Analysts predict container freight rates from Asia to Mediterranean could hit US$20,000

According to Sea-Intelligence Consulting, if per nautical mile rates reach peak levels as seen during the pandemic, spot container rates for the Shanghai to Genoa route could increase to $21,600 per 40ft container.

Spot container freight rates on major East-West routes increased slowly in the mid-June week, with single-digit increases.

While double-digit increases did not appear this week, last week's surprising increase appears to have been built on shipping line price hikes on June 1. Drewry's World Container Index (WCI) increased only 2% compared to the previous week; although it has increased by 202% compared to the same time in 2023.

The WCI index for the route from Shanghai to Rotterdam also increased only 2%, reaching 6,177 USD/40ft container, an increase of 358% compared to 2023. On the same Asia-Northern Europe route, Xeneta's XSI index also increased by 3.3 % compared to the previous week, reaching 5,835 USD/40ft container.

The WCI Shanghai-Genoa index increased by 3%, reaching 6,882 USD/40ft container.

On the Asia - North America routes, the WCI index for the Shanghai-Los Angeles and Shanghai-New York routes both increased by only 1%, reaching 6,025 USD and 7,299 USD/40ft container, respectively. The XSI index of the Asia route to the US West Coast increased by 1.5%, reaching 5,949 USD/40ft container.

The timing of a price increase may cause, or be correlated, with the percentage rate increase. Whatever the case, ocean freight rates are reflecting the market's actual supply-demand situation, which tends to increase slowly, while the sharper rises are forced by carriers’ aggressive pricing.

If that is true, then the forecast shows that this week's price increase will be stronger than last week, as commented by Mr. Peter Sand, chief analyst of Xeneta, during the TOC Europe 24 conference taking place in Rotterdam: “I’m afraid to say there will be another spot rate hike in mid-June, although it seems to us at the moment that the next hike will be less extreme than the previous one, possibly indicating a slight improvement for shippers.”

What happens after this price increase will depend on how long the current shipping demand situation lasts, along with incidents such as port congestion, the Red Sea crisis and more. But if shipping capacity remains limited and voyages continue to be extended, according to analysis from Sea-Intelligence just released, rates from Asia to the Mediterranean are forecast to exceed 20,000 USD/40ft container, this analysis uses pandemic rates as a reference frame.

“The easiest answer to ‘how high can rates go?’ would be to point to the maximum level seen during the pandemic,” said Alan Murphy, CEO of Sea-Intelligence. “This, however, does not account for the increased round-Africa sailing distances that weren’t present during the pandemic."

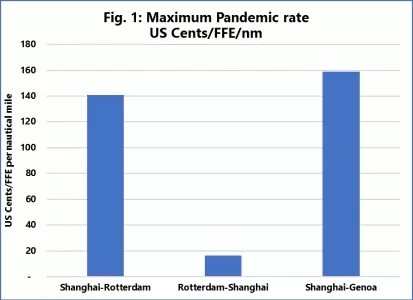

“To account for the longer sailing distances, we can look at the rates in relation to the distance sailed, $-per-40ft for each nautical mile sailed,” he added.

During the pandemic, the figure was $1.60 on Asia-Mediterranean routes and $1.40 on Asia-North Europe routes, according to Sea-Intelligence data.

Source: Sea-Intelligence Consulting

“While this is simply historical fact, it also sets a precedent, which is that during times of severe distress, freight rates per nautical mile can reach these very high levels,” Mr. Murphy further explained.

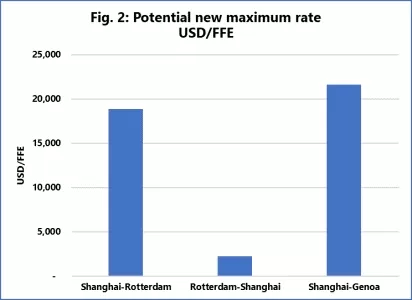

“And here we arrive at the scary scenario for shippers: if the rate paid per nautical mile reaches the same level as during the pandemic, we will see spot rates of $18,900 per 40ft from Shanghai to Rotterdam, $21,600 from Shanghai to Genoa and $2,200 per 40ft on the back-haul from Rotterdam to Shanghai."

“And this is not to say that the rates couldn’t go any higher,” this expert left out.

Source: Sea-Intelligence Consulting

See more:

- Signs show that container freight rates are slowing down

- International shipping and logistics market update - Week 24/2024

- Container Freight Rates for China-Europe Exports Expected to Surpass $10,000

Source: Phaata.com (According to The LoadStar)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)