Carrier Profits Have Little Impact on Inflation

Carrier profits have a small impact on inflation, accounting for only 0.9% of the cumulative inflation over the period of 2020-2022. The sharp drop in carrier profits in 2023 will add a deflationary component to world inflation.

According to Sea-Intelligence, during the freight rate peak in 2021-2022, carriers' high profits were often blamed for being a main driver of inflation. At its peak, freight rates were over twice as high as in the same period in 2019. Shipping lines' combined profits in 2021 and 2022 totaled over 400 billion USD.

However, compared to the value of goods being moved, carriers' profits are relatively small. This is true even when compared only to merchandise categories that are primarily shipped in containers.

According to the IMF, the global average inflation rate in consumer prices in 2021 was 4.7%, increasing by 4.0 percentage points to 8.7% in 2022. "When we compare global inflation to the carriers’ profits as a share of the value of global merchandize trade, we can calculate the inflationary effect caused by the carriers’ profits. In simpler terms, the increase in carriers’ profits from one year to the next can be seen as the resultant added inflation in that year," said Sea-Intelligence.

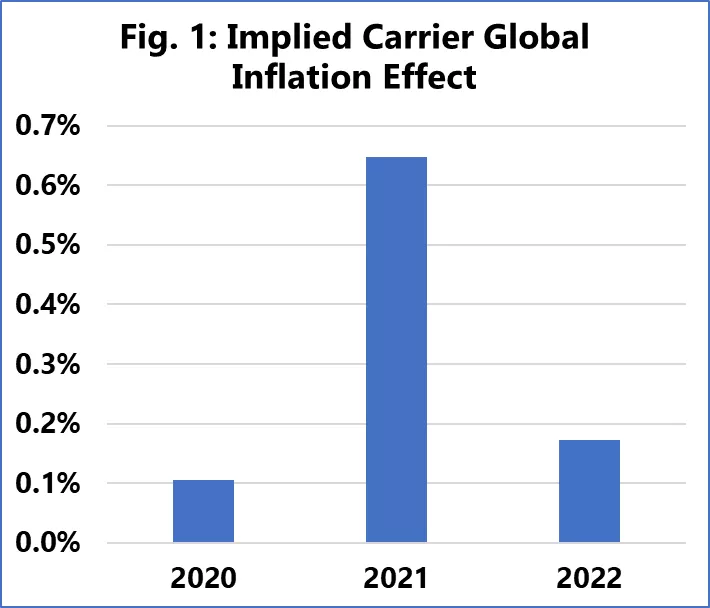

Implied carrier global inflation effect (Source: Sea-Intelligence)

As Figure 1 shows, carriers' added profits account for only a minor explanatory variable of full inflation each year. Over the full period of 2020-2022, global inflation has been a cumulative 17.5%. In the same period, the cumulative effect from carriers' increased profits has been 0.9%. Additionally, the sharp drop in carrier profits in 2023 will add a deflationary component to world inflation.

Read more:

- Sea-Intelligence: Global container demand 6-7% below GDP since 2019

- Relationship Between Global GDP and Container Demand

Source: Phaata.com (According to Sea-Intelligence)

Phaata - Vietnam's First International Logistics Marketplace

► Connect Shippers & Logistics Companies faster!

.webp)

.webp)

.webp)

.webp)