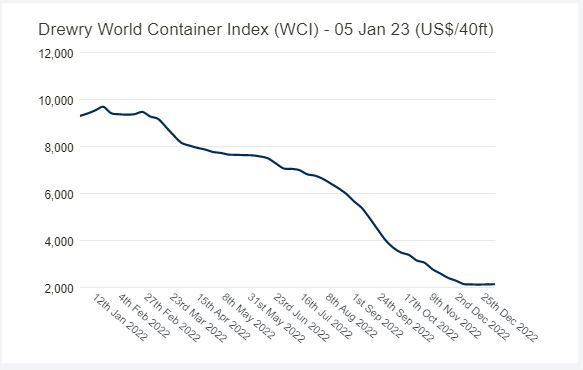

Spot container freight rates end a 43-week series of declines

The Drewry World Container Index (WCI) finally turned green in its first report of 2023, ending at $2,135, recording a 0.7% gain, after overcoming a slump decrease since February 2022.

Drewry's WCI World Container Index (Source: Drewry)

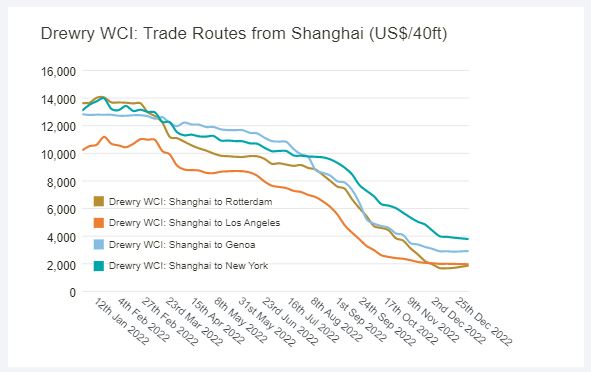

The index was mainly driven by a 10% increase in China-Rotterdam freight rate. The Shanghai-Genoa rate is supported with 2% increments. While rates on other routes fell slightly, transatlantic rates on the Rotterdam-New York route fell 6%.

Drewry's Shanghai Container Freight Index (Source: Drewry)

While the market is anticipating a downward trend in freight rates until mid-2023, due to the impact of the decline occurring during the Lunar New Year, inflation in Europe and interest rates in the US.

The Global Supply Chain Pressures Index (GCSPI) bounced off its September lows to a record 1.20 for November 2022, mainly influenced by delivery times in China. The easing of Zero-Covid policy in China could be a move that spurs change action on trade.

The Shanghai Containerized Freight Index (SCFI) has broken its downward streak since the 2022 Chinese New Year, in its last report recorded for 2022, while the Freightos Global Index (FBX) recorded gains of more than 6% in the latest weekly quote.

It should also be noted that blanked sailings have hit a record high (17%) compared to the 12-13% average witnessed over the past few weeks.

Read more:

Source: Phaata.com (According to ContainerNews)

Phaata - Vietnam's First Global Logistics Marketplace

► Find Better Freight Rates & Logistics Services

.png)

.jpg)