International shipping and logistics market update - Week 16/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 16/2024.

International shipping and logistics market update - Week 16/2024

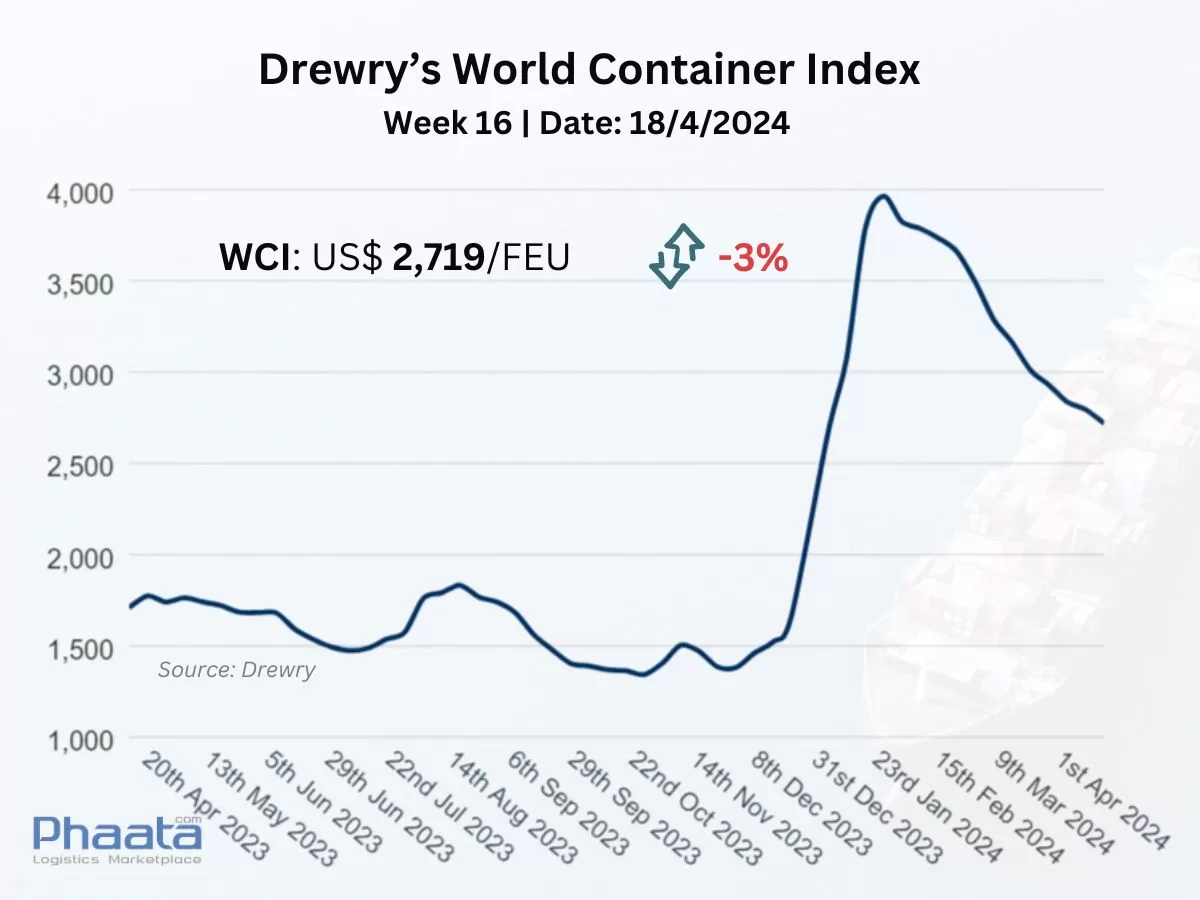

Drewry’s World Container Index for the week 16/2024 continued to decrease by 3% compared to the previous week, down to 2,719 USD. This freight index increased 53% compared to the same week last year and was 91% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 16/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 16/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

The freight rates from Asia to the West Coast of North America in the week 16/2024 continued to decrease sharply to 3,318 USD/FEU, equivalent to a decrease of 3.35% compared to the previous week and a decrease of 14.4% compared to the previous month, according to Xeneta data.

