International shipping and logistics market update - Week 24/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 24/2024.

International shipping and logistics market update - Week 24/2024

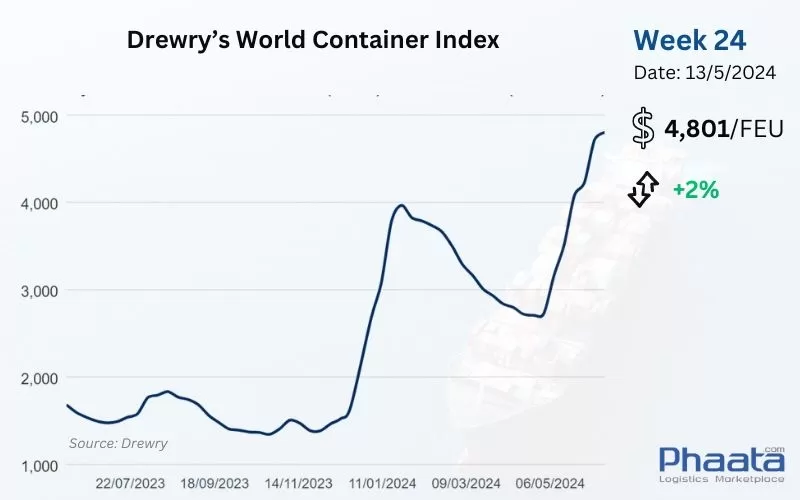

Drewry’s World Container Index for the week 24/2024 continued to increase by 2% compared to the previous week, to 4,801 USD. This freight index increased 202% compared to the same week last year and was 238% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 24/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

The freight rates from Asia to the West Coast of North America in the week 24/2024 continued to increase slightly to 5,947 USD/FEU, equivalent to an increase of 0.71% compared to the previous week and an increase of 50.33% compared to the previous month, according to Xeneta data.

The market entered its peak period. It is expected that imports in June will be 10.7% higher than the same period last year, according to Flexport's report.

Carriers expect these rate increases to continue and accelerate in the short term as ships leaving Asia are expected to be full throughout June. Particularly for vessels sailing from Vietnam and China (including Yantian/Shanghai/Ningbo) to West Coast of North America ports are very tight.

For long-term fixed freight rates, starting from June 1, carriers will apply Peak Season Surcharge (PSS) and it is likely that PSS will continue to apply on June 15.

Importers expect a difficult peak season and are trying to overcome the uncertainties.

Asia-US West Coast Freight rate | Week 24/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

The rate for container shipping from Asia to Northern Europe in the week 24/2024 continued to increase to 5,836 USD/FEU, equivalent to an increase of 1.50% compared to the previous week and an increase of 54.92% compared to the previous month, according to Xeneta data.

The market continues to be tense and space is limited at least until mid-June. Many factors are at play including port congestion, lack of container equipment and ongoing delays of ships rerouting via the Cape of Good Hope leading to low reliability and many blank sailings from Asia. The situation became more difficult, three sailings from Ocean Alliance as voided and one from MSC as slide-down.

Demand continued to be stronger than usual and rates increased again. The forecast increase in shipping demand is driven not only by consumer demand but also by companies adjusting inventory levels due to longer-than-expected delivery times. The next rate increase is expected to be announced in the first half of June at $1,000/FEU.

To push cargo on sooner estimated time of departure (ETD) and avoid delays, more carriers are open to Premium options to get cargo loaded on the first available departure date with higher equipment priority.

Shippers are trying to push delivery schedules earlier to avoid additional shipping costs. All sailings are fully booked unless seats are guaranteed. Shippers should book early, split reservations into smaller lots, and pick up empty containers as soon as possible. Reservations should be made four weeks in advance if possible.

Many shipping lines such as CGM CMA, Evergreen, Hapag Lloyd, Yangming and HMM have reported a shortage of empty container equipment. It is expected that the situation will be difficult throughout May until the number of empty containers improves. Shippers should pick up empty containers for packing as soon as possible.

Asia-Northern Europe Freight rate | Week 24/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 24/2024 decreased to 688 USD/FEU, equivalent to a decrease of 2.41% compared to the previous week, and a decrease of 6.65% compared to the previous month, according to Xeneta data.

Capacity remains available for vessels sailing from major U.S. ports to discharge ports in Asia, Northern Europe and the Mediterranean.

Some inland rail locations have container equipment problems related to the global disruption of container flows. When making loading reservations at U.S. domestic railroad locations, shippers are advised to make reservations 3-4 weeks in advance of the sailing's departure date.

US West Coast - Asia Freight rate | Week 24/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week 24/2024 increased slightly to 626 USD/FEU, equivalent to an increase of 1.46% compared to the previous week; and decreased by 21.75% compared to the previous month.

Northern Europe - Asia Freight rate | Week 24/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Shippers' Concerns Rise Amid Strike Threat from U.S. East Coast Port Union

- Container Freight Rates for China-Europe Exports Expected to Surpass $10,000

- Singapore reopens disused container terminals to ease port congestion

- Rising consumption in China and US contributes to sharp increase in container freight rates

- Singapore port becomes new bottleneck in global supply chain

- Early peak season along with bad weather and port congestion cause container freight rates to spike unexpectedly

- COSCO schedules: Vietnam - North America in Jun 2024

- SITC updates Vietnam-Intra Asia sailing schedules in Jun 2024

- International shipping and logistics market update - Week 23/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)