International shipping and logistics market update - Week 40/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 40/2024.

International shipping and logistics market update - Week 40/2024

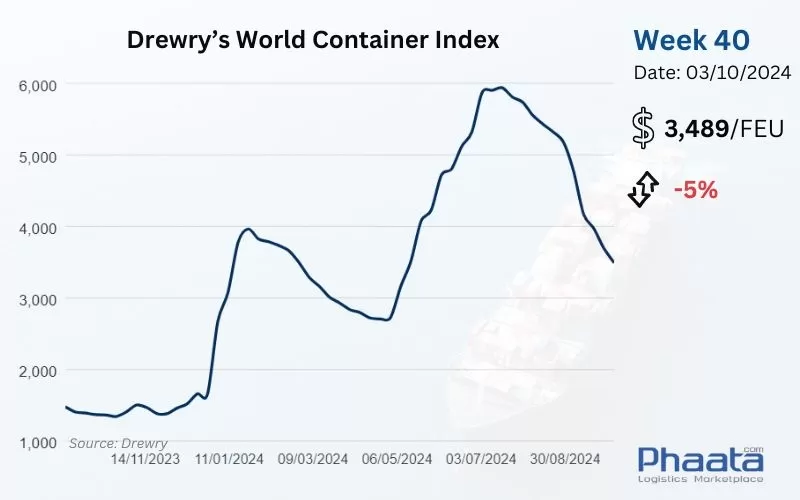

Drewry’s World Container Index for the week of 40/2024 continued to decline sharply by 5% compared to the previous week, to USD 3,489. This freight rate index is 146% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 40/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

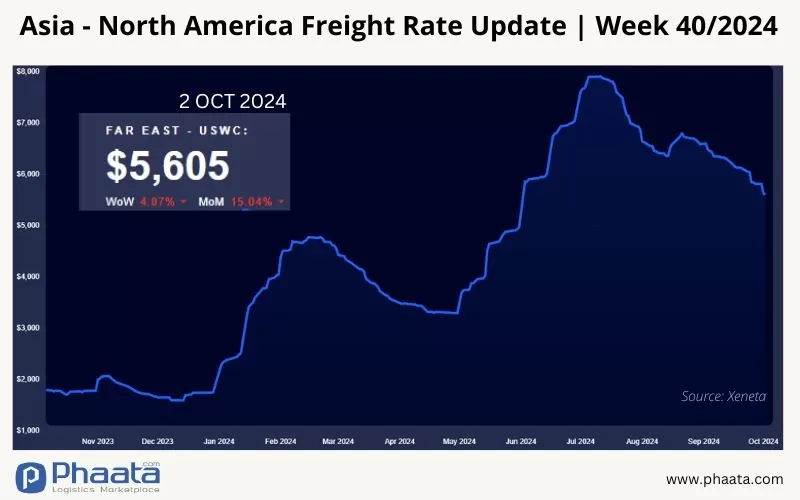

Ocean freight rates from Asia to the West Coast of North America in week 40/2024 continued to decline to USD 5,605/FEU, equivalent to a decrease of 4.07% compared to the previous week, down 15.04% compared to the previous month, according to Xeneta data.

Current high inventory levels could reduce importers’ appetite for additional shipments in the coming weeks, causing freight rates to plummet. There is no indication that volumes will pick up at this time, even before Golden Week.

Carriers are implementing cancellation plans that will impact Weeks 38 to 41 to accommodate reduced capacity on the trade. Changes to shipping schedules or transit times are expected, especially for feeder connections, as cancellations could result in shipments being transferred to subsequent sailings.

The International Longshoremen’s Association (ILA) has officially called a strike starting October 1 across East Coast and Gulf Coast, shutting down major ports from Maine to Texas. Carriers have begun declaring force majeure on certain vessels.

In response to the ILA strike, some BCOs are shifting some of their volumes to the US West Coast for contingency planning.

Carriers have announced port congestion surcharges, demurrage and detention (D&D) regulations, and terminal status updates following Golden Week. This could lead to further disruptions to operations, increased port congestion, and challenges deploying vessels to East Coast and Gulf Coast schedules. There may also be equipment shortages at origin ports, depending on the duration of the strike-affected ports.

Spot rates extended through mid-October. Terminals have announced booking restrictions to East Coast terminals via Los Angeles, leading to carriers suspending bookings.

Long-term contracted fixed rates: Peak Season Surcharge (PSS) will remain unchanged through October.

Asia-US West Coast Freight rate | Week 40/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 40/2024 continued to fall sharply to USD 3,829/FEU, equivalent to a decrease of 18.43% compared to the previous week, a decrease of 44.77% compared to the previous month, according to Xeneta data.

Demand is falling sharply as China is on holiday, carriers are actively reducing freight rates to find cargo.

Spot freight rates continued to fall in the first half of October. Shipping lines are now more proactive in adjusting prices to find cargo to optimize vessel usage efficiency.

While the equipment shortage has largely been resolved, some ports of loading (POLs) with low direct calls are still likely to have equipment shortages for certain container types, such as 20’GP and 45’HC.

Asia-Northern Europe Freight rate | Week 40/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia remained stable at $646/FEU in week 40/2024 increased sharply by 11.92% compared to the previous week, reaching USD 723/FEU, a 6.17% increase compared to the previous month, according to Xeneta data.

Capacity has been reduced on routes from the US to the Indian subcontinent, Middle Eastern ports and Northern European ports, related to vessel shortages and cancelled sailings.

In October, freight rates are forecast to increase on major routes from US East Coast and Gulf Coast ports.

To ensure smooth export shipments, Phaata.com advises shippers to book 2 weeks in advance for coastal loading shipments and 3-4 weeks or more for inland rail loading shipments.

.webp)

US West Coast - Asia Freight rate | Week 40/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 40/2024 fluctuated sharply to 341 USD/FEU, equivalent to a decrease of 26.98% compared to the previous week, a decrease of 27.45% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 40/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Global shipping stocks plunge after US port strike ends

- Global shipping stocks plunge after US port strike ends

- US East Coast Strike Begins With ‘Chaos’ Forecast

- US East Coast Strike Could Disrupt Global Shipping

- COSCO schedules: Vietnam - North America in Oct 2024

- SITC updates Vietnam-Intra Asia sailing schedules in Oct 2024

- Pacific Lines updates domestic sailing schedules in Oct 2024

- International shipping and logistics market update - Week 39/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)