International shipping and logistics market update - Week 13/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 13/2024.

International shipping and logistics market update - Week 13/2024

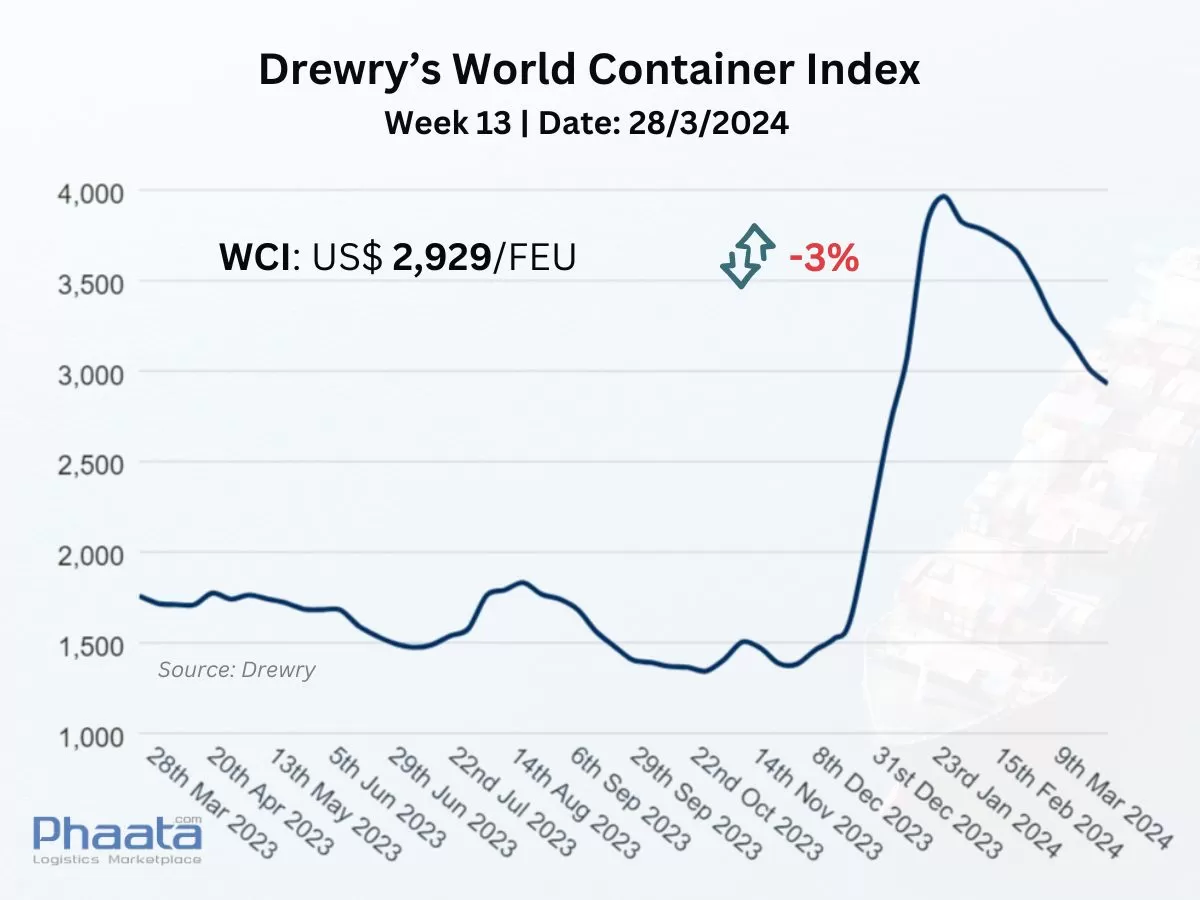

Drewry’s World Container Index for the week 13/2024 continued to decrease by 3% compared to the previous week, down to 2,929 USD. This freight index increased by 71% compared to the same week last year and was 106% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 13/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 13/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

