International shipping and logistics market update - Week 20/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 20/2024.

International shipping and logistics market update - Week 20/2024

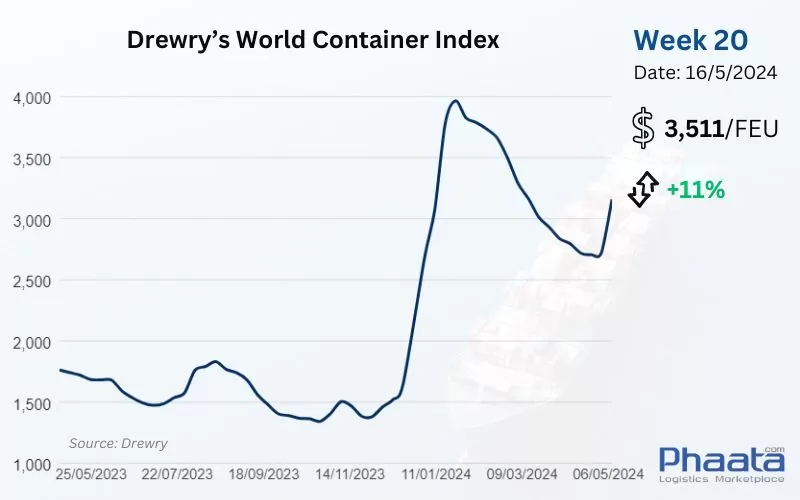

Drewry’s World Container Index for the week 20/2024 continued to increase sharply by 11% compared to the previous week, to 3,511 USD. This freight index increased 104% compared to the same week last year and was 147% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 20/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

The freight rates from Asia to the West Coast of North America in the week 20/2024 continued to increase to 4,025 USD/FEU, equivalent to an increase of 3.82% compared to the previous week and an increase of 17.24% compared to the previous month, according to Xeneta data.

The new annual contract season begins on May 1 with the application of a high general rate increase (GRI). The increase in spot freight rates is due to strong US import demand and the extension of long-term fixed-price contracts, leading to ships operating near full capacity. Rising freight rates have increased the difference between fixed freight rates in long-term contracts and floating freight rates. At the same time, it may lead to many shipments being transferred to bookings at the price of long-term contracts in May.

The Panama Canal Authority announced another increase in daily ship movements. However, shipping lines remain cautious about redeploying capacity through the canal as demand for the number of ships passing through the Cape of Good Hope remains high and restrictions on vessel weight restrictions when passing through the Panama Canal remain in place. apply.

Rail unions in Canada have announced a possible strike starting on May 22. A strike that would affect all rail services in Canada.

Asia-US West Coast Freight rate | Week 20/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

The rate for container shipping from Asia to Northern Europe in the week 20/2024 continued to increase slightly to 3,805 USD/FEU, equivalent to an increase of 1.93% compared to the previous week and an increase of 16.65% compared to the previous month, according to Xeneta data.

Market demand shows signs of increasing again. Shipping lines announced the application of GRI (General Rate Increase) in May.

The Red Sea situation continues to be chaotic as ships have to reroute via the Cape of Good Hope, affecting on-time performance and scheduled reliability. Ships moving in the area are still at risk of being attacked by drones. Ships passing through the Mediterranean may be affected.

Bookings remain high after China's Labor Day holiday. Another GRI (General Rate Increase) is expected in the second half of May at around $1000/FEU. Shippers are speeding up shipments earlier to avoid increased shipping costs.

Currently, the number of sailing is expected to be full until Week 21 (last week of May). Week 22 is about to end. Reservations should be made four weeks in advance if possible.

Many shipping lines such as CGM CMA, Evergreen, Hapag Lloyd, Yangming and HMM have reported a shortage of empty container equipment. It is expected that the situation will be difficult throughout May until the number of empty containers improves. Shippers should pick up empty containers for packing as soon as possible.

Asia-Northern Europe Freight rate | Week 20/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 20/2024 continued to decrease to 723 USD/FEU, down 3.47% compared to the previous week, and down 5.49% compared to the previous month, according to Xeneta data.

Capacity remains available for vessels sailing from major U.S. ports to discharge ports in Asia, Northern Europe and the Mediterranean.

Some inland rail locations have container equipment problems related to the global disruption of container flows. When making loading reservations at U.S. domestic railroad locations, shippers are advised to make reservations 3-4 weeks in advance of the sailing's departure date.

US West Coast - Asia Freight rate | Week 20/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week 20/2024 continued to decrease slightly to 797 USD/FEU, equivalent to a decrease of 0.87% compared to the previous week; and decreased by 9.84% compared to the previous month.

Northern Europe - Asia Freight rate | Week 20/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Hapag-Lloyd reports sharp decline in Q1 financial results

- HMM and SM Line cooperate on trans-Pacific service amid changing alliances

- COSCO SHIPPING establishes new warehouse in Los Angeles, USA

- International shipping and logistics market update - Week 19/2024

- COSCO schedules: Vietnam - North America in May 2024

- SITC updates Vietnam-Intra Asia sailing schedules in May 2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)