International shipping and logistics market update - Week 43/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 43/2024.

International shipping and logistics market update - Week 43/2024

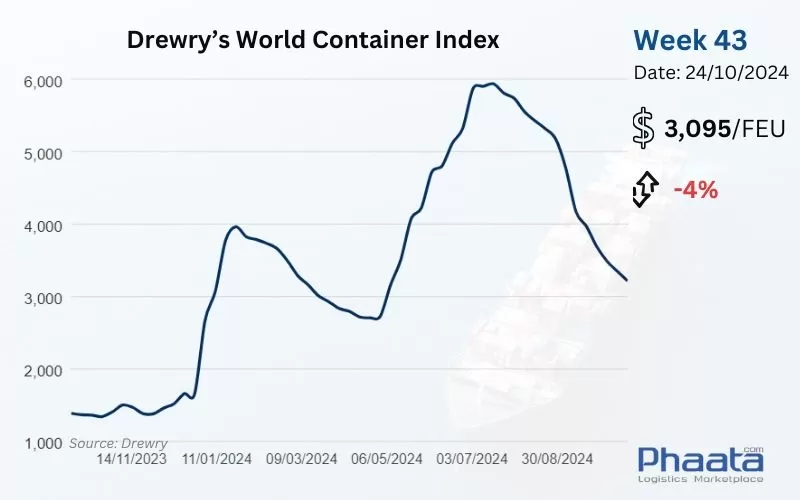

Drewry’s World Container Index for the week of 43/2024 continued to decrease by 4% compared to the previous week, to USD 3,095. This freight rate index is 126% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 43/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 43/2024 to USD 5,199/FEU, down 2.70% week-on-week and 14.05% month-on-month, according to Xeneta data.

Ocean freight volumes have recovered after Golden Week but overall market demand remains low. As a result, the General Rate Increase (GRI) has been withdrawn by shipping lines and freight rates have been extended until the end of October, with rates falling on one route in particular.

Spaces are available for both the East and West Coasts as the impact of the ILA strike has been negligible. All strike-related surcharges have been canceled.

Contractual fixed rates remain in place, and Peak Season Surcharges (PSS) remain in place and are expected to extend subject to further changes.

Asia-US West Coast Freight rate | Week 43/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 43/2024 to USD 3,235/FEU, however the rate of decline has slowed, equivalent to a decrease of 1.37% compared to the previous week, down 33.24% compared to the previous month, according to Xeneta data.

Demand recovery after Golden Week has been slow. However, bookings for weeks 43 and 44 are picking up as shippers look to avoid November rate increases (carriers are preparing to implement a general GRI rate increase in November).

Spaces began to fill in the second half of October, after carriers cut 15% of capacity due to sailing cancellations. Three alliances had previously announced blanked sailings for November, mainly due to vessel delays and efforts to balance supply and demand to prevent a market downturn.

While gear shortages are generally improving, some less directly served ports of loading (POLs) are still expecting occasional gear shortages due to rerouting and blanked sailings.

Asia-Northern Europe Freight rate | Week 43/2024 (Image: Phaata.com)

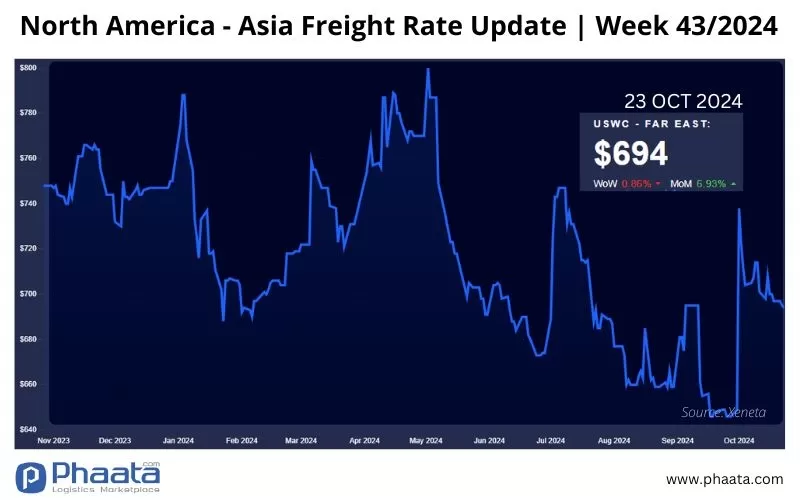

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia in week 43/2024 continued to decrease slightly by 0.86% compared to the previous week, to 694 USD/FEU, this price increased by 6.93% compared to the previous month, according to Xeneta data.

US West Coast - Asia Freight rate | Week 43/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 43/2024 decreased slightly to 385 USD/FEU, equivalent to a decrease of 0.26% compared to the previous week, a decrease of 17.56% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 43/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Suez and Panama Canal Disruptions Threaten Global Trade and Development: UNCTAD

- Cargo volumes soar at Singapore Changi Airport

- Maersk raises 2024 profit forecast

- International shipping and logistics market update - Week 42/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)