International shipping and logistics market update - Week 15/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 15/2024.

International shipping and logistics market update - Week 15/2024

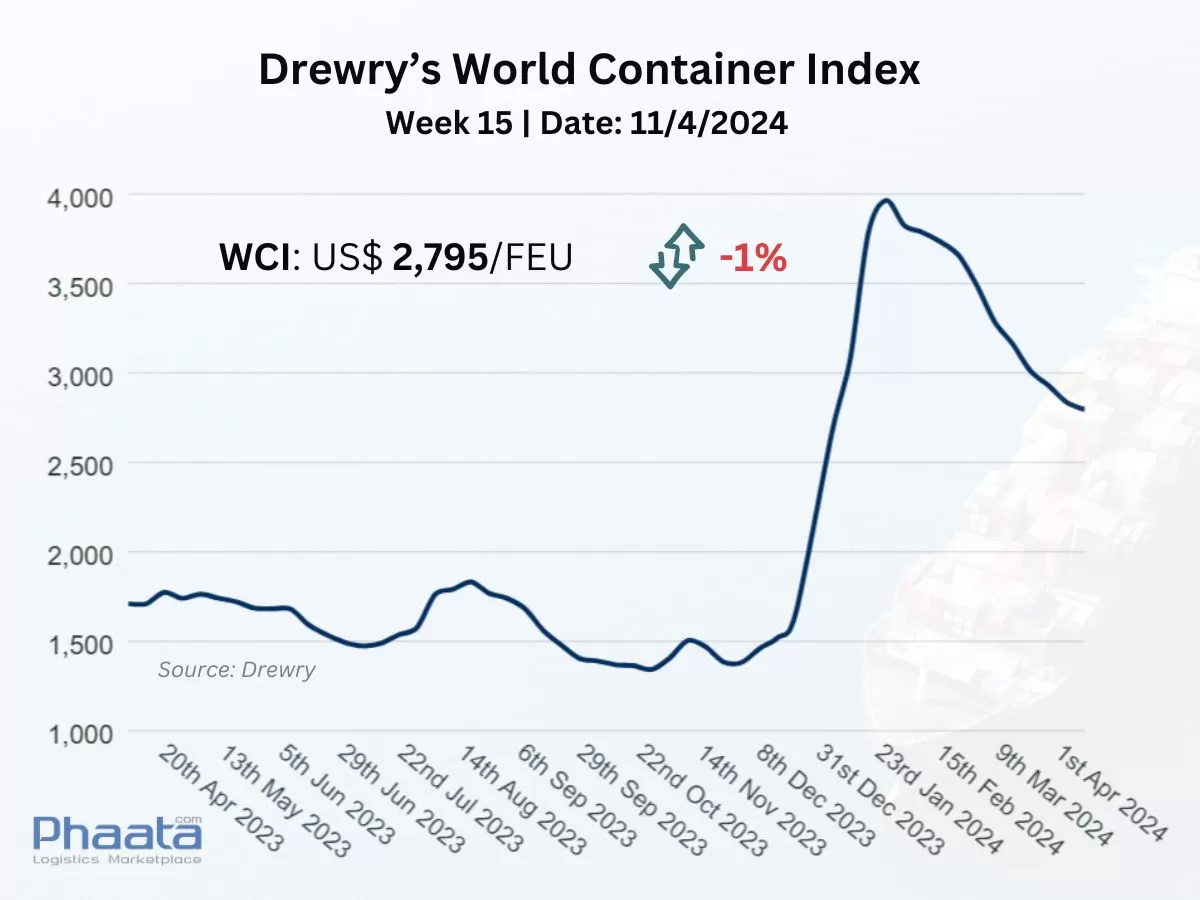

Drewry’s World Container Index for the week 15/2024 continued to decrease by 1% compared to the previous week, down to 2,795 USD. This freight rate index increased 64% compared to the same week last year and was 97% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 15/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 15/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

