International shipping and logistics market update - Week 47/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 47/2024.

International shipping and logistics market update - Week 47/2024

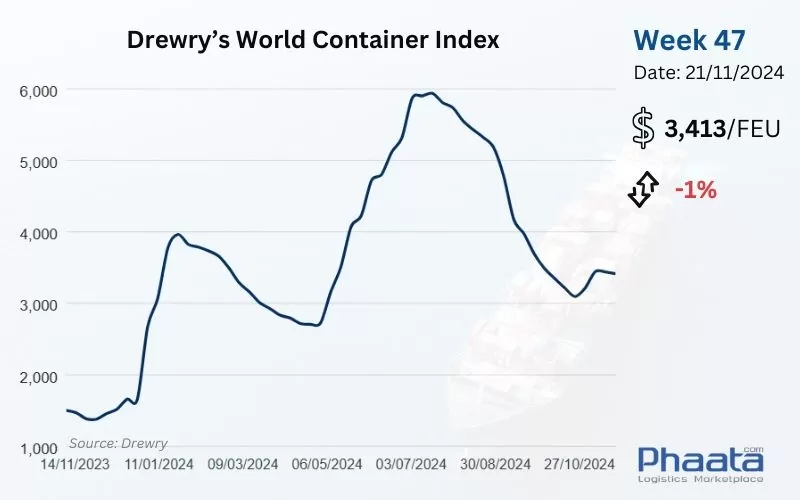

Drewry’s World Container Index for the week of 47/2024, down slightly from the previous week, stood at $3,413/FEU. This freight rate index is 140% higher than the pre-pandemic average of 2019 ($1,420).

Drewry’s World Container Index Week 47/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 47/2024 continued to decline sharply to $4,740/FEU, down 6.32% from the previous week, down 10.92% from the previous month, according to Xeneta data.

The lack of space from Asia to the US West Coast has improved as additional vessels are expected to be added in late November, causing rates to decline to the West Coast.

However, rates from Asia to the US East Coast and Gulf Coast remain stable as most services are fully utilized through November.

Carriers are beginning to focus on the upcoming General Rate Increase (GRI) for East Coast services, with rates expected to adjust around December 1, subject to final confirmation.

East Coast sailings are at normal levels, but some carriers and services are full or facing capacity constraints through November.

ILA negotiations and potential tariff actions remain the main pressures on rates and capacity on this trade.

Long-term fixed rates and Peak Season Surcharges (PSS) remained stable until the end of November.

Asia-US West Coast Freight rate | Week 47/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 47/2024 increased to USD 4,140/FEU, equivalent to a 2.27% increase compared to the previous week, up 26.92% compared to the previous month, according to Xeneta data.

Space is limited in the second half of November due to many canceled sailings and the number of containers being transferred to later sailings continuously increasing. Carriers are expected to cut 15-18% of capacity in November, with ten sailing cancellations announced so far, which will continue to impact market supply.

With bookings postponed to avoid arrivals during the Christmas and New Year holidays in Europe, the November GRIs have not materialised and carriers are instead preparing for the December GRIs, which are expected to be at USD3,900/20'GP and USD6,000/40'GP.

The Shanghai Container Freight Index (SCFI) fell slightly by USD29/TEU in Week 47, reflecting the extended FAK rates in the second half of November. A further slight decline is expected before the December GRIs increase.

Specific equipment shortages are occurring at major ports in China but remain manageable. For shippers who need to secure space and an expected time of departure (ETD) can consider choosing the "premium" service of the shipping lines.

Asia-Northern Europe Freight rate | Week 47/2024 (Image: Phaata.com)

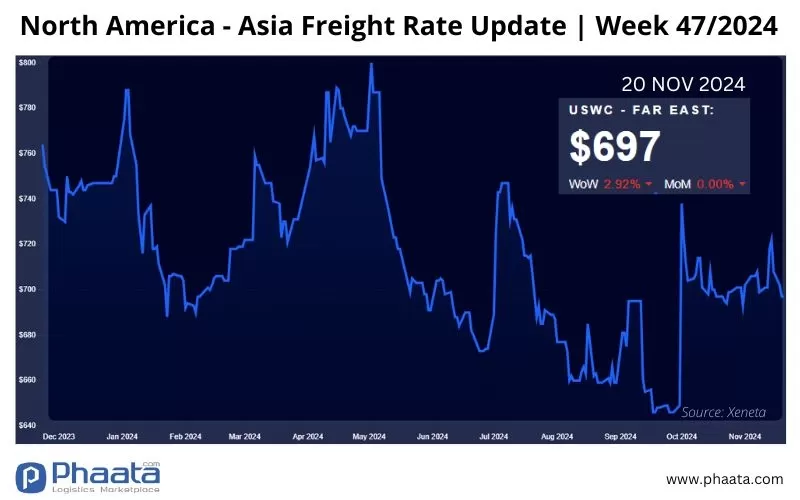

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia in week 47/2024 decreased by 2.92% compared to the previous week, to USD 697/FEU, this price is stable compared to the previous month, according to Xeneta data.

US West Coast - Asia Freight rate | Week 47/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 47/2024 decreased slightly to USD 351/FEU, down 0.28% compared to the previous week, and down 8.83% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 47/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Global Container Shipping Industry Profits to Rise 'Hugely' in 2024

- Hapag-Lloyd joins ONE and others in installing bow windshields

- Shipping looks back at a turbulent year in the Red Sea and 1,000 days of war in Ukraine

- Evergreen in talks for first megamax order of the year

- Toll Group expands logistics footprint in Auckland

- International shipping and logistics market update - Week 46/2024

- COSCO schedules: Vietnam - North America in Nov 2024

- SITC updates Vietnam-Intra Asia sailing schedules in Nov 2024

- Pacific Lines updates domestic sailing schedules in Nov 2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)