Freight Rates Could Further Decrease

The Red Sea crisis has pushed sea freight rates sharply higher recently, however, rates are currently showing a downward trend. Business Forum Magazine has conducted an exchange with Mr. Nguyen Hoai Chung, Founder and CEO of Phaata, regarding this trend.

The Red Sea crisis has driven up sea freight rates significantly in recent times. However, rates are showing a downward trend.

Business Forum Magazine conducted an exchange with Mr. Nguyen Hoai Chung, Founder and CEO of Phaata, regarding this trend.

Mr. Nguyen Hoai Chung, Founder and CEO of Phaata

- How has the Red Sea crisis affected export businesses in Vietnam?

During the Red Sea crisis, Asian and specifically Vietnamese export businesses may face six challenges:

Firstly, freight rates passing through the Red Sea or circumventing the Cape of Good Hope in South Africa have risen sharply.

Secondly, cargo insurance costs have also increased, adding to the logistics expenses for export businesses.

Thirdly, to ensure safety, container shipping companies have redirected ships to circumvent the Cape of Good Hope instead of going through the Suez Canal as before. This adds about 6,000 km to the journey and an additional 10 days.

Fourthly, delivery delays may lead importers to cancel or reject orders, causing losses for export businesses.

Fifthly, export businesses may lose customers/markets in Europe and the Middle East if they cannot transport their goods in a timely and efficient manner.

Lastly, many shipping companies have canceled voyages through the Red Sea, altering services, schedules, policies, etc., to cope with the crisis. This disrupts the market and makes it more difficult for export businesses to find new transport/logistics partners.

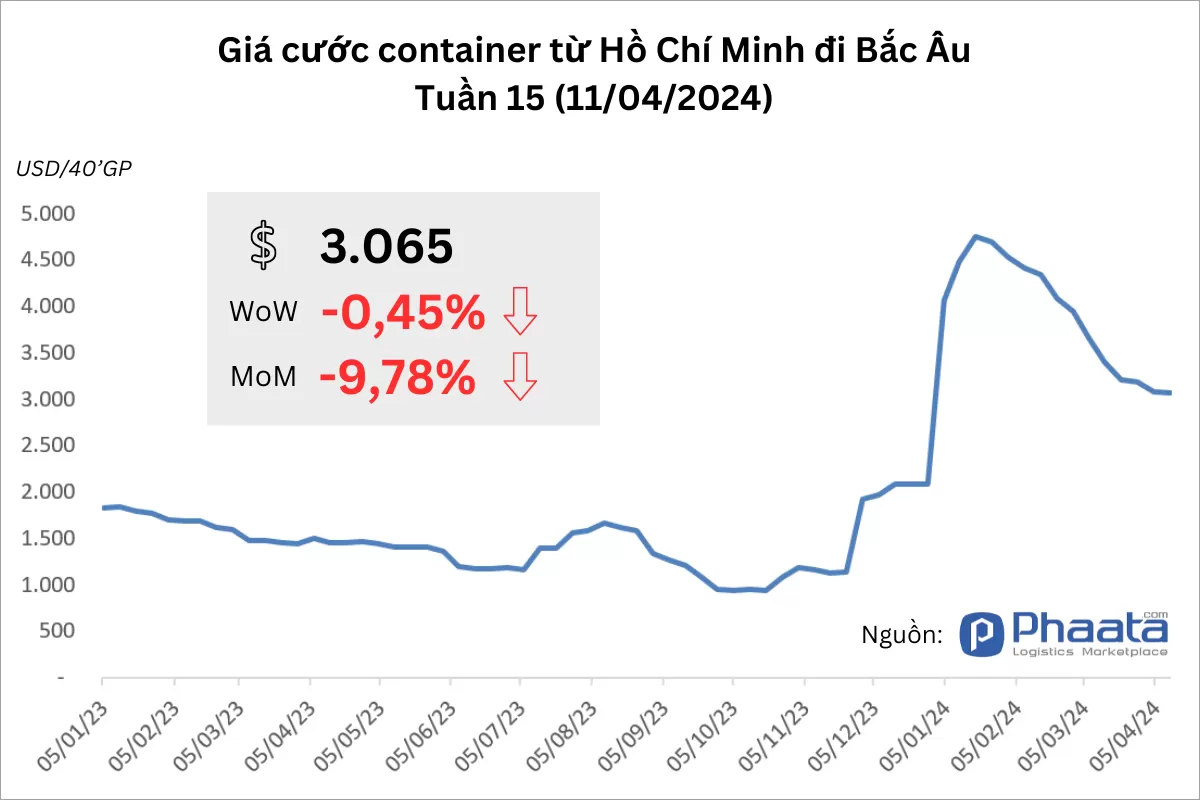

The sea freight rates on the Ho Chi Minh City - Northern Europe route are currently trending downward. Source: Phaata.

- What are the prospects for Vietnam's exports in the near future?

Despite being affected by the Red Sea crisis, Vietnam's export of goods in Q1/2024 still experienced strong growth. According to statistics from the General Statistics Office, Vietnam's goods export turnover in Q1/2024 reached $93.06 billion, up 17% compared to the same period last year.

Specifically, there is high growth in most major markets such as the US, EU, China, ASEAN, with diverse groups of goods achieving high export turnover, including processed industrial products, agricultural-forestry-aquatic products, and mineral fuels.

