Global Container Shipping Industry Profits to Rise 'Hugely' in 2024

The container shipping industry is on track for its most profitable year since the Covid era, with Q3 earnings soaring thanks to the Red Sea crisis and strong shipping volumes.

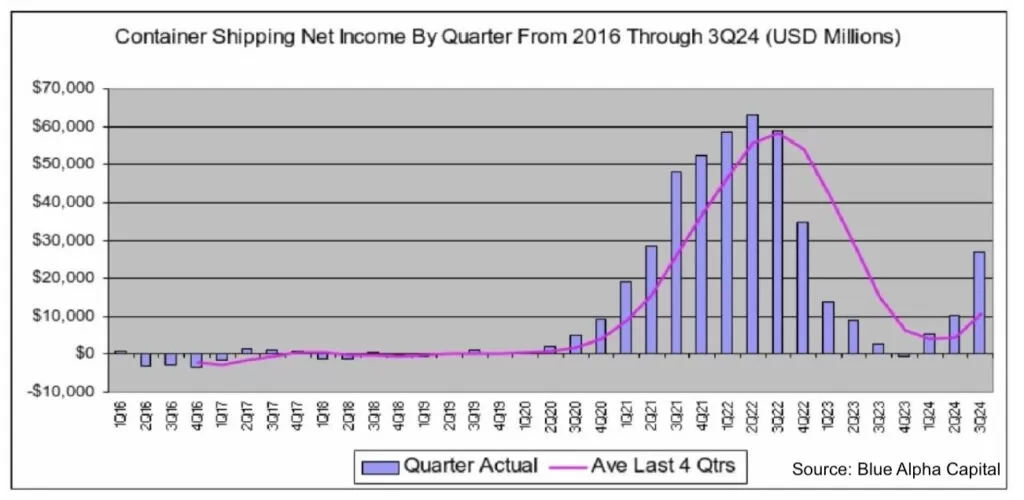

The container shipping industry is on track for its most profitable year since the Covid era. According to data compiled by John McCown's Blue Alpha Capital, the container shipping industry posted a total net income of $26.8 billion in the third quarter, a sharp 164% increase from the $10.2 billion reported in the third quarter.

Compared to the third quarter of last year, net income for the quarter was up $24 billion, or 856%, from the $2.8 billion profit in the same quarter last year.

Looking at the Q3 earnings objectively, the $26.8 billion is more than double the container shipping industry’s profits in any previous year apart from the Covid pandemic.

The surprisingly strong earnings growth in 2024 was driven by the Red Sea shipping crisis, as well as strong volumes across all trade lanes.

The $26.8 billion earned in Q3 is more than double the container shipping industry’s profits in any previous year apart from the Covid pandemic.

Analyzing the profits of publicly traded global carriers, analysts at Linerlytica note that the EBIT margins of the nine largest publicly listed shipping companies rose to 33% from 16% in the previous quarter. However, a clear gap has emerged between the best and worst performers, with Hapag-Lloyd and Maersk trailing their rivals by a wide margin. The two Gemini Cooperation partners achieved an average EBIT margin of 23% in Q3, less than half Evergreen’s 50.5%.

““Signs point to 3Q24 being a peak but near term catalysts abound,” Blue Alpha Capital said in a note issued yesterday, a view shared by analysts at Sea-Intelligence, who noted in their latest weekly report: “We are now clearly past the rate peak in 2024, which has been underpinned by the Red Sea crisis.”

While various spot indices have fallen from recent highs, Blue Alpha Capital is predicting a strong fourth quarter for shipping line earnings, which is being demonstrated at ports around the world.

For example, cargo volumes at the top two U.S. ports — Los Angeles and Long Beach — set new records in October.

“These robust, sustained volumes will likely continue in the coming months with strong consumer spending, an early Lunar New Year, importer concerns about unresolved East Coast labour issues, and the possibility of new tariffs next year that could drive up shipping costs,” said Gene Seroka, CEO of the Port of Los Angeles.

“The current market is not only being driven by demand, but also a host of micro inefficiencies that are keeping both freight and charter markets buoyant,” brokerage Braemar noted in a recent report.

Drewry's Container Composite Index, released today, fell $28 to $3,412.89 per FEU, 67% below its pre-pandemic peak of $10,377 in September 2021 but 140% above its pre-pandemic average of $1,420 in 2019.

See more:

- Evergreen in talks for first megamax order of the year

- Hapag-Lloyd joins ONE and others in installing bow windshields

- Shipping looks back at a turbulent year in the Red Sea and 1,000 days of war in Ukraine

- International shipping and logistics market update - Week 46/2024

- Long Beach Breaks Record with Nearly 1 Million TEUs in a Month

- Port of Hamburg reaches 5.8 million TEU in the first nine months of the year

- COSCO SHIPPING's investment in Chancay Port in Peru begins operations

- ILA Cancels Contract Talks with US East Coast Ports

- Port of Melbourne sees container volumes increase in September

- Trump Wins US Presidential Election – 10 Key Questions for Container Shipping

Source: Phaata.com (via Splash247)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)