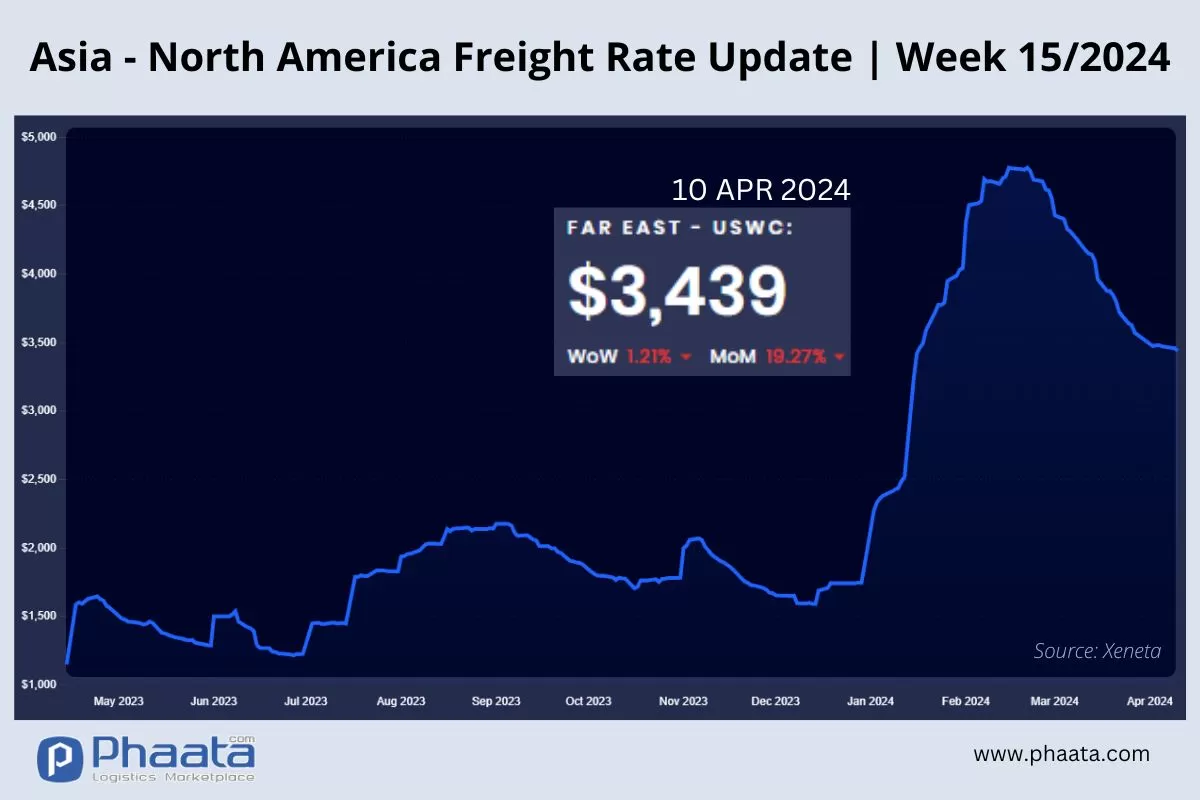

The freight rates from Asia to the West Coast of North America in the week 15/2024 continued to decrease sharply to 3,439 USD/FEU, equivalent to a decrease of 1.21% compared to the previous week and a decrease of 19.27% compared to the previous month, according to Xeneta data.

Due to the situation in the Red Sea, ships cannot return empty containers to Asia in time to meet demand. If the situation does not change, there may be equipment shortages in the coming weeks.

Shipping companies are evaluating the possibility of adding more ships to routes through Suez. Alternative routes could be via the Suez Canal or via the US West Coast by rail. Additionally, shipping lines are also enforcing eight-tonne average weight restrictions on containers moving through the canal. Travel via Panama remains the fastest route to the US East Coast.

Major shipping lines have lost half of the gains seen in the early days of the Red Sea crisis, and the market is shifting in favor of shippers in trans-Pacific contract negotiations, according to the latest report of Baltic Exchange. In the report, Vespucci Maritime CEO Lars Jensen noted that the pace of rate declines on trans-Pacific routes is slowing, currently indicating a possible stabilization over the next month but remains at a level significantly higher than pre-crisis levels, as well as higher than pre-pandemic levels.