Major shipping lines are currently at a reduced advantage compared to the early days of the Red Sea crisis, and the market is shifting in favor of shippers in trans-Pacific contract negotiations. The rate of rate decline on trans-Pacific routes is slowing, now indicating a possible stabilization over the next month but remains at a level significantly above pre-crisis levels, as well as higher than pre-pandemic levels.

Due to the situation in the Red Sea, ships cannot return empty containers to Asia in time to meet demand. If the situation does not change, there may be equipment shortages.

Asia-US West Coast Freight rate | Week 16/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 16/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

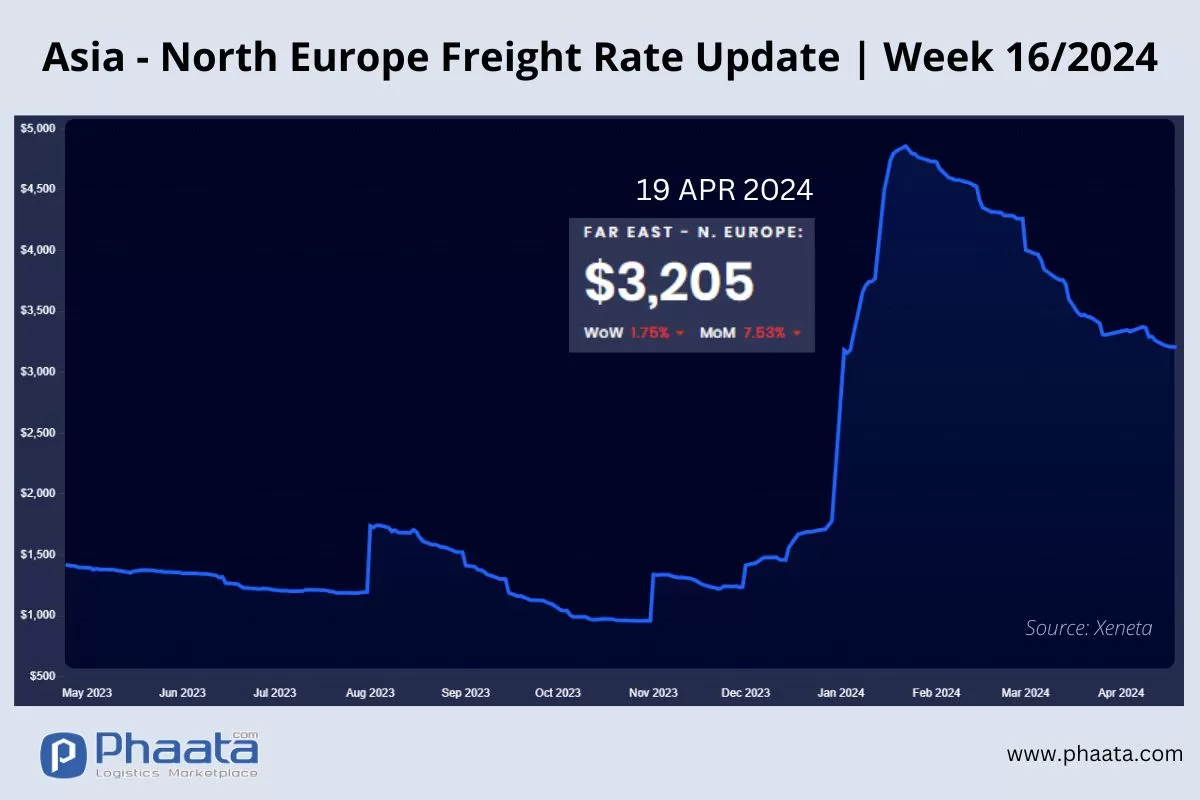

The rate for container shipping from Asia to Northern Europe in the week 16/2024 decreased slightly to 3,205 USD/FEU, equivalent to a decrease of 1.75% compared to the previous week and a decrease of 7.53% compared to the previous month, according to Xeneta data.

Demand is still on a downward trend. The pace of rate declines on Asia-Europe routes is slowing, now indicating a possible stabilization over the next month but remains at a level significantly above pre-crisis levels, as well as as higher than pre-pandemic levels.

