Global shipping sees highest growth in tonne-miles since 2010

The global shipping industry has seen its highest growth in tonne-miles in 14 years as the Red Sea crisis and drought in Panama have led to higher demand for vessels and higher freight rates.

.webp)

The Red Sea shipping crisis - and drought in Panama - have led to the highest recorded increase in tonne-miles this year since 2010, helping to push freight rates to highly profitable levels for most shipping segments.

According to data from Clarksons Research, seaborne trade is still on track to grow by 6.5% in tonne-miles this year, the fastest pace in 14 years. Annual growth in tonne-miles has averaged 2.9% since the financial crisis.

“With disruption and increasing trade complexity driving voyage distances, this has significantly boosted vessel demand,” Clarksons noted in its most recent weekly report.

The London broker said global seaborne trade volumes are on track to hit 12.6 billion tonnes this year, forecasting what it described as a “mind- boggling” 66.6 trillion tonne-miles.

Speaking at last month’s Maritime CEO Forum held at the Monaco Yacht Club, Jan Rindbo, CEO of Danish shipping giant Norden, pointed out that today’s global fleet is built for a fully optimised trade.

“This is why we have great markets because we’ve seen this fragmentation with Russia, Red Sea or whatever it is,” he explained. “So I think fragmentation will mean you need more ships to transport the same volume of cargo.”

The ClarkSea Index, a cross-industry weighted barometer of the shipping industry created by Clarksons, was at $23,022 a day on Friday, 32% above its 10-year trend.

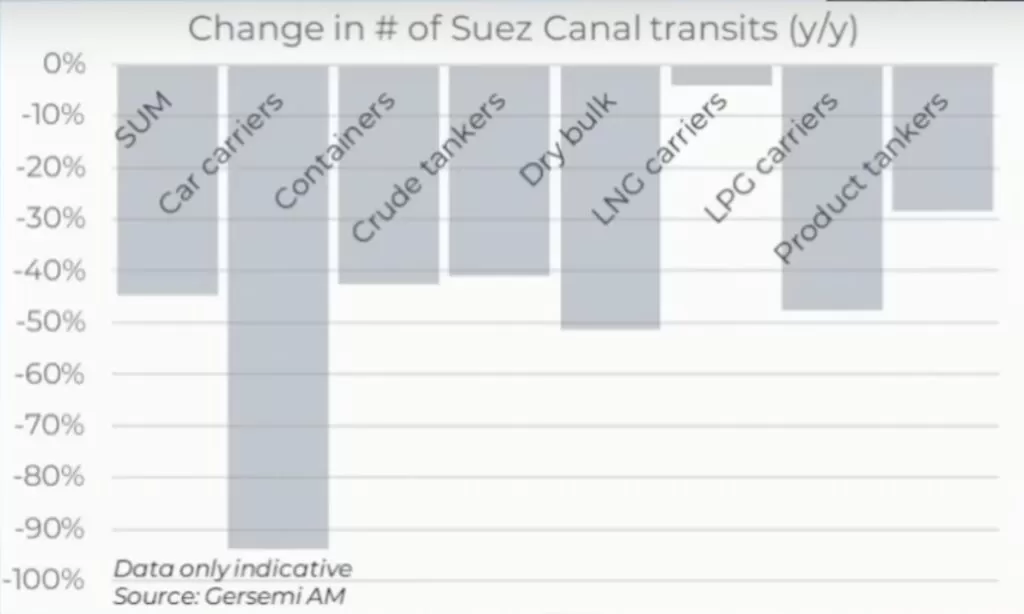

Data from Gersemi Asset Management (see chart below) shows that container ships have seen the biggest adjustment in trading patterns due to the ongoing Houthi campaign against merchant shipping in the Red Sea and Gulf of Aden.

Alphaliner reported this month that the ongoing Red Sea crisis has had a bigger impact on container ship usage than covid, helping to push profits to a significant high this year.

Estimates from US-based Blue Alpha Capital show that the container shipping industry raked in a total of $26.8 billion in profits in Q3, more than double what the container shipping industry earned in any previous year outside of the covid period.

See more:

- International shipping and logistics market update - Week 47/2024

- Global Container Shipping Industry Profits to Rise 'Hugely' in 2024

- Evergreen in talks for first megamax order of the year

- Hapag-Lloyd joins ONE and others in installing bow windshields

- Shipping looks back at a turbulent year in the Red Sea and 1,000 days of war in Ukraine

- Long Beach Breaks Record with Nearly 1 Million TEUs in a Month

- Port of Hamburg reaches 5.8 million TEU in the first nine months of the year

- COSCO SHIPPING's investment in Chancay Port in Peru begins operations

- Trump Wins US Presidential Election – 10 Key Questions for Container Shipping

Source: Phaata.com (via Splash247)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)