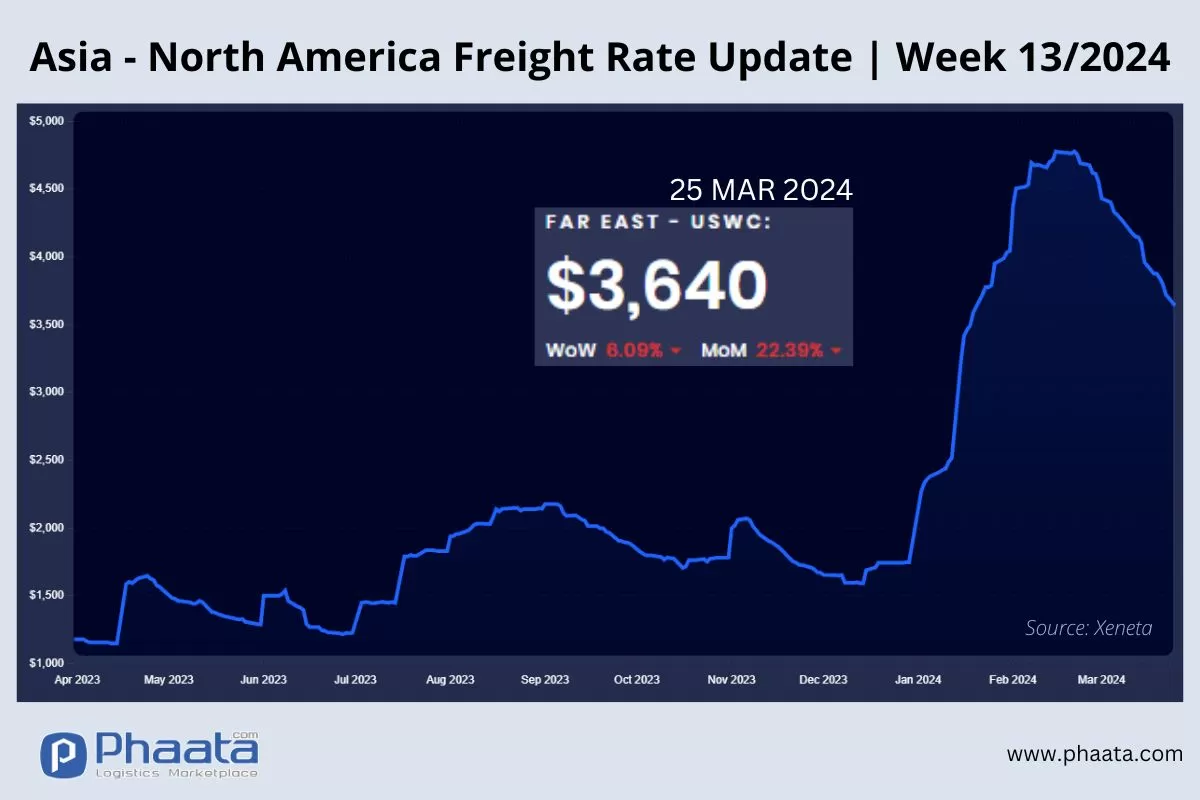

The freight rates from Asia to the West Coast of North America in the week 13/2024 continued to decrease sharply to 3,640 USD/FEU, equivalent to a decrease of 6.09% compared to the previous week and a decrease of 22.39% compared to the previous month, according to Xeneta data.

Due to the situation in the Red Sea, ships cannot return empty containers to Asia in time to meet demand. If the situation does not change, there may be equipment shortages in the coming weeks.

Shipping companies are evaluating the possibility of adding more ships to routes through Suez. Alternative routes could be via the Suez Canal or via the US West Coast by rail. Additionally, shipping lines are also enforcing eight-tonne average weight restrictions on containers moving through the canal. Travel via Panama remains the fastest route to the US East Coast.

The Port of Houston in Texas saw strong import growth in February, with general merchandise imports up 49% month-over-month. Despite challenges such as shipping restrictions through the Panama Canal, container shipping through the Port of Houston has shown significant growth.

Asia-US West Coast Freight rate | Week 13/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 13/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

