International shipping and logistics market update - Week 21/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 21/2024.

International shipping and logistics market update - Week 21/2024

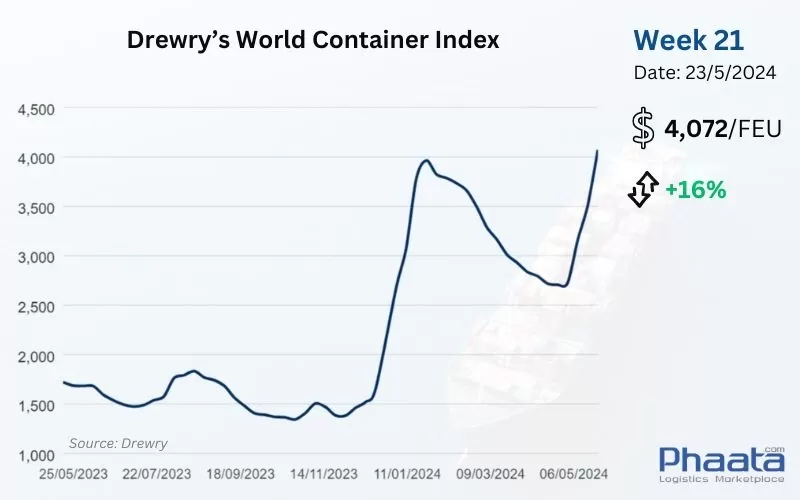

Drewry’s World Container Index for the week 21/2024 continued to increase sharply by 16% compared to the previous week, to 4,072 USD. This freight rate index increased 142% compared to the same week last year and was 187% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 21/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

The freight rates from Asia to the West Coast of North America in the week 21/2024 continued to increase sharply to 4,760 USD/FEU, equivalent to an increase of 5.31% compared to the previous week and an increase of 43.68% compared to the previous month, according to Xeneta data.

The market entered its peak period. The volume of goods imported from Asia to North America in May is forecast to increase by 6.8% over the same period last year and this demand will not ease during the traditional peak season (imports expected in Jun will be 10.7% higher than the same period last year), according to Flexport's recent report.

Carriers expect these rate increases to continue and accelerate in the short term as ships leaving Asia are expected to be full throughout May and June. Particularly for vessels sailing from Vietnam and China (including Yantian/Shanghai/Ningbo) to West Coast of North America ports are very tight.

For long-term fixed freight rates, starting from June 1, carriers will apply Peak Season Surcharge (PSS) and it is likely that PSS will continue to apply on June 15.

Importers expect a difficult peak season and are trying to overcome the uncertainties.

Asia-US West Coast Freight rate | Week 21/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

The rate for container shipping from Asia to Northern Europe in the week 21/2024 continued to increase sharply to 4,677 USD/FEU, equivalent to an increase of 9.58% compared to the previous week and an increase of 46.06% compared to the previous month, according to Xeneta data.

The market continues to be tense and space is limited at least until mid-June. Many factors are at play including port congestion, lack of container equipment and ongoing delays of ships rerouting via the Cape of Good Hope leading to low reliability and many blank sailings from Asia. The situation became more difficult, three sailings from Ocean Alliance as voided and one from MSC as slide-down.

Demand continued to be stronger than usual and rates increased again. The forecast increase in shipping demand is driven not only by consumer demand but also by companies adjusting inventory levels due to longer-than-expected delivery times. The next rate increase is expected to be announced in the first half of June at $1,000/FEU.

To push cargo on sooner estimated time of departure (ETD) and avoid delays, more carriers are open to Premium options to get cargo loaded on the first available departure date with higher equipment priority.

Shippers are trying to push delivery schedules earlier to avoid additional shipping costs. All sailings are fully booked unless seats are guaranteed. Shippers should book early, split reservations into smaller lots, and pick up empty containers as soon as possible. Currently, the number of sailing is expected to be full until Week 21 (last week of May). Week 22 is about to end. Reservations should be made four weeks in advance if possible.

Many shipping lines such as CGM CMA, Evergreen, Hapag Lloyd, Yangming and HMM have reported a shortage of empty container equipment. It is expected that the situation will be difficult throughout May until the number of empty containers improves. Shippers should pick up empty containers for packing as soon as possible.

Asia-Northern Europe Freight rate | Week 21/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 21/2024 continued to decrease to 705 USD/FEU, down 1.81% compared to the previous week, and down 8.20% compared to the previous month, according to Xeneta data.

Capacity remains available for vessels sailing from major U.S. ports to discharge ports in Asia, Northern Europe and the Mediterranean.

Some inland rail locations have container equipment problems related to the global disruption of container flows. When making loading reservations at U.S. domestic railroad locations, shippers are advised to make reservations 3-4 weeks in advance of the sailing's departure date.

US West Coast - Asia Freight rate | Week 21/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week 21/2024 continued to decrease slightly to 782 USD/FEU, equivalent to a decrease of 0.51% compared to the previous week; and decreased by 9.70% compared to the previous month.

Northern Europe - Asia Freight rate | Week 21/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- SITC launches new service from Ho Chi Minh to Japan

- Red Sea crisis helps container shipping lines increase profits

- SITC launches new service from Ho Chi Minh to ILOILO

- International shipping and logistics market update - Week 20/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)