Top 10 largest container shipping lines in the world control 85% of the market

When all the newly-ordered vessels are delivered, MSC will become the world's largest container shipping line and far ahead of other shipping lines.

A container vessel of MSC

Strong consolidation in the container shipping sector is something that tankers and bulk carriers can only dream of. The latest data from Alphaliner shows how consolidated the shipping lines are, how soon rankings will change, and how new shipbuilding orders will drive competition among shipping lines.

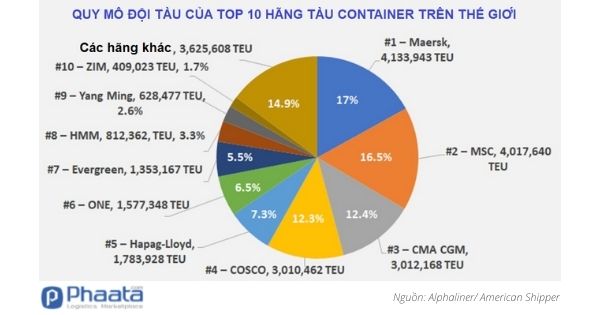

The world's top 10 container shipping lines are currently exploiting 85% of the total global shipping capacity. The top 4 carrier groups including Maersk, MSC, CMA CGM and COSCO control more than half of capacity (58%). The top 7 carriers, including Hapag-Lloyd, ONE and Evergreen, control 78% of global capacity.

The fleet size of the Top 10 container shipping lines in the world

The level of fleet concentration is greatly increased thanks to the existence of three alliances including 2M, Ocean Alliance and THE Alliance, sharing ships on the main East-West shipping route. These three alliances have a total of 9 members and are all among the top 10 shipping lines in the world.

Strategic steps of MSC

The strategic move puts MSC in a position to become the world's largest container shipping company, topping the rankings.

The Swiss-based shipping line has been very active in the used ship market. MSC has purchased 49 more ships since August last year. The company has also been very busy in the charter market and is also very active in the new vessel order market.

With three used ships that the company recently purchased, MSC has just passed the milestone of a fleet of 4 million TEU (equivalent to a 20-foot container). Alphaliner notes that MSC's fleet has grown by 4% since the start of the year alone.

If counting new-to-order ships, MSC overtook Maersk a few months ago to become the world's largest carrier. Even for the fleet that is in operation, MSC will soon take the crown.

The usurpation could even happen before the end of the year, as MSC will receive four more 23,656 TEU 'megamax' newly built ships in the coming months, Alphaliner said.

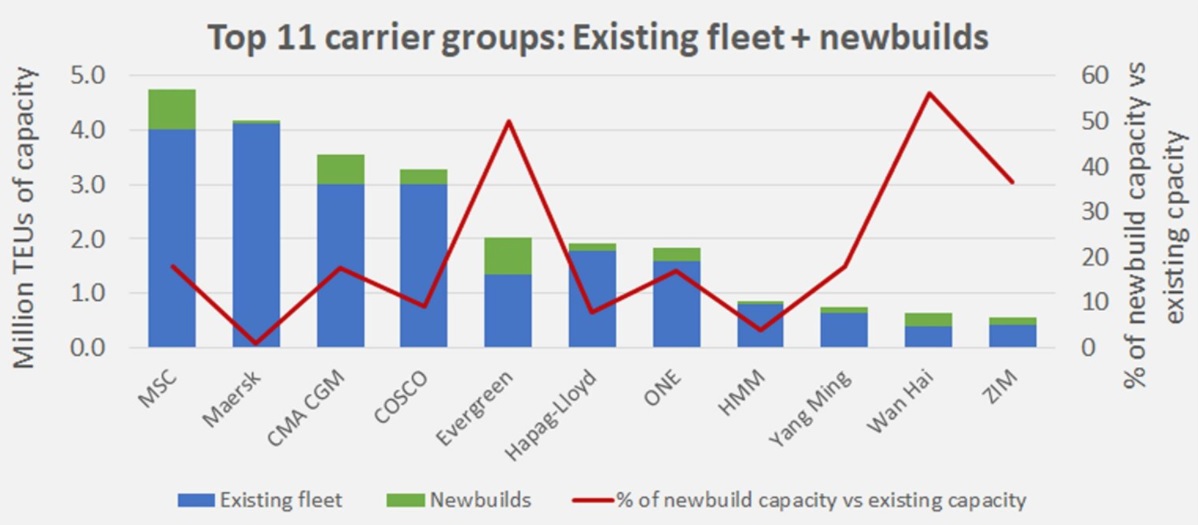

Newly built vessel capacity helps increase market share of carriers

When all the newly built to order ships are delivered, the MSC will outpace the others.

While the total capacity of the operating fleet and the newly built ships is not equivalent to future capacity (as many orders may be temporary and many ships may continue to lease or cease, bought, sold or discarded), but it is also an indicator of future rankings.

Maersk has the fewest new shipbuilding orders among all major shipping lines, with a new build capacity of just 0.9% of current operating capacity. In contrast, according to Alphaliner data, MSC's new shipbuilding orders account for 18% of the active fleet. The total capacity of MSC's existing and newly built vessels is 4,742,400 TEU, 14% and 34% higher than Maersk and CMA CGM respectively, by the same calculation.

Top 11 shipping lines after receiving new ships on order (Source: Alphaliner / American Shipper)

Beyond the 'who has the biggest fleet' competition between Maersk and MSC, the broader and more important story is that some of the world's top carriers will be the dominant players in new capacity by 2023-24, placed orders starting Q4 2020.

Among other leading carriers, Wan Hai's ratio of new order capacity on existing fleet is 56%, Evergreen 50%, ZIM 37%, CMA CGM and Yang Ming 18%, ONE 17% and COSCO 9%.

Part of the capacity from this new vessel is to replace older vessels, however the new build data implies that capacity control of the top 10 vessels will increase from the current 85% to even higher in the future.

Phaata.com (Source: According to FreightWaves)

Phaata.com - The first international logistics marketplace in Vietnam

► Where to find the most Freight rates and Freight Forwarders

.png)

.jpg)