Asia-Northern Europe Freight rate | Week 16/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 16/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 16/2024 were at 776 USD/FEU, a slight increase of 1.44% compared to the previous week, and an increase of 7.33% compared to the previous month, according to data. Xeneta.

Empty containers at many railway stations in the US mainland are lacking due to a lack of imports into the Midwest. Shippers should make reservations 2-3 weeks in advance to ensure they have container equipment for export plans.

US West Coast - Asia Freight rate | Week 16/2024 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 16/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

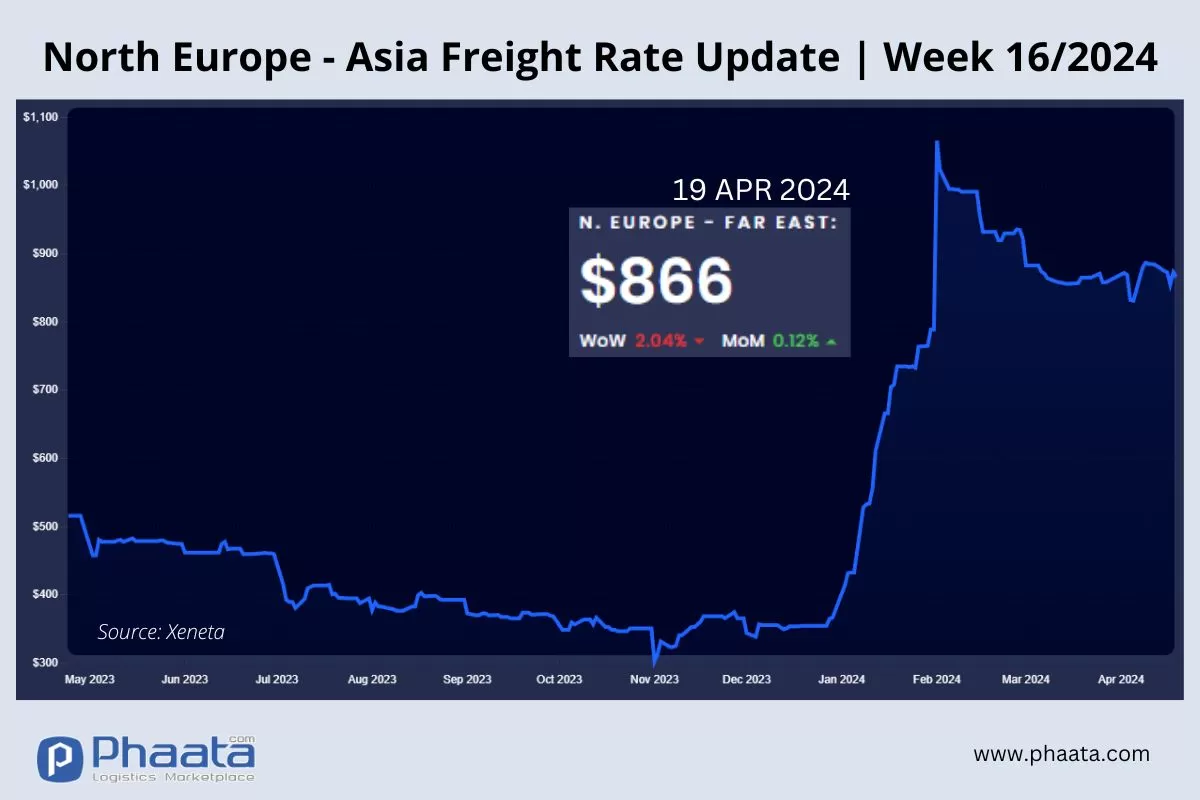

The freight rate from Northern Europe to Asia in the week 16/2024 decreased slightly to 866 USD/FEU, equivalent to a decrease of 2.04% compared to the previous week; and increased by 0.12% compared to the previous month.

Northern Europe - Asia Freight rate | Week 16/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 16/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Jebel Ali returns to top 10 largest container ports in the world

- US container import volumes remain stable, in the face of some potential global challenges

- International shipping and logistics market update - Week 15/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)