International shipping and logistics market update - Week 5/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week of 5/2024.

International shipping and logistics market update - Week 5/2024

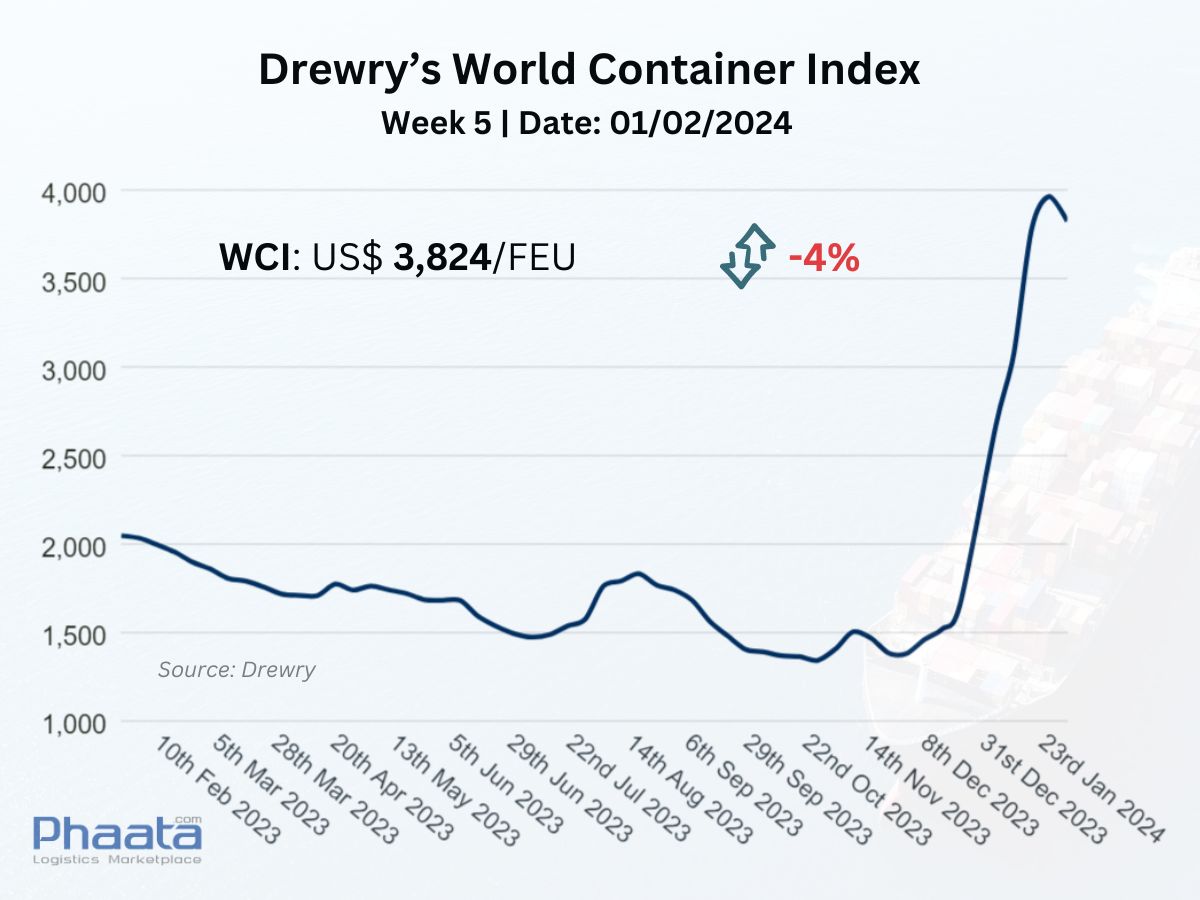

Drewry’s World Container Index for the week week 5/2024 began to reverse, down 4% compared to the previous week, down to 3,824 USD. This freight rate index increased 88% compared to the same week last year and was 169% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 5/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 5/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

