CMA CGM reinvests nearly 90% of record profits achieved in 2022

Shipping line CMA CGM is reinvesting for the future, achieving $24.9 billion in net profit in 2022, despite a sharp drop in performance in the fourth quarter.

Container ship CMA CGM (Photo: CMA CGM)

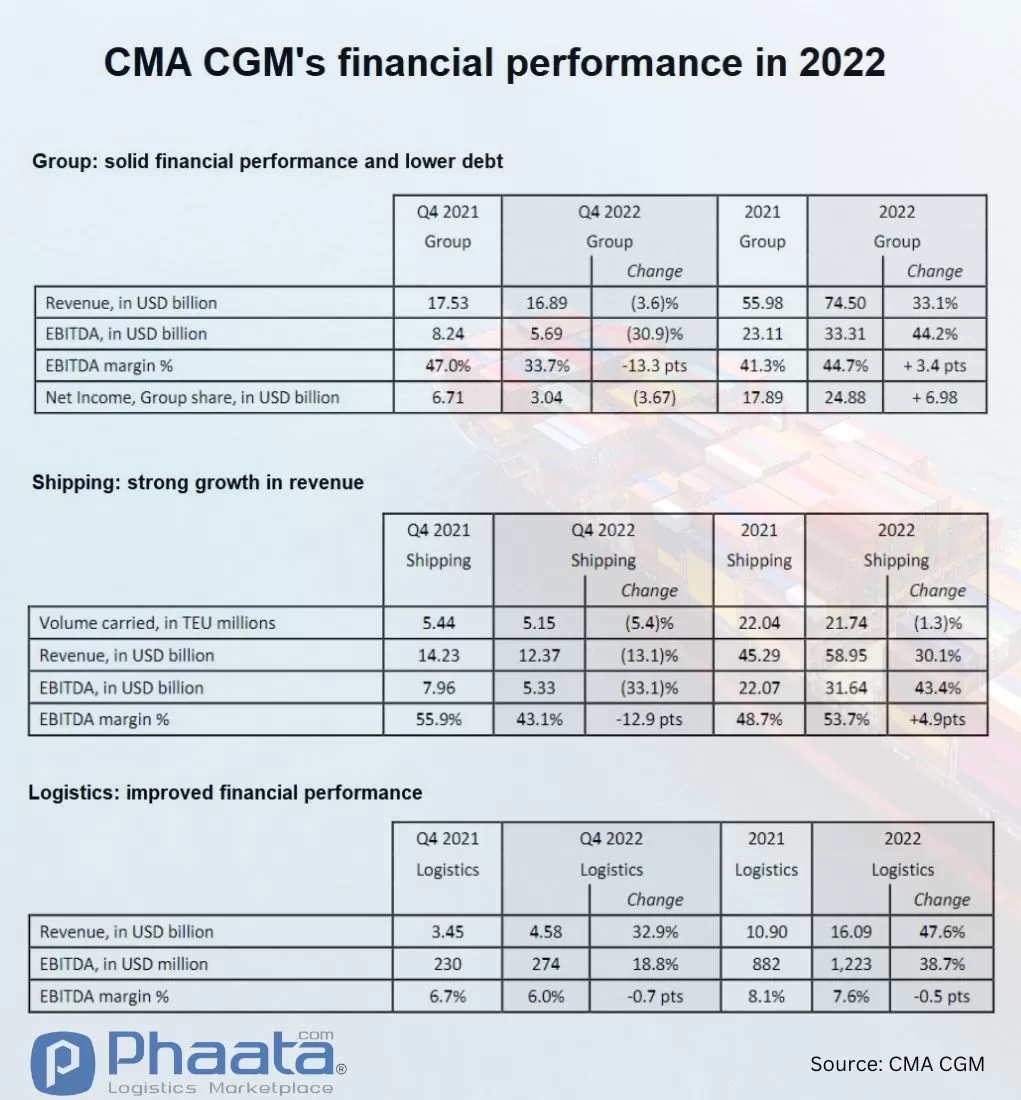

The French container shipping owner reported a net profit of $24.9 billion for 2022, up from $17.9 billion the previous year, while revenue grew 33.1% to $74.5 billion. However, due to the sharp decline in container freight rates, net profit in the second quarter of 2022 fell 54.7% year-on-year to $3.0 billion, compared with $6.7 billion.

The CMA CGM describes 2022 as the year of two contrasting halves. With the first half of 2022 highlighted by high consumer demand and shipping capacity constrained by port congestion and supply chain issues. By contrast, the second half of 2022 saw a shock with demand worsening in the fourth quarter, with a drop in US inventories, the impact of inflation on consumer spending, and a recession. energy crisis in Europe. As a result, the company saw a 7.2% drop in container volumes on east-west shipping routes in the fourth quarter of last year.

Commenting on the results, Rodolphe Saadé, President and CEO of CMA CGM Group, said, “Our group achieved exceptional, historic results in 2022 that have enabled us to invest significantly in operations across our business, step up our energy transition and share the created value with our employees."

"As trade returns to normal and freight rates decline, our strategy and recent investments will prove all the more relevant and allow us to look forward to 2023 with confidence."

The company said it has reinvested nearly 90% of its net profit for 2022 into assets and capacity, in addition to strengthening its balance sheet.

Financial report of CMA CGM shipping line in 2022 (Source: CMA CGM)

Investments include 100% ownership of the Fenix Marine Services docks in Los Angeles/Long Beach, and late last year the company announced the acquisitions of GCT Bayonne and GCT New York in the Port of New York & New Jersey, pending regulatory approval.

In logistics, an area favored for investment by container carriers in recent years, CMA CGM has acquired e-commerce logistics solutions from Ingram Micro's Commerce & Lifecycle Services, European automotive logistics company GEFCO, and home delivery specialist Colis Privé.

CMA CGM plans to expand its new air freight division to 12 cargo planes by 2026 and has acquired a 9% stake in Air France-KLM as part of a long-haul air freight partnership. term.

Looking to the future, the company commented: “Second-half 2022 trends remained at play in 2023, as market conditions in the transport and logistics industry continue to deteriorate.” The firm said that the balance between supply and demand is expected to remain challenging with growing supply while the demand outlook "seems uncertain".

CMA CGM though has seen some signs of stabilizing macroeconomic signals and noted that Latin America and Southeast Asia markets remain strong.

“The group is closely monitoring the evolutions in the economic and geopolitical situation, despite limited visibility over the rest of the year, and remains confident in its ability to weather the cycle thanks to the diversification of its businesses and its financial strength," the carrier said.

Read more:

- Sea shipping costs dip amid sliding demand

- Hapag-Lloyd announces financial results for 2022 and forecast for 2023

- Evergreen continues to spend money to buy more containers

Source: Phaata.com (According to CMA CGM | Seatrade Maritime)

Phaata - Vietnam's First Global Logistics Marketplace

► Find Better Freight Rates & Logistics Services

.webp)

.webp)