Suez and Panama Canal Disruptions Threaten Global Trade and Development: UNCTAD

UNCTAD has warned of serious disruptions to global trade due to challenges at the Suez and Panama Canals, calling for urgent action to protect supply chains and mitigate risks.

A container ship passing through the Suez Canal (Source: TradeWindsNews)

These disruptions are straining supply chains, pushing up prices and reshaping global trade patterns, with vulnerable economies hit hardest, according to UNCTAD's latest analysis.

Global trade is facing significant disruptions as two of the world's most important maritime chokepoints - the Suez and Panama Canals - face serious challenges due to geopolitical tensions and climate-related risks.

In addition to straining global supply chains and undermining economic growth, these disruptions are also pushing up prices, reshaping trade patterns, upsetting energy flows and food supplies, and threatening to exacerbate food security risks, particularly in vulnerable economies.

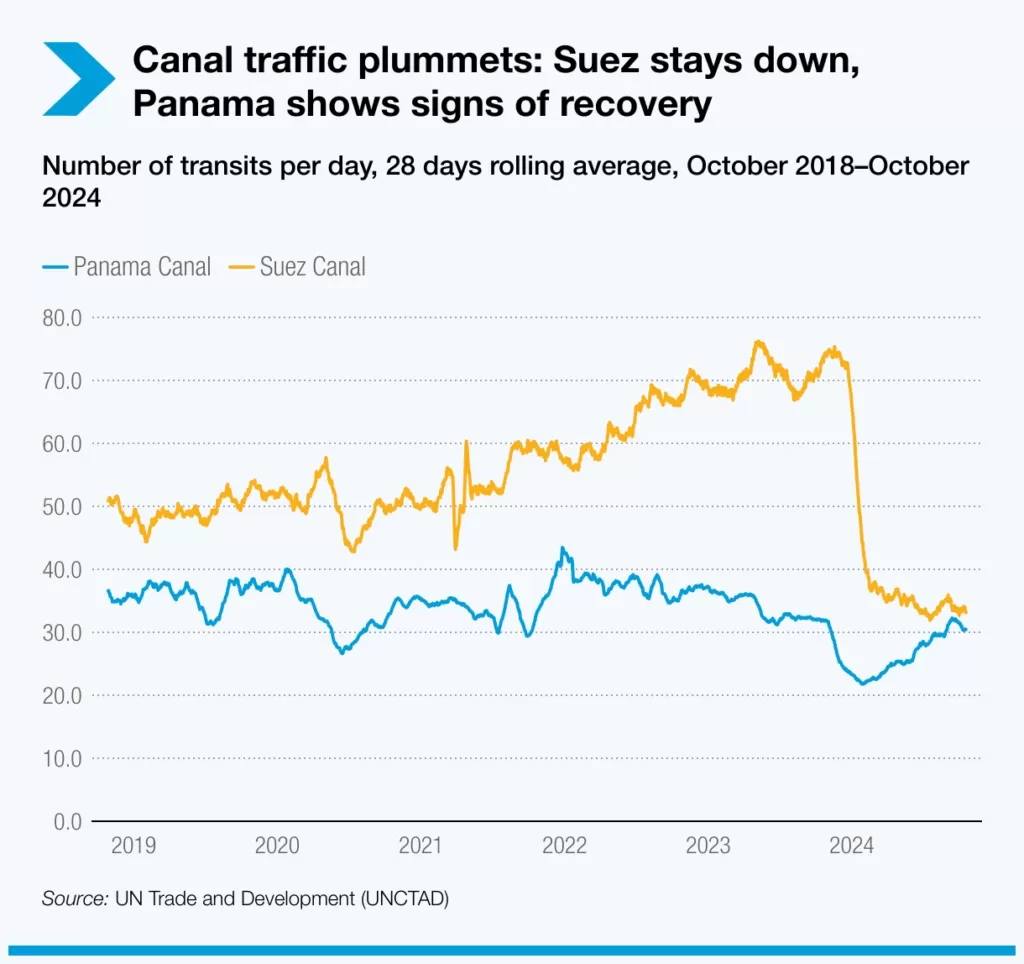

Canal traffic plummets

The number of cargo ships transiting the Suez Canal has bottomed out. The latest available data shows that as of mid-October 2024, the average of 33 transits per day was 57% below the previous peak, 55% below a year ago, and just 4% above the lowest four-week average on record.

