to extend depending on further changes.

Asia-US West Coast Freight rate | Week 44/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 44/2024 reversed slightly to $3,278/FEU, up 1.33% week-on-week, down 25.06% month-on-month, according to Xeneta data.

Shippers are stepping up bookings to avoid increased freight costs for late November departures, with vessels expected to be full in the coming weeks.

Carriers are expected to cut capacity by 15-18% in November, with ten blanked sailings announced so far, which will continue to impact market supply.

The General Rate Increase (GRI) implemented in the first half of November is likely to remain at around $4,400-4,500 per FEU. Carriers are planning for the second half of November GRI at around $5,400 per FEU.

The Shanghai Containerized Freight Index (SCFI) increased by $277 per TEU in week 44 and is expected to see a further increase in week 45 to reflect the GRI adjustments. With vessel name bookings becoming increasingly limited, carriers will relaunch premium services starting November 1 at $2,000 per container for ETD (Estimated Time of Departure) needs.

Asia-Northern Europe Freight rate | Week 44/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia in week 44/2024 increased slightly by 1.01% week-on-week to $701/FEU, up 8.01% month-on-month, according to Xeneta data.

US West Coast - Asia Freight rate | Week 43/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 44/2024 remained stable at USD 385/FEU, down 17.56% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 44/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Red Sea Crisis Brings ‘Vessel Bunching’ to Pandemic Peak

- ILA union at US East and Gulf Coast ports to resume contract talks in November

- Suez and Panama Canal Disruptions Threaten Global Trade and Development: UNCTAD

- Cargo volumes soar at Singapore Changi Airport

- Maersk raises 2024 profit forecast

- COSCO schedules: Vietnam - North America in Nov 2024

- SITC updates Vietnam-Intra Asia sailing schedules in Nov 2024

- Pacific Lines updates domestic sailing schedules in Nov 2024

- International shipping and logistics market update - Week 43/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)