OOCL's profit doubles in the first half of 2022

OOCL posted a profit of $5.7 billion in the first half of 2022, more than double the same period a year ago, even despite a drop in container volume.

Container ship OOCL Korea (Photo: OOCL)

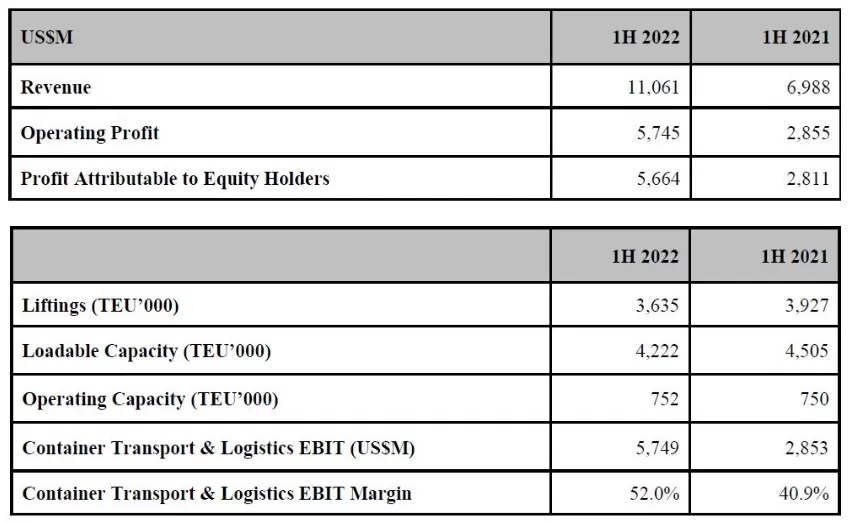

Orient Overseas Container Line (OOCL) net profit for the first half of 2022 more than doubled year-on-year in 2021 to $5.7 billion, even as the Hong Kong-based carrier suffered container volume cuts when the shipping market is adjusted.

During the first six months of 2022, OOCL - acquired by COSCO in 2018 - had a shipping volume of 3.64 million TEU, down slightly from 3.93 million TEU in the first half of 2021.

In the first half of 2022, OOCL generated the highest half-year revenue in its history, reaching $11.06 billion, up 58% from the $6.99 billion achieved in the first half of 2021.

“As has been the case for over two years, our market is neither enjoying an extraordinary demand boom, nor suffering from any lack of vessels in deployment. Rather, levels of demand, which are better than expected but not phenomenally strong, continue to outpace the effective level of supply, which is under significant downward pressure from a combination of congestion, delays and disruptions," OOCL said.

OOCL added, “These market forces pushed freight rates upwards on most trade lanes, and it is these market forces, in addition to our usual careful attention to cost control, that have driven the strong profitability that has been achieved during the period.”

Report on financial and operating results of OOCL in H1-2022 (Source: OOCL)

Like other shipping lines in the same industry, OOCL warns that until the third quarter of this year, there has not been a strong increase in cargo volume, even though this is the traditional peak period for container shipping. While retailers in the US and Europe tend to stock up on Christmas goods this time around, inflation and economic uncertainty amid the ongoing Russia-Ukraine conflict could be the factors that reduce production.

OOCK commented, “Undoubtedly, there’re legitimate concerns about the impact of inflation and interest rate rises on consumer spending in many key economies. Even if US retailers’ inventory-to-sales ratios remain low, we note some year-on-year increases in absolute levels of US inventory. Indeed, some larger US retailers have specifically reported that they are holding higher levels of inventory."

“At the time of writing, our ships are sailing full on our main long-haul trade lanes, and are forecast to continue to be fully loaded in the coming weeks. There has not been much evidence, so far, of the kind of significant seasonal uptick that is often a feature of the traditional Transpacific peak season. We continue to monitor the situation closely.”

See more:

- ZIM's profit exceeds 3 billion USD in the first half of 2022

- Yang Ming announced a profit of 4 billion USD in the first 6 months of 2022

- Shipping lines continue to reap record profits, HMM achieved a profit of USD 4.6 billion in H1 2022

Source: Phaata.com (According to OOCL)

Phaata - Vietnam's First Global Logistics Marketplace

► Find Better Freight Rates & Logistics Services

.webp)

.webp)

.webp)

.webp)