By contrast, traffic through the Panama Canal is showing signs of recovery. As of mid-October 2024, the four-week average was 30 transits per day, 30% below the previous peak and just 4% below a year ago. Importantly, it was 40% higher than the lowest transit level recorded in early 2024.

Diversion of vessel capacity around Africa's Cape of Good Hope has increased by 89%. While this keeps goods moving, it significantly increases costs, delays and carbon emissions.

For example, a typical large container ship carrying 20,000–24,000 TEUs on the Far East-Europe route incurs an additional $400,000 in emissions costs per voyage when diverted around Africa instead of using the Suez Canal, according to the European Union's Emissions Trading System (ETS).

Suez Canal traffic plummets ( Source: Container-News)

Longer Routes, Higher Costs

Longer routes have led to increased port congestion, fuel consumption, crew wages, insurance premiums and piracy risks, while increasing overall costs and greenhouse gas emissions.

The global Ton-Mile Index is set to increase by 4.2% in 2023, further straining supply chains. By mid-2024, diversions away from the Red Sea and Panama Canal have increased global ship demand by 3% and container ship demand by 12%.

Port hubs such as Singapore and major Mediterranean ports are struggling with increased demand for transshipment services, adding to congestion and delays globally.

Source: Container-News

Vulnerable economies hit hardest

Small Island Developing States (SIDS) and Least Developed Countries (LDCs) are bearing the brunt of these disruptions.

