International shipping and logistics market update - Week 17/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 17/2024.

International shipping and logistics market update - Week 17/2024

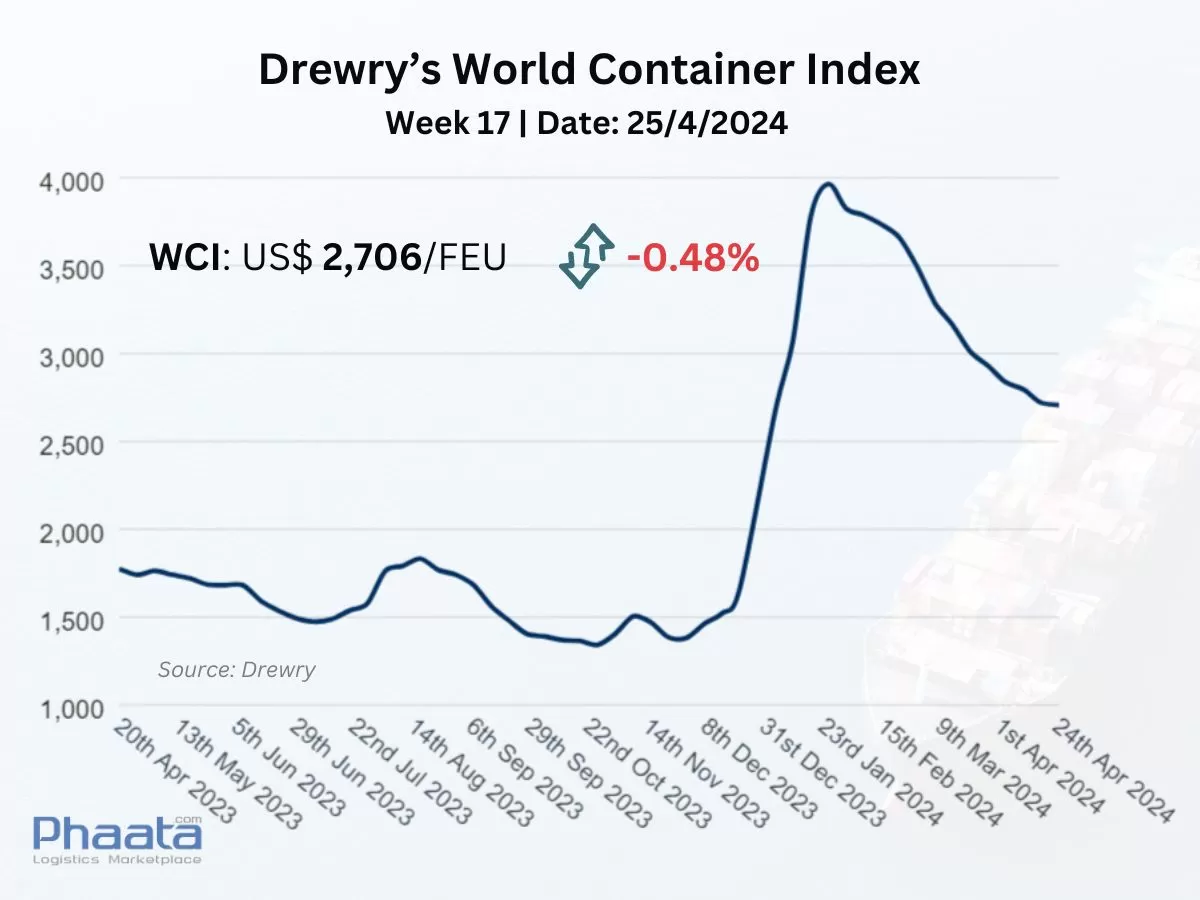

Drewry’s World Container Index for the week 17/2024 continued to decrease by 0,48% compared to the previous week, down to 2,706 USD. This freight index increased 55% compared to the same week last year and was 90% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 17/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 17/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