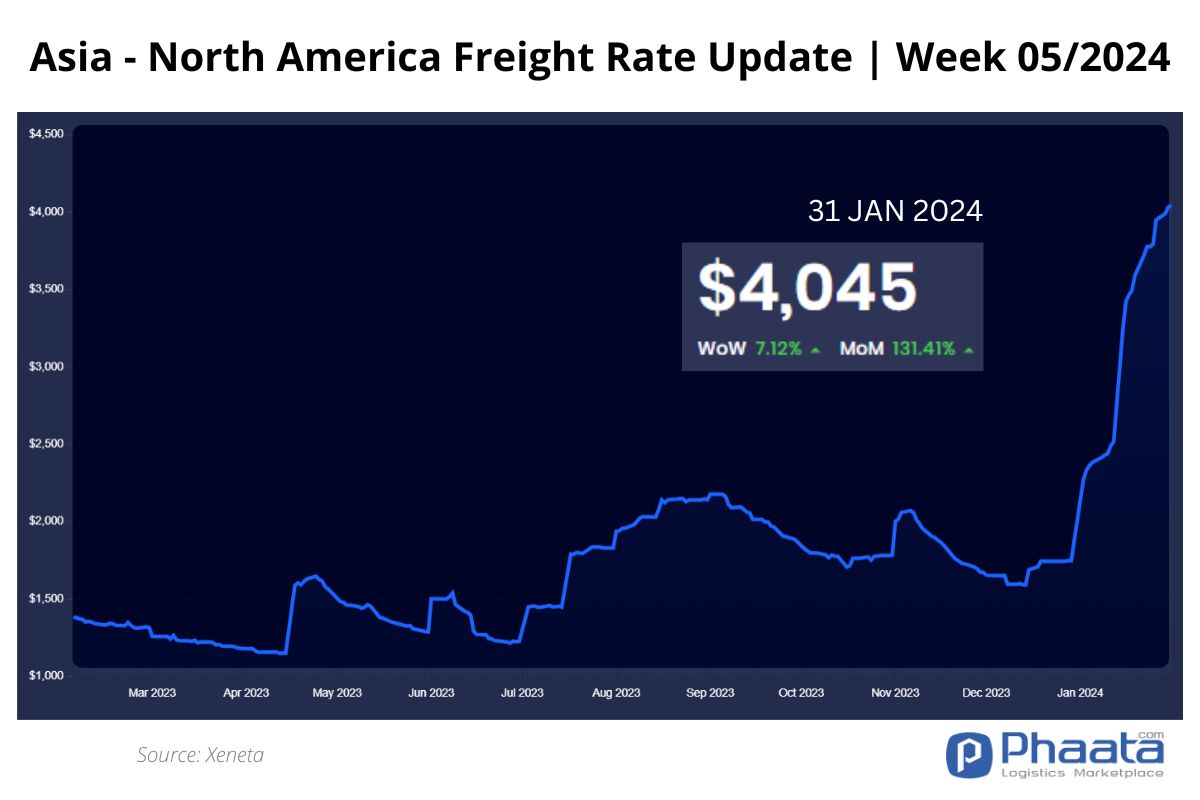

During the peak season market, carriers have proactively pushed up freight rates for sailings scheduled to start in January 2024. The freight rates on North American routes increased sharply. Ocean freight rates from Asia to the West Coast of North America in the week 5/2024 continued to increase sharply to 4,045 USD/FEU, up 7.12% over the previous week and up 131.41% over the previous month, according to Xeneta data.

Most of the ships' spaces are currently booked due to the situation in the Panama Canal and the sudden increase in cargo demand in preparation for the Lunar New Year peak season.

Factories are expected to close in the first week of February, and some small factories may start taking holidays in mid-January.

Due to the situation in the Red Sea, ships cannot return empty containers to Asia in time to meet demand. If the situation does not change, there may be equipment shortages in the coming weeks.

Prolonged drought is causing more restrictions on container ship traffic through the Panama Canal. There are 32 transits per day, down from the normal 36, and the canal is planning to gradually reduce that number weekly to an expected 18 per day before February 1. While container traffic has so far not been affected, further reductions will likely start to have an impact. Carriers are evaluating the possibility of adding more ships to Suez-bound routes. Alternative routes could be via the Suez Canal or via the U.S. West Coast by rail. Carriers are also implementing weight restrictions of 8 tons on average for containers moving through the canal. Traveling through Panama remains the fastest route to the U.S. East Coast.

