International shipping and logistics market update - Week 25/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 25/2024.

International shipping and logistics market update - Week 25/2024

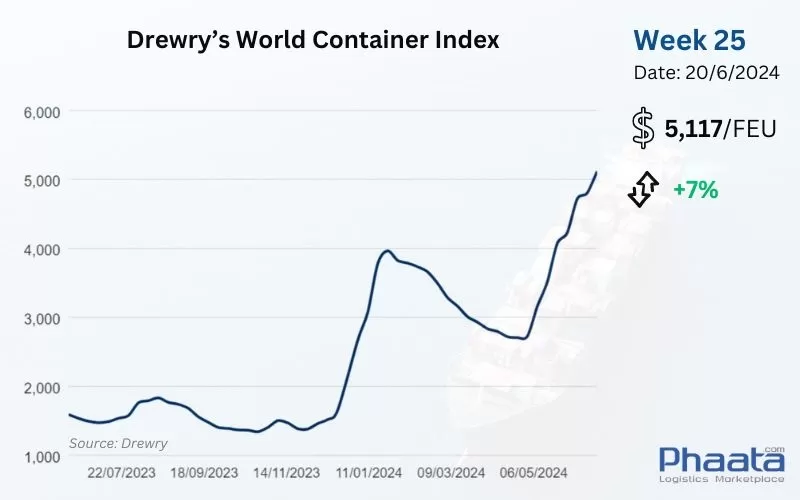

Drewry’s World Container Index for the week 25/2024 continued to increase sharply by 7% compared to the previous week, to 5,117 USD. This freight index increased 233% compared to the same week last year and was 260% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 25/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

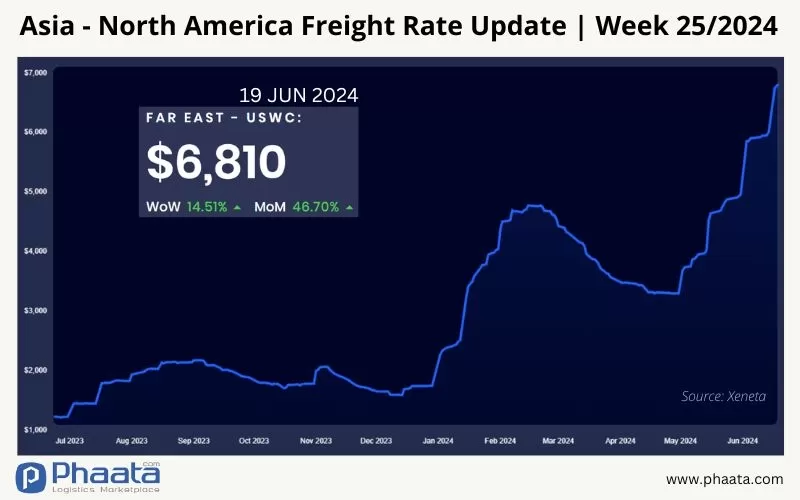

The freight rates from Asia to the West Coast of North America in the week 25/2024 continued to increase very strongly to 6,810 USD/FEU, equivalent to an increase of 14.51% compared to the previous week and an increase of 46.70% compared to the previous month, according to Xeneta data.

The market entered its peak period. Carriers successfully increased the Peak Season Surcharge (PSS) on June 15, with additional increases announced for July.

It is expected that imports into the US in June will be 10.7% higher than the same period last year, according to Flexport's report.

Demand is very high, with volumes exceeding last year's figure on the trans-Pacific route due to the impact of vessels having to bypass the Cape of Good Hope and port congestion in Asia and North America. Phaata is seeing more premium services being offered from shipping lines, including expedited shipping services, equipments and guaranteed slots, as other carriers try to reduce backlogs in Asia by adding more capacity.

Carriers expect these rate increases to continue and accelerate in the short term, as ships leaving Asia are expected to be fully booked through June. Services from Asia to North America were near capacity at the end of June and into July. Routes from Vietnam and South/East China (Yantian/Shanghai/Ningbo) to the US are particularly limited.

Shippers are expecting an extremely difficult peak season and are trying to weather the uncertainties.

Asia-US West Coast Freight rate | Week 25/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

The rate for container shipping from Asia to Northern Europe in the week 25/2024 continued to increase sharply to 6,813 USD/FEU, equivalent to an increase of 16.74% compared to the previous week and an increase of 50.90% compared to the previous month, according to Xeneta data.

Demand continued to be stronger than usual and rates increased again. The forecast increase in shipping demand is driven not only by consumer demand but also by companies adjusting inventory levels due to longer-than-expected delivery times.

The market continues to be tense and slots limited at least through June and into July. Many factors are at play including port congestion, lack of container equipment and ongoing delays of routed vessels passing through the Cape of Good Hope leads to low reliability and many ships departing from Asia are canceled, making the situation even more difficult.

Equipment shortages have become severe at most major departure ports in Asia. Shipping lines are rearranging empty containers to improve the situation, but with continued delays of ships rerouting through the Cape of Good Hope, Phaata expects this problem to persist in the coming weeks. .

Port congestion in Asia remains high due to high yard utilization, unexpected bad weather and crowded vessels, leading to low port efficiency and long waiting times. This situation has resulted in carriers being forced to bypass ports at the last minute to catch up on shipping times.

Strikes in the ports of Bremerhaven, Hamburg and Le Havre have not yet affected schedules, but inland shipping networks risk delays. Customers importing goods to Germany and France should closely monitor deliveries as strikes could last until July if unions do not receive a satisfactory response from the government to their demands .

Demand continued to grow stronger than usual and freight rates increased again in the second half of June (increased by $1,500-2000 per FEU). With equipment shortages, customers will likely continue to push products out to avoid further delays. Shipping lines are preparing for the next General Rate Increase (GRI) in the first half of July, expected to increase by $1000/FEU.

To provide earlier priority shipping and ensure delays are avoided, many shipping lines are willing to use "Premium" options to prioritize loading onto the earliest sailings along with a set priority level.

Shippers are trying to push delivery schedules earlier to avoid additional shipping costs. All sailings are fully booked unless seats are guaranteed. Shippers should book early, split reservations into smaller lots, and pick up empty containers as soon as possible.

Asia-Northern Europe Freight rate | Week 25/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 25/2024 increased slightly to 690 USD/FEU, equivalent to an increase of 0.29% compared to the previous week, and a decrease of 3.90% compared to the previous month, according to Xeneta data.

Capacity remains available for vessels sailing from major U.S. ports to discharge ports in Asia, Northern Europe and the Mediterranean.

Some inland rail locations have container equipment problems related to the global disruption of container flows. When making loading reservations at U.S. domestic railroad locations, shippers are advised to make reservations 3-4 weeks in advance of the sailing's departure date.

US West Coast - Asia Freight rate | Week 25/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week 25/2024 increased slightly to 631 USD/FEU, equivalent to an increase of 0.80% compared to the previous week; and decreased by 19.41% compared to the previous month.

Northern Europe - Asia Freight rate | Week 25/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Analysts predict container freight rates from Asia to Mediterranean could hit US$20,000

- MSC launches new service connecting China and Vietnam directly to Europe

- Suez Canal revenue plummets nearly 50% due to Red Sea crisis

- Signs show that container freight rates are slowing down

- International shipping and logistics market update - Week 24/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)