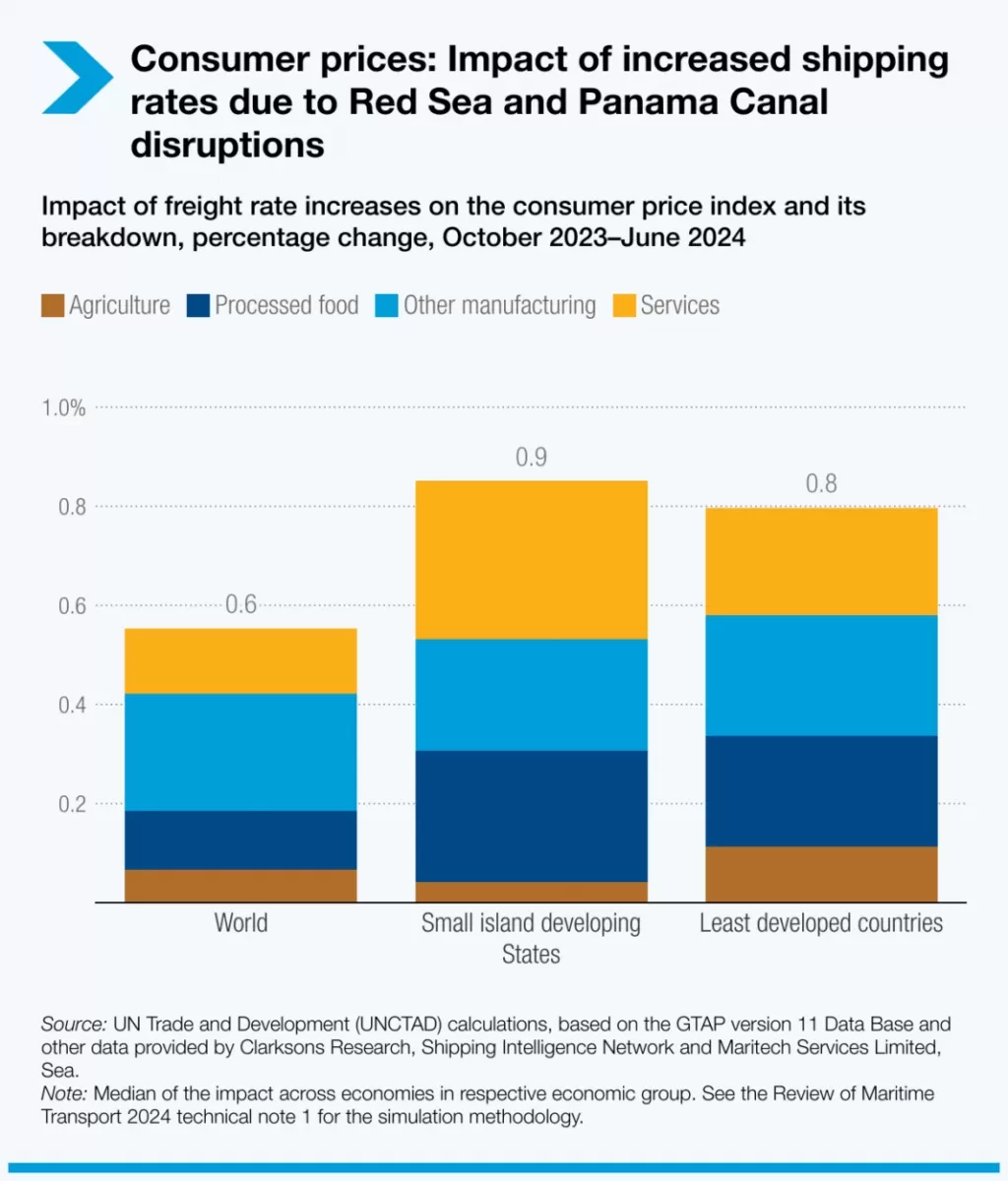

If the observed container freight rate increases from October 2023 to June 2024 – due to the Red Sea crisis and Panama Canal disruption – persist until the end of 2025, global consumer prices could rise by 0.6% by the end of 2025.

SIDS would be hit hardest, potentially facing a 0.9% increase, with processed food prices rising by 1.3%. These vulnerable economies, which rely heavily on shipping for essential imports, have seen their maritime connectivity decline by 9% over the past decade, making them ten times less connected to the global shipping network than non-SIDS countries.

Energy supplies are also at risk, as disruptions on key sea lanes affect the transport of oil, gas and other vital energy commodities.

Rapid action needed to mitigate vulnerabilities in global chokepoints

To address these growing challenges, the United Nations Conference on Trade and Development (UNCTAD) Maritime Transport Report 2024 calls for rapid and coordinated action to protect global trade and mitigate the impact of these vulnerabilities.

The organization emphasizes the need to:

- Strengthen international cooperation and improve monitoring systems to ensure shipping lanes operate properly, provide early warnings and enable rapid and efficient diversions.

- Diversify shipping lanes and support regional trade initiatives to reduce dependence on long-haul routes and promote intra-regional trade flows.

- Urgent and robust investment in infrastructure at key choke points to mitigate the impact of climate and conflict risks.

The challenges of the Suez and Panama Canals highlight the vulnerability of global supply chains to disruptions, including those caused by increasing climate and geopolitical risks.

With maritime transport accounting for more than 80% of global trade, ensuring the resilience of maritime infrastructure and accelerating the transition to low-carbon shipping are critical to maintaining the flow of goods around the world.

Read more:

- Port of Long Beach Reports Record Container Volume

- Sea-Intelligence Reports Worsening Global Trade Imbalance

- Shippers advised to delay airfreight tenders until after turbulent peak season ends

- Air freight rates remain high despite falling demand during Golden Week

- Sea-Intelligence forecasts 10-17% capacity cut due to US East Coast port strike

- Marketing Solution: Advertise Shipping Schedules with Phaata Logistics Marketplace

Source: Phaata.com (via UNCTAD / ContainerNews)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)