The collapse of the Francis Scott Key Bridge in Baltimore on March 26 is not expected to affect shipping rates.

Asia-US West Coast Freight rate | Week 15/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 15/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

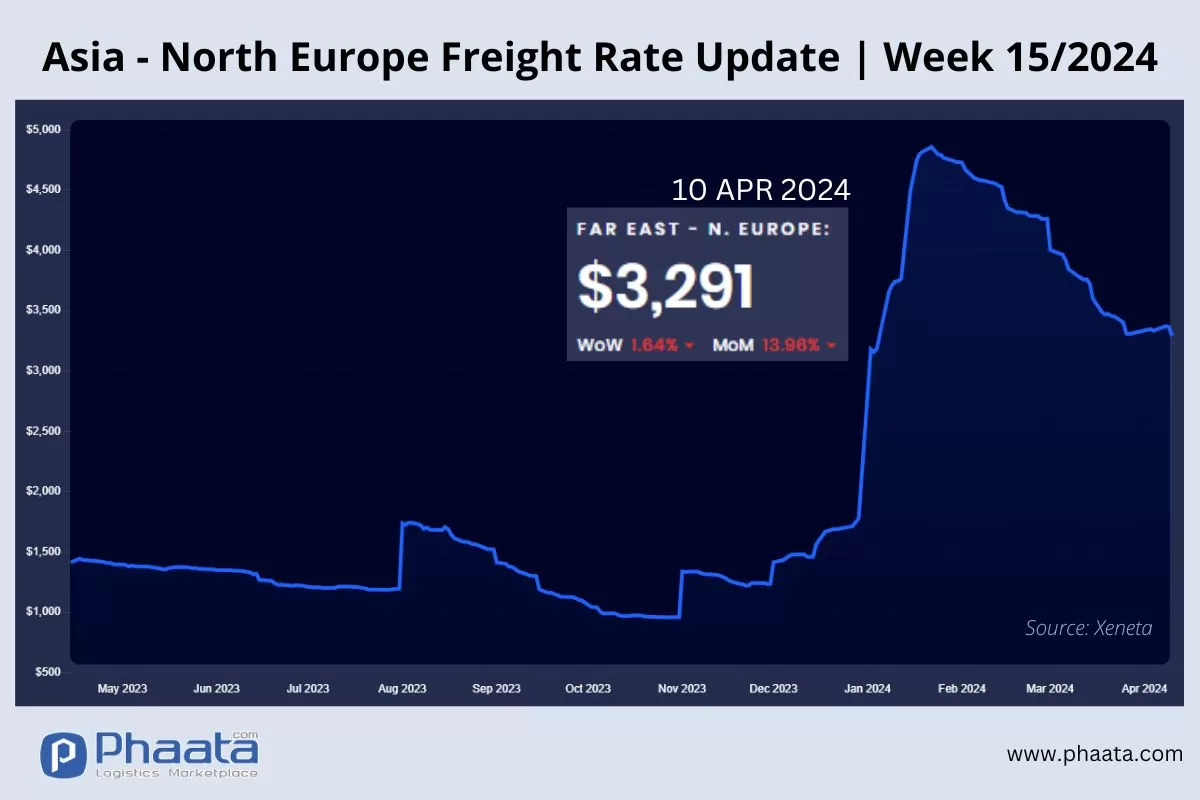

The rate for container shipping from Asia to Northern Europe in the week 15/2024 decreased slightly to 3,291 USD/FEU, equivalent to a decrease of 1.64% compared to the previous week and a decrease of 13.96% compared to the previous month, according to Xeneta data.

Shipping lines are preparing to implement a General Freight Increase (GRI) in April with an increase of 400-600 USD per FEU. While demand remains stable at this time, discussions on current incentives and the finalization of long-term agreements are continuing, especially Red Sea surcharges are currently still maintained by shipping lines.

The pace of rate declines on Asia-Europe routes is slowing, now indicating a possible stabilization over the next month but remains at a level significantly above pre-crisis levels, as well as as higher than pre-pandemic levels.

Asia-Northern Europe Freight rate | Week 15/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 15/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 15/2024 increased slightly to 787 USD/FEU. This price increased by 3.42% compared to the previous week, and increased by 4.24% compared to the previous month, according to Xeneta data.