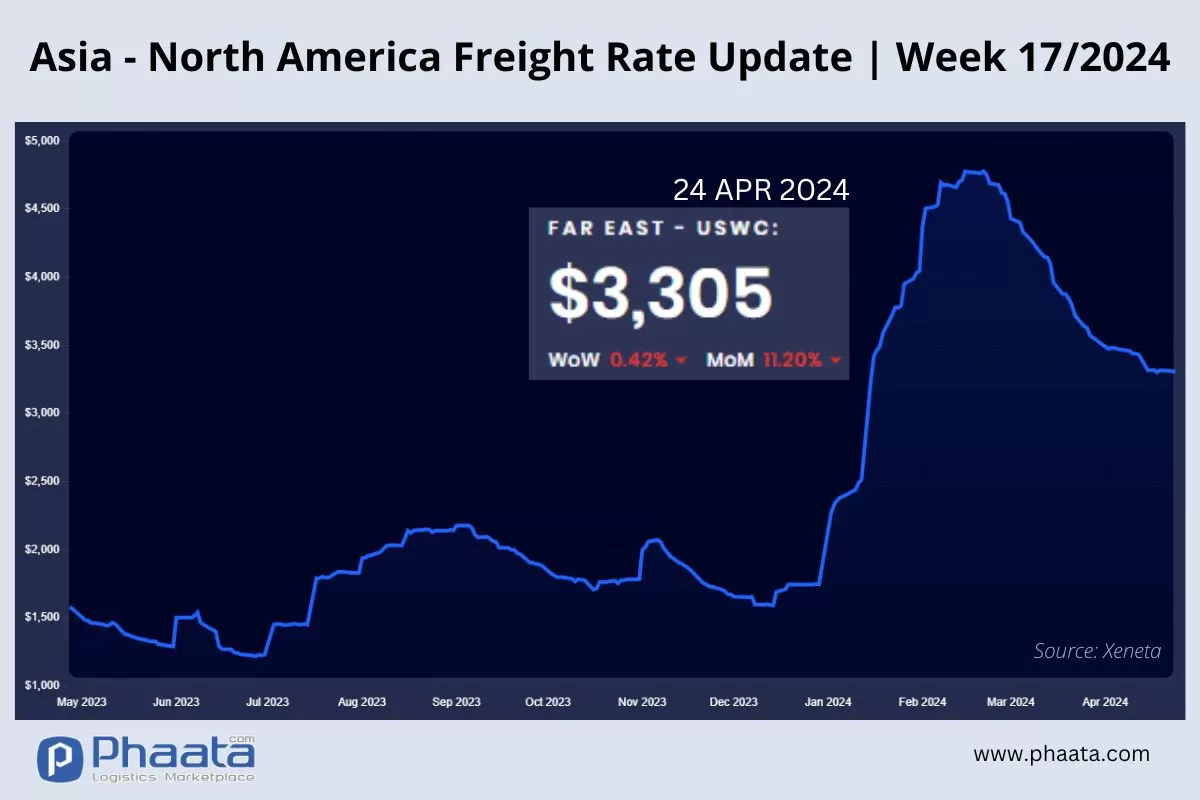

The freight rates from Asia to the West Coast of North America in the week 17/2024 continued to decrease sharply to 3,305 USD/FEU, equivalent to a decrease of 0.42% compared to the previous week and a decrease of 11.2% compared to the previous month, according to Xeneta data.

Ports in Shanghai, Ningbo and Busan were closed last week due to heavy fog in the area. The closure has led to heavy congestion and delays at the terminal. Carriers announced GRI (General Rate Increase) May 1. This will increase the difference between fixed rates on long-term contracts and floating rates; At the same time, it could lead to more shipments being moved to bookings at the prices of long-term contracts in May. Cargoes are showing signs of increasing.

Major shipping lines are currently at a reduced advantage compared to the early days of the Red Sea crisis, and the market is shifting in favor of shippers in trans-Pacific contract negotiations. The rate of rate decline on trans-Pacific routes is slowing, now indicating a possible stabilization over the next month but remains at a level significantly above pre-crisis levels, as well as higher than pre-pandemic levels.

Asia-US West Coast Freight rate | Week 17/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 17/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

The rate for container shipping from Asia to Northern Europe in the week 17/2024 decreased slightly to 3,203 USD/FEU, equivalent to a decrease of 0.16% compared to the previous week and a decrease of 7.24% compared to the previous month, according to Xeneta data.

Demand is still on a downward trend. The pace of rate declines on Asia-Europe routes is slowing, now indicating a possible stabilization over the next month but remains at a level significantly above pre-crisis levels, as well as as higher than pre-pandemic levels.

Asia-Northern Europe Freight rate | Week 17/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 17/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 17/2024 were at 772 USD/FEU, a slight decrease of 1.03% compared to the previous week, and an increase of 7.07% compared to the previous month, according to data. Xeneta.

Empty containers at many railway stations in the US mainland are lacking due to a lack of imports into the Midwest. Shippers should make reservations 2-3 weeks in advance to ensure they have container equipment for export plans.

US West Coast - Asia Freight rate | Week 17/2024 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 17/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week 17/2024 increased slightly to 866 USD/FEU, equivalent to a increase of 1.29% compared to the previous week; and increased by 0.12% compared to the previous month.

Northern Europe - Asia Freight rate | Week 17/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 17/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Freight Rates Could Further Decrease

- HMM sees opportunities even though Hapag-Lloyd exiting THE Alliance

- Hapag-Lloyd aims to consolidate its position in the top 5 container lines

- COSCO schedules: Vietnam - North America in May 2024

- SITC updates Vietnam-Intra Asia sailing schedules in May 2024

- International shipping and logistics market update - Week 16/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)