Container shipping giant CMA CGM maintains over a billion dollar profit in Q2

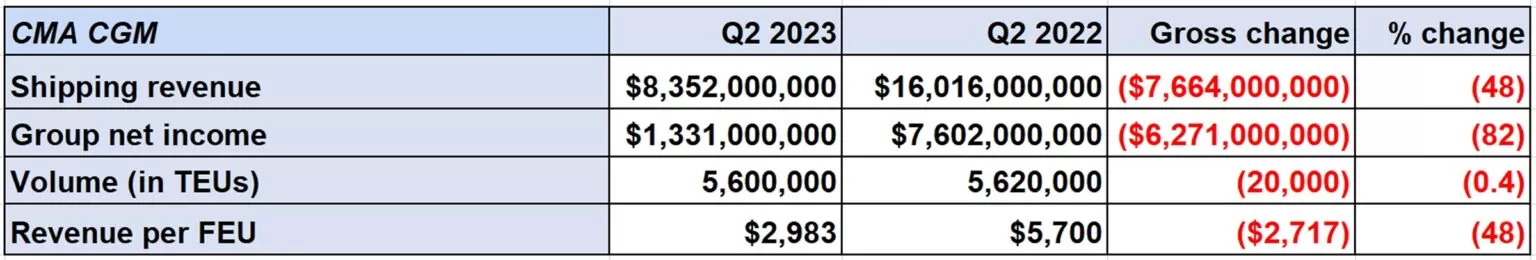

CMA CGM reported its net profit for the second quarter of 2023 was $1.33 billion, down 82% from the previous year's record and down 34% from the first quarter; Revenue per FEU is still 36-37% higher than pre-COVID-19 levels.

A container ship of CMA CGM (Photo: CMA CGM)

French shipping company CMA CGM, the world's third largest shipping company, has summarized its Q2/2023 operations with both bad news and good news. The bad news is that profits continue to fall, and the good news is that the shipping line is still raking in over a billion dollar per quarter, revenue and net profit per shipping container is still much higher than pre-COVID levels and it still has huge amount of cash thanks to the sudden profits during the boom period of the shipping industry.

On July 28, Mr. Rodolphe Saade, CEO of CMA CGM said that "performance remains robust" despite "difficult market conditions" amid “further normalization” of shipping rates.

Still plenty of cash

CMA CGM reported its net profit for the second quarter of 2023 of $1.33 billion, down 82% from the previous year's record and down 34% from the first quarter of 2023.

Despite the decline compared to the peak period, this result is still basically better than the business performance in the pre-pandemic period. In 2018 and 2019, CMA CGM posted a net loss of USD 109 million in Q2/2019 and a net income of USD 22.7 million in Q2 2018.

Q2/2023 results are said to be in line with CMA CGM's expectations. Earlier at the end of May, the Marseille-based shipping line said that it expects the first quarter to be the best quarter in 2023. With the results announced, from the perspective of CMA CGM, the market forecast continued downward trend for the rest of 2023 is unchanged. The airline said that the combination of "unclear demand" and newbuilding deliveries “is likely to weigh on freight rates in shipping, particularly on east-west lines,” it said.

Despite the acquisition of many businesses and the grand plan to build new ships, CMA CGM still has still plenty of cash left in the coffers, affording it a runway to “weather the cycle.” As of June 30, CMA CGM had $3.8 billion in “financial resources net of debt,” down $1.85 billion from the end of last year. (As of the Q2 2019, the group had net debt of $18.6 billion.)

The group's shipping division reported revenue of $2,983 per FEU for the second quarter of 2023, down 16% from the first quarter of this year, but still 36% higher than in the second quarter of 2018 and 37% compared to the second quarter of 2019.

Volume and revenue of CMA CGM in the second quarter of 2023 (Source: CMA CGM)

On the journey to become the second largest shipping company in the world

France's No. 1 shipping line could overtake Maersk to become the world's second largest carrier in the next few years.

According to Alphaliner's data, CMA CGM is currently operating a fleet of 627 vessels with a total capacity of 3.5 million TEUs (including both owned and leased vessels). CMA CGM is ordering to build 119 new ships with a total capacity of 1.2 million TEUs, the ratio of the capacity of newly built ships to the current operating fleet is 35%.

In terms of capacity, CMA CGM's new ships have a total capacity just behind MSC, the world's largest container shipping company (MSC is building 116 new ships with a total capacity of nearly 1.45 million TEUs). "CMA CGM’s most recent orders suggest a more urgent growth ambition," Alphaliner said.

CMA CGM's total new-build capacity is three times higher than that of Maersk (currently at approximately 400,000 TEU). Alphaliner believes that the maritime group from France can take second place in terms of fleet size by the end of 2024 or early 2025.

This timeline is based on the assumption that half of CMA CGM's new build capacity will replace the vessels it currently charters and half will be fleet growth, while Maersk states that it will primarily use new ships to replace the number of ships being chartered, not to develop their own fleet.

Strong capacity increase move

CMA CGM's future capacity growth comes from its active activities in both the used vessel and charter markets. According to Alphaliner, since August 2020, CMA CGM has purchased 105 container ships with a total capacity of 427,000 TEUs, second only to MSC.

As for the charter market this year, Alphaliner recorded CMA CGM as the busiest shipping line so far. By the end of July 2023, the shipping company from France has chartered 170 vessels, more than four times more than the number 2 shipping company COSCO with the number of chartering 40 ships.

From a strategic perspective, CMA CGM is using the sudden profits gained from the supply chain crisis to elevate the shipping line in the long term, rather than taking money out of their pocket and enriching shareholders through dividends. toweringly high.

According to consulting Alphaliner, “CMA CGM’s group net income of $24.9 billion in 2022 made history as the largest-ever annual corporate profit recorded in France. Unlike several other large carriers, the Marseille-based group opted not to pay out a significant portion in dividends, instead reinvesting 90% of the profits, equal to $21.8 billion, back into the business.”

Read more:

- Ocean freight: Good news and bad news

- Transpacific container freight rates increase due to strike at Canadian ports

- Forecast of the container shipping market in the second half of 2023

Source: Phaata.com (According to Freightwaves)

Phaata - Vietnam's First International Logistics Marketplace

► Connect Shippers & Logistics Companies faster!

.webp)

.webp)

.webp)

.webp)