Empty containers at many railway stations in the US mainland are lacking due to a lack of imports into the Midwest. Shippers should make reservations 2-3 weeks in advance to ensure they have container equipment for export plans.

US West Coast - Asia Freight rate | Week 15/2024 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 15/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

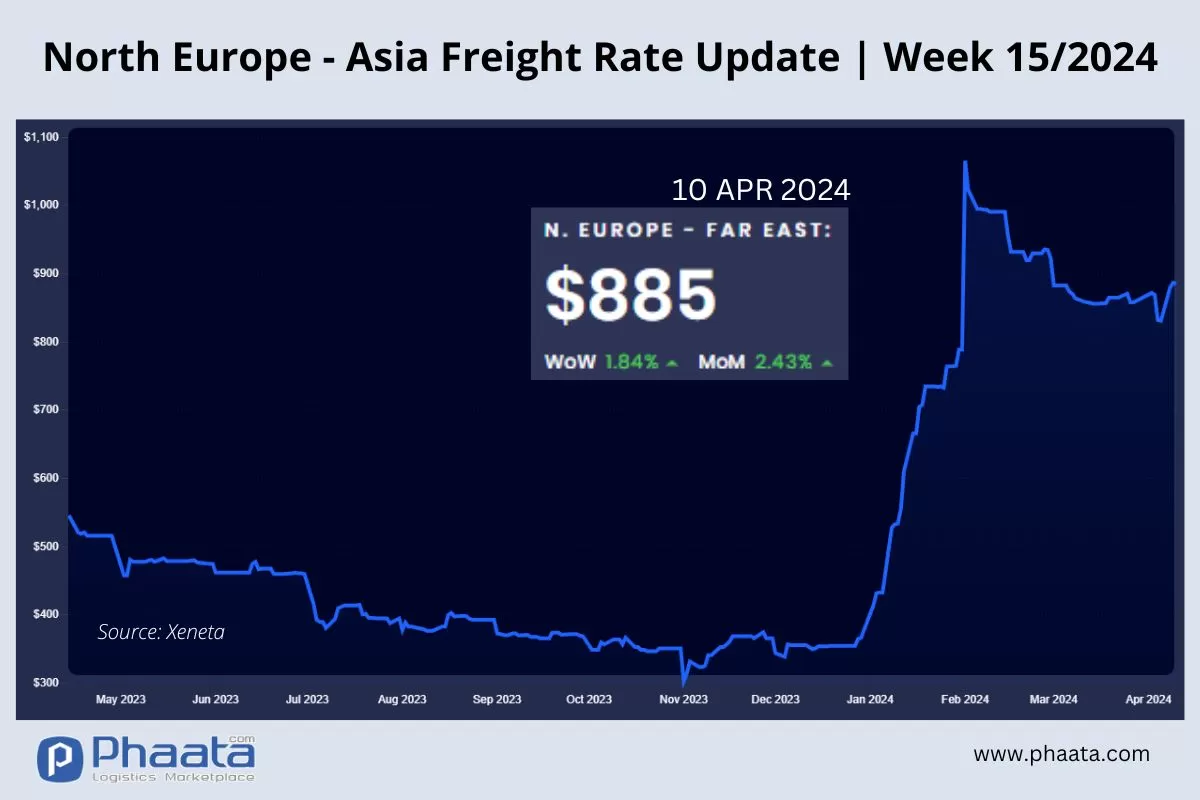

The freight rate from Northern Europe to Asia in the week 15/2024 increased slightly to 885 USD/FEU, equivalent to an increase of 1.84% compared to the previous week; and increased by 2.43% compared to the previous month.

Northern Europe - Asia Freight rate | Week 15/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 15/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Market gradually stabilized during trans-Pacific contract negotiations for new season

- Reliability of global container shipping schedules improved

- ZIM surpasses Yang Ming on global container shipping line rankings

- OOCL's revenue decreased in Q1 2024 despite container volume growth

- MSC shipping line leads in capacity for reefer containers

- International shipping and logistics market update - Week 14/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)