With this momentum, Vietnam's goods exports may continue to grow sustainably in the future.

- Sir, why are sea freight rates showing a downward trend despite the Red Sea crisis? What is your outlook for sea freight rates in the near future?

The situation remains tense. By early January 2024, many shipping companies had ceased services to Europe via the Suez Canal in the Red Sea, opting instead to divert ships via the Cape of Good Hope in South Africa. This led to a sudden surge in freight rates, reaching a peak of $4,753/40’GP in the third week of January 2024 on the route from Ho Chi Minh City to Europe, up 164.31% compared to the same period in 2023, according to Phaata logistics marketplace data.

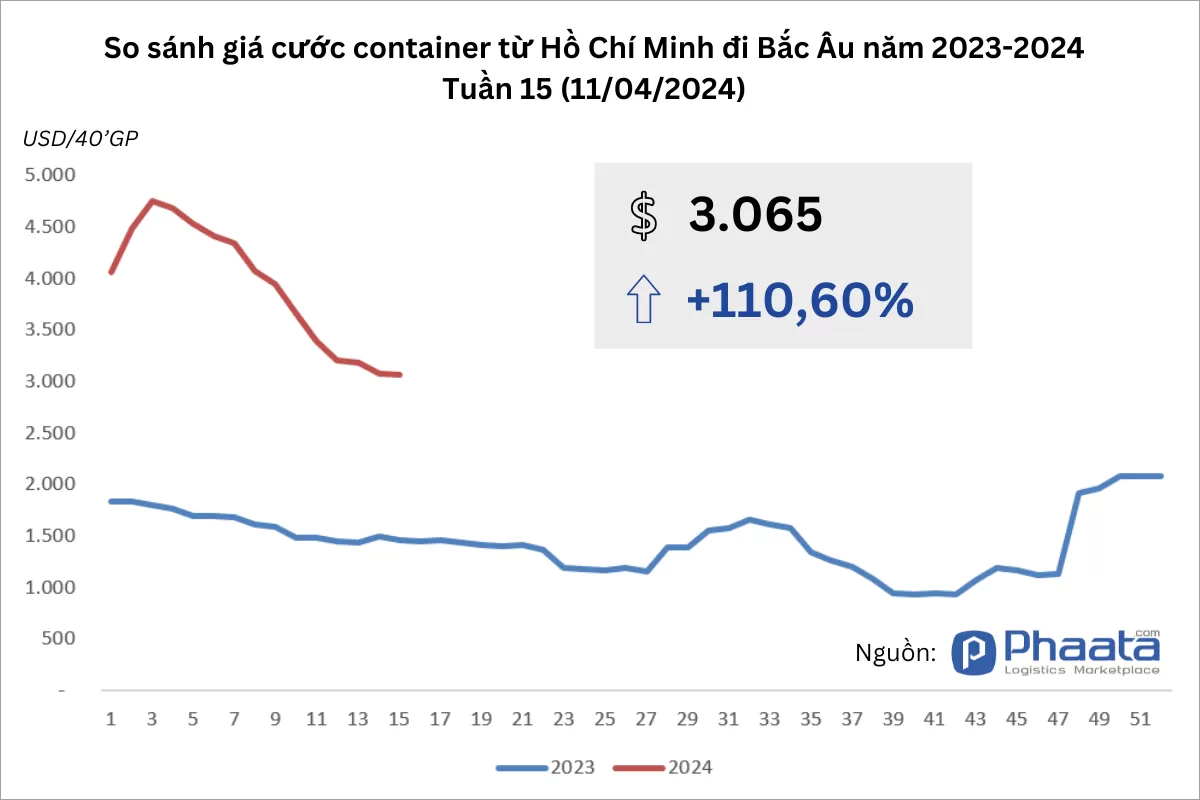

However, freight rates have begun to steadily decline since early February 2024. As of mid-April, freight rates on the Ho Chi Minh City to Northern Europe route have dropped to $3,065/40’GP in week 15, a slight decrease of 0.45% compared to the previous week, and a decrease of 9.78% compared to the previous month. Although rates have declined, they remain very high compared to 2023. Specifically, container freight rates on the Ho Chi Minh City to Northern Europe route last week were still 110.6% higher than the same period last year.

Comparison of freight rates for the Ho Chi Minh City - Northern Europe sea route in 2023 and 2024. Source: Phaata

The downward trend in freight rates in recent times is due to a decrease in transportation demand after the Lunar New Year. Container shipping companies have proactively adjusted their operational activities for greater efficiency in response to the Red Sea crisis, contributing to easing the pressure on freight rates. Currently, the international trade and maritime transportation markets are gradually accepting the new route via the Cape of Good Hope as a replacement for the Suez Canal route.

I believe this is a new normal state in international transportation where all parties involved (including shipping companies, exporters, and importers) must accept and adjust their business activities until the Red Sea crisis ends.

In my opinion, freight rates on the Ho Chi Minh City to Northern Europe route may continue to decline further, but the rate of decline will slow down and remain at around $2,500-3,000/40’GP until the end of the second quarter of this year, if the Red Sea crisis persists and container shipping continues to circumvent the Cape of Good Hope.

- Thank you, sir, for your insights!

Source: Business Forum Magazine | Translated by Phaata

.webp)

.webp)