Global shipping industry concentration has not changed significantly

Recent market volatility has not significantly affected the level of concentration in the global shipping industry, Sea-Intelligence reports, despite concerns from shippers.

In Issue 675 of Sea-Intelligence Sunday Spotlight, the Danish shipping data analytics company looked at whether the turbulence of the past four years has led to the largest shipping lines becoming increasingly dominant over midsize carriers, or whether it is an opportunity for midsize carriers to become more important than the larger ones.

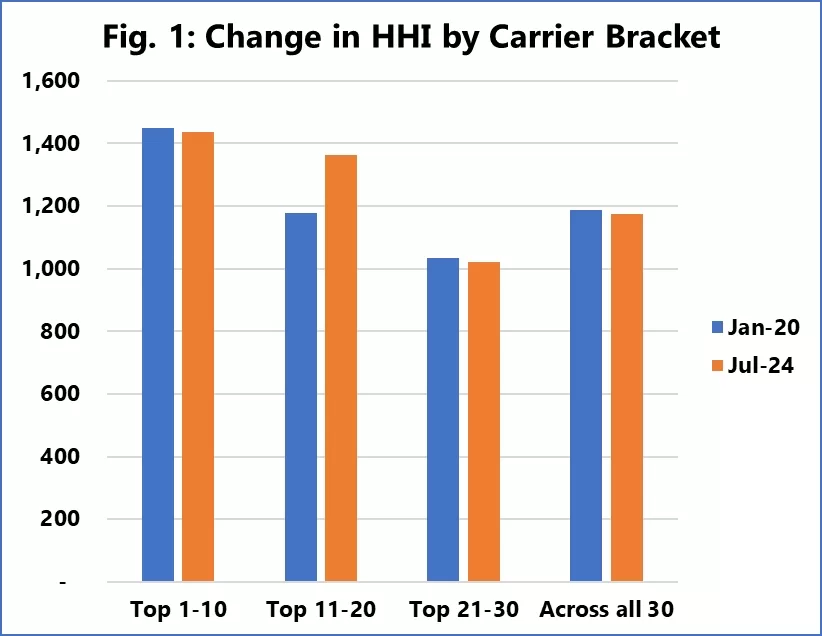

To assess this, Sea-Intelligence calculated the global Herfindahl-Hirschmann Index (HHI) for the top 30 shipping lines, dividing them into three equal segments. The HHI is a measure of industry consolidation: an HHI below 1,500 indicates low levels of integration, 1,500-2,500 indicates medium levels of concentration, and above 2,500 reflects high levels of concentration.

Source: Sea-Intelligence

For the industry as a whole, represented by all 30 carriers combined, the HHI has declined slightly, remaining below 1,200 and indicating low levels of concentration. The levels of concentration among the top 10 carriers have remained largely stable despite recent disruptions. Similarly, the levels of concentration for the bottom group (ranked 21 to 30) have remained unchanged.

However, there has been a slight increase in the levels of concentration among carriers ranked 11 to 20, although this remains below the 1,500 threshold, which is consistent with competitive pressure among the major carriers.

Overall, the data shows that despite concerns from shippers about industry concentration, global connectivity levels remain within what is considered normal, with recent market volatility not significantly increasing or decreasing these levels

Source: Phaata.com (via Sea-Intelligence)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)