Asia-US West Coast Freight rate | Week 5/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 5/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

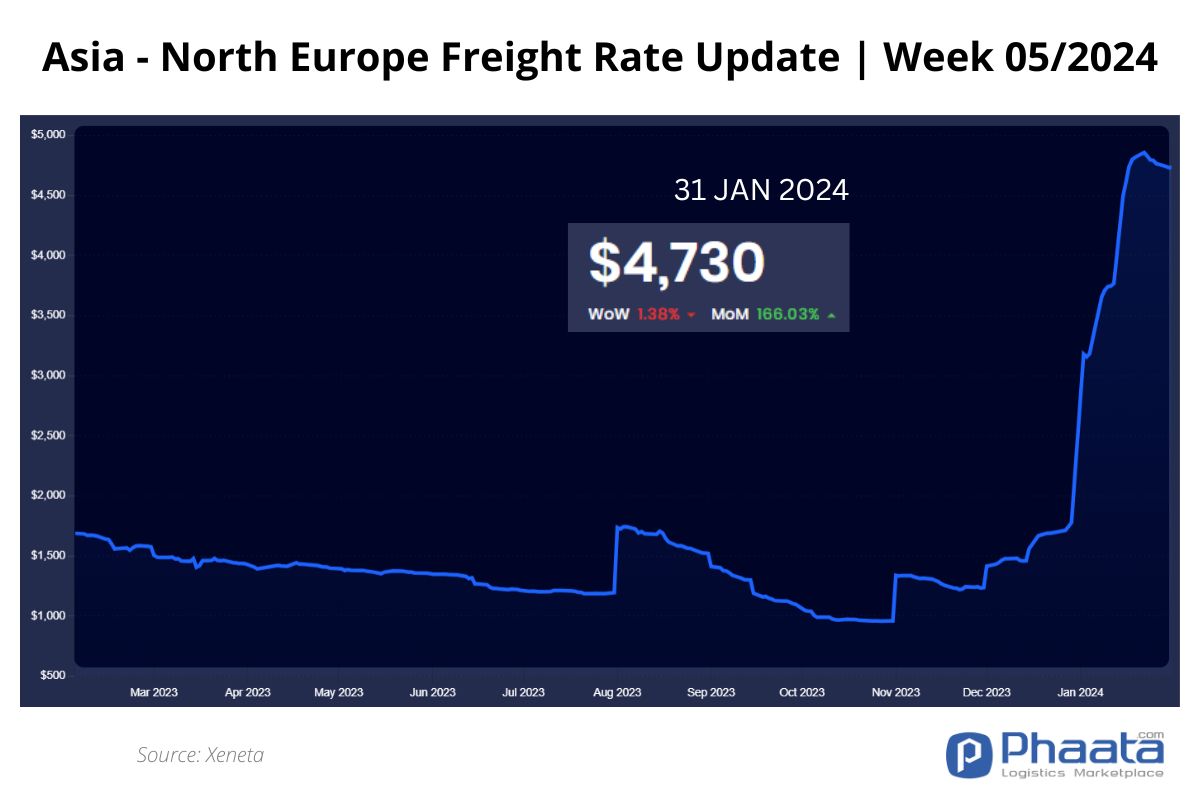

The rate for container shipping from Asia to Northern Europe in the week 5/2024 began to reverse, falling to 4,730 USD/FEU, a slight decrease of 1.38% compared to the previous week and an increase of 166.03% compared to the previous month, according to Xeneta data.

Most of the ships' spaces are currently booked due to the situation in the Red Sea, the Suez Canal and the sudden increase in cargo demand in preparation for the Lunar New Year peak season. Factories are expected to close in the first week of February, and some small factories may start taking holidays in mid-January.

Due to the situation in the Red Sea, ships cannot return empty containers to Asia in time to meet demand. If the situation does not change, there may be equipment shortages in the coming weeks.

Spot freight rates continue to rise sharply as the threat from the Red Sea causes most shipping lines to reroute ships from the Suez Canal to the Cape of Good Hope. This significantly increases shipping costs and is expected to increase total shipping time by 2-4 weeks depending on the vessel's destination. We predict that this increase in spot rates will not easily stop even after the Lunar New Year.

The Ocean Alliance and 2M have announced more than 15 blanked sailings in February, and there may be more announcements from THE Alliance soon. If the situation does not change, there may be equipment shortages in the coming weeks.

Mediterranean route: Following Northern Europe, Asia-Mediterranean route rates for the second half of January are increasing in week 3. Week 4 rates are expected to remain high before Lunar New Year.

