Sea-Intelligence forecasts 10-17% capacity cut due to US East Coast port strike

The US East Coast port strike reduced shipping capacity from Asia, Northern Europe and the Mediterranean, with exporters expected to brace for temporary capacity shortages.

.webp)

Port of New York & New Jersey ( Photo: World Cargo News)

With the USEC port strike now over, Sea-Intelligence observes that the impact is much less severe than initially feared. However, the three-day closure did lead to vessel queues, which is expected to negatively affect capacity availability in the origin regions.

The most optimistic view from Danish analysts is that the impact will be limited to three days of strikes, but in reality it will take some time to clear the backlog of vessels and containers. Sea-Intelligence believes that the impact is likely to be equivalent to a week of lost capacity.

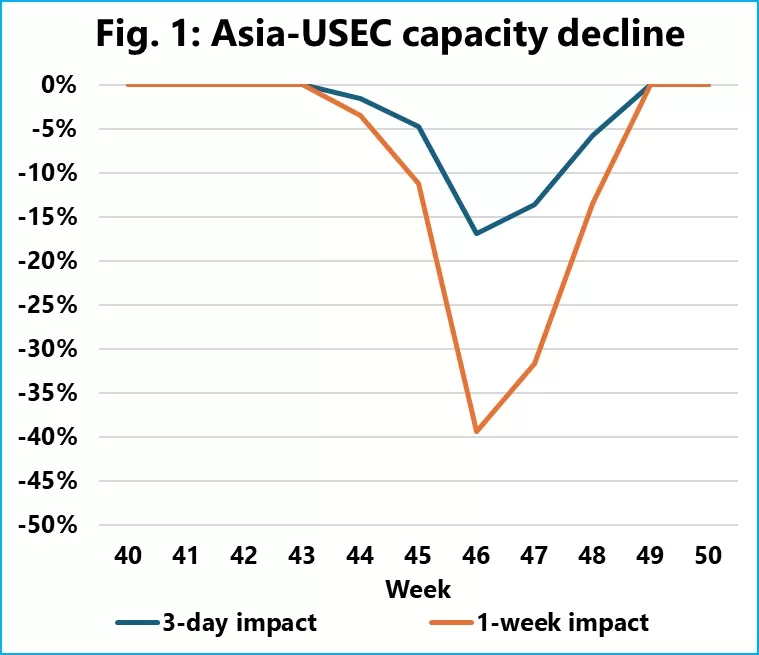

The chart shows the relative capacity loss for Asian exporters, comparing the impact over three days and one week with a baseline scenario without strikes.

“Here we see a 17% drop in capacity offered from Asia to US East Coast in the 46th week, if the impact is limited to the minimum of vessels being stuck in the US East Coast for just three days, while if it takes a full week to get the vessel backlog cleared, then we approach a 40% capacity loss for a short period,” said Alan Murphy, CEO Sea-Intelligence.

Similarly, for the North European to US East Coast trades, exporters should prepare for a 14% capacity reduction in week 44, rising to 30% if a week is needed to clear congestion. For the Mediterranean to US East Coast trades, a three-day impact translates into a 10% capacity reduction in week 43, rising to 25% if the impact lasts a week.

“Will the shipping lines take action to mitigate this capacity shortfall?”” Murphy asks, answering his own question: “We find this to be quite unlikely.”

“Exporters, especially in Asia, North Europe, and the Mediterranean, should therefore prepare for a temporary, short-term crunch in capacity.,” said Murphy.

Read more:

- Hurricane Milton: Florida Ports Close; South Carolina Restricts Shipping

- Ocean freight rates fall and air freight rates rise as ILA strike ends

- Global shipping stocks plunge after US port strike ends

- International shipping and logistics market update - Week 40/2024

- Recession fears grow as US port strike enters third day

- US East Coast Strike Begins With ‘Chaos’ Forecast

- US East Coast Strike Could Disrupt Global Shipping

Source: Phaata.com (via Sea-Intelligence)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)