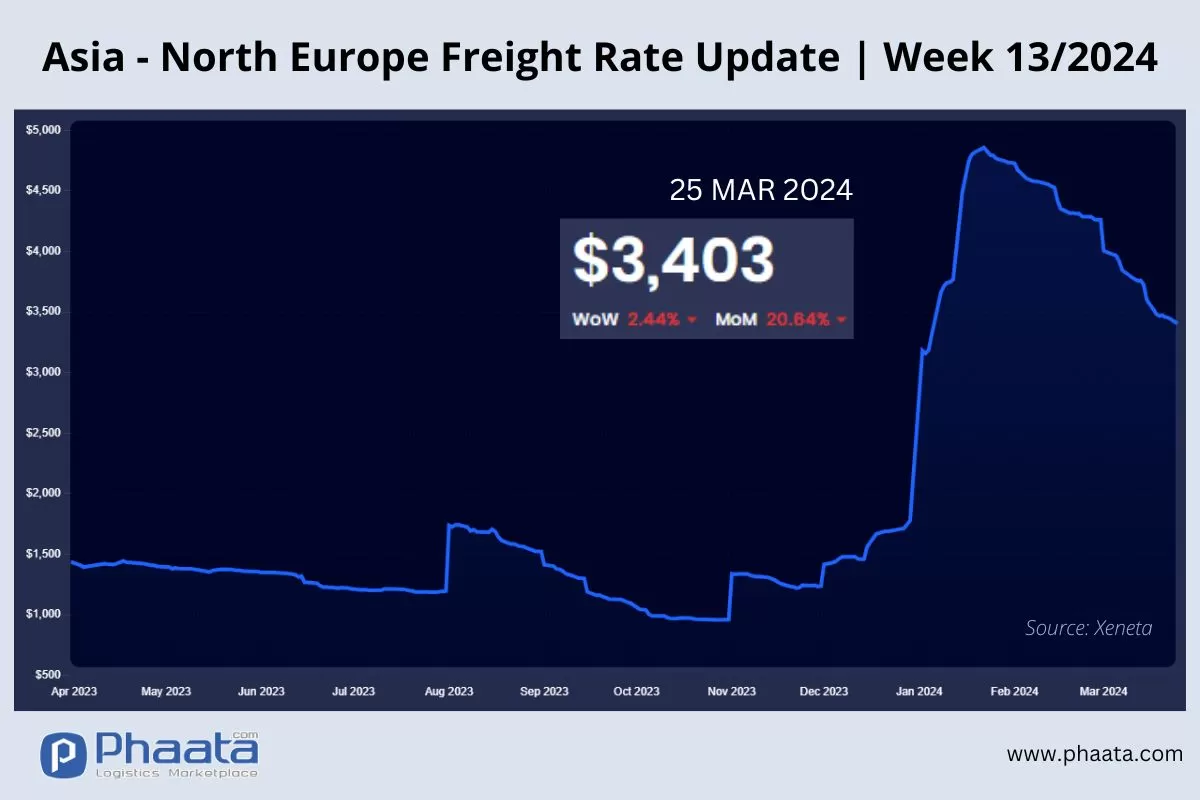

The rate for container shipping from Asia to Northern Europe in the week 13/2024 continued to decrease sharply to 3,403 USD/FEU, equivalent to a decrease of 2.44% compared to the previous week and a decrease of 20.64% compared to the previous month, according to Xeneta data.

Shipping lines are preparing to implement a General Freight Increase (GRI) in April with an increase of 400-600 USD per FEU. While demand remains stable at this time, discussions on current incentives and the finalization of long-term agreements are continuing, especially Red Sea surcharges are currently still maintained by shipping lines.

For the Asia-Europe route, shipping around the Cape of Good Hope continues. Over the weekend, a Chinese oil tanker named Huang Pu was attacked. Shipping lines are investigating conditions in the Indian Ocean to determine whether it is safe for shipping.

"Day 8 Product" services of the Ocean Alliance (including shipping lines CMA CGM, COSCO Shipping, Evergreen and OOCL) are effective from April 2024, updated as follows:

-Restructuring all services from Asia to Northern Europe via the Cape of Good Hope.

-Providing 6 services from Asia to Northern Europe with the widest range and largest capacity on this route.

-Temporarily suspend FAL7 service and dock at Pusan port on FAL1 service. The ports of Pusan, Nansha, Hong Kong and Ho Chi Minh will continue to be served by a separate main/feeder vessel to connect to the six alliance services to Northern Europe with improved frequency and reliability.

-The Port of Tangier will be transferred from FAL3 service to FAL1 service. Dunkirk will become the first port of call on FAL3, offering the best service to French customers with two direct express services: FAL1 into Le Havre and FAL3 into Dunkirk.

-FAL1's new itinerary: Ningbo, Shanghai, Yantian, Singapore, Tangier, Le Havre, Hamburg, Gdansk, Rotterdam, Port Kelang, Ningbo.

-FAL3's new itinerary: Qingdao, Shanghai, Ningbo, Yantian, Singapore, Dunkirk, Rotterdam, Southampton, Antwerp, Le Havre, Algeciras, Singapore, Qingdao.

Asia-Northern Europe Freight rate | Week 13/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 13/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 13/2024 remained stable at 731 USD/FEU. This price increased by 1.81% compared to the previous month.

Empty containers at many railway stations in the US mainland are lacking due to a lack of imports into the Midwest. Shippers should make reservations 2-3 weeks in advance to ensure they have container equipment for export plans.

Overall demand remains weak and is forecast to last until the end of the first quarter of 2024. Fierce competition is taking place among carriers. Freight rates continue to be offered by shipping companies at attractive rates to fill ships while capacity is still surplus.

US West Coast - Asia Freight rate | Week 13/2024 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 13/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week 13/2024 increased slightly to 871 USD/FEU, equivalent to an increase of 1.63% compared to the previous week; and decreased by 6.34% compared to the previous month.

Northern Europe - Asia Freight rate | Week 13/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 13/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- South Carolina Ports handled more than 200,000 TEUs in February

- Port of Melbourne increases container throughput in February

- As container shipping lines scale up, supply-demand imbalance intensifies

- CMA CGM updates container freight rates from Asia to Northern Europe

- Port of Oakland: Import and export container volume continues to grow

- International shipping and logistics market update - Week 12/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)