Asia-Northern Europe Freight rate | Week 5/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 5/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 5/2024 continued to decrease slightly by 0.28% compared to the previous week, down to 704 USD/FEU.

Empty containers at many railway stations in the US mainland are lacking due to a lack of imports into the Midwest. Shippers should make reservations 2-3 weeks in advance to ensure they have container equipment for export plans.

Overall demand remains weak and is forecast to last until the end of the first quarter of 2024. Fierce competition is taking place among carriers. Freight rates continue to be offered by shipping companies at attractive rates to fill ships while capacity is still surplus.

US West Coast - Asia Freight rate | Week 5/2024 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 5/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

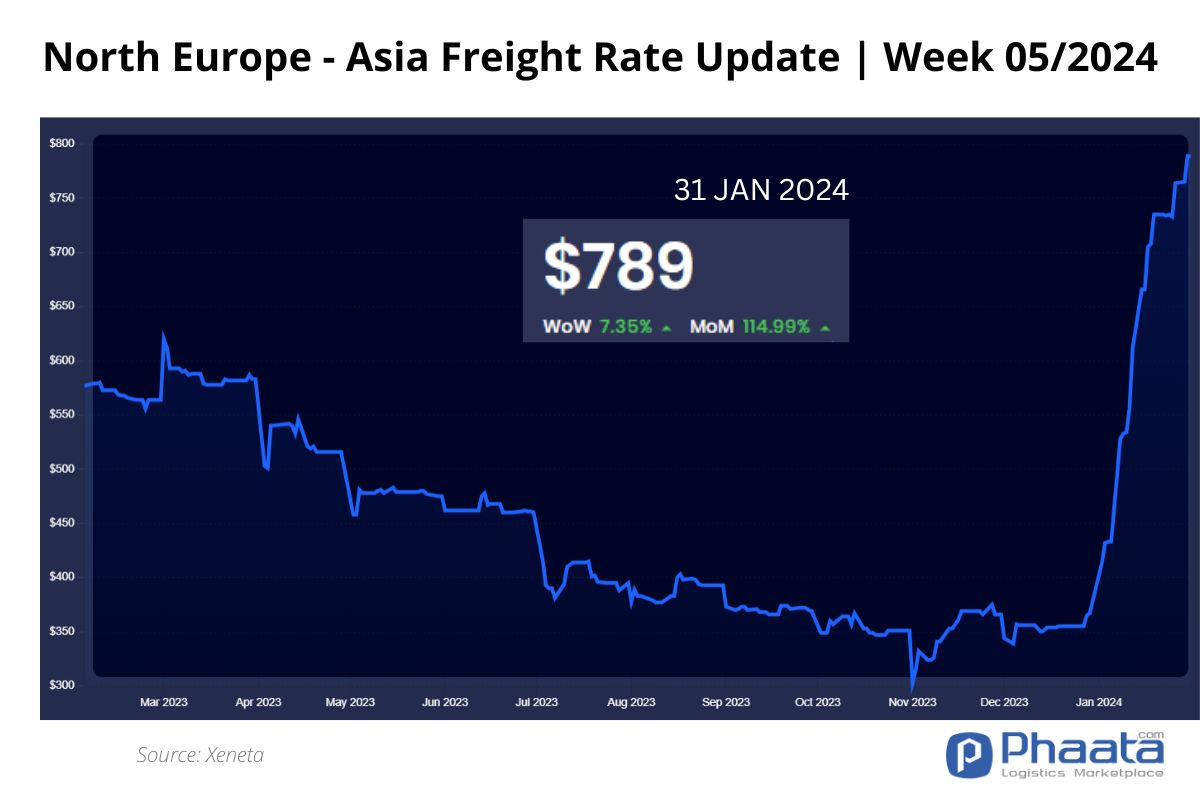

The freight rate from Northern Europe to Asia in the week of 5/2024 continued to increase by 7.35% compared to the previous week, to 789 USD/FEU.

Northern Europe - Asia Freight rate | Week 5/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 5/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- ONE awards AiP certification for ammonia dual fuel vessels

- Red Sea crisis affects old ship recycling market

- Yang Ming refrains from chartering additional vessels amid the Red Sea crisis

- Increased Container Ship Transits through Panama Canal

- Maersk Names First Large Methanol-Powered Container Ship

- International shipping and logistics market update - Week 04/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)