International shipping and logistics market update - Week 18/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 18/2024.

International shipping and logistics market update - Week 18/2024

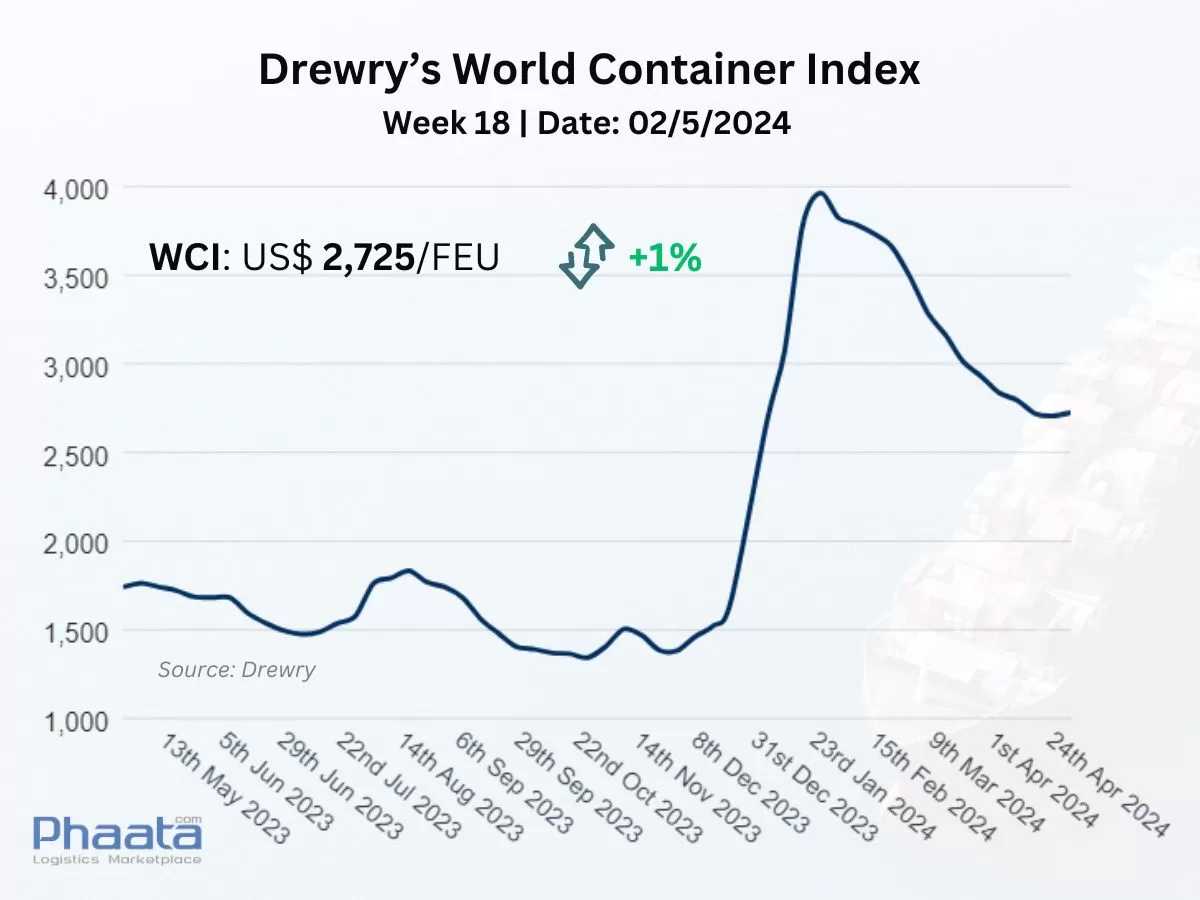

Drewry’s World Container Index for the week 18/2024 increased slightly by 1% compared to the previous week, to 2,725 USD. This freight index increased 55% compared to the same week last year and was 92% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 18/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 18/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

The freight rates from Asia to the West Coast of North America in the week 18/2024 continued to decrease slightly to 3,296 USD/FEU, equivalent to a decrease of 0.39% compared to the previous week and a decrease of 7.75% compared to the previous month, according to Xeneta data.

Carriers announced a GRI (General Rate Increase) on May 1. This will increase the difference between fixed rates on long-term contracts and floating rates; At the same time, it may lead to many shipments being transferred to reservations at the price of long-term contracts in May. Goods are showing signs of increasing.

Major shipping lines are currently at a reduced advantage compared to the early days of the Red Sea crisis, and the market is shifting in favor of shippers in trans-Pacific contract negotiations. The rate of rate decline on trans-Pacific routes is slowing, now indicating a possible stabilization over the next month but remains at a level significantly above pre-crisis levels, as well as higher than pre-pandemic levels.

Asia-US West Coast Freight rate | Week 18/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 18/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

The rate for container shipping from Asia to Northern Europe in the week 18/2024 increased slightly to 3,223 USD/FEU, equivalent to an increase of 0.59% compared to the previous week and a decrease of 2.54% compared to the previous month, according to Xeneta data.

Demand is still on a downward trend. The pace of rate declines on Asia-Europe routes is slowing, now indicating a possible stabilization over the next month but remains at a level significantly above pre-crisis levels, as well as as higher than pre-pandemic levels.

Some shipping lines announced GRI (General Rate Increase) from mid-May.

Asia-Northern Europe Freight rate | Week 18/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 18/2024 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week 18/2024 were at 770 USD/FEU, down slightly by 0.26% compared to the previous week, and increased by 5.34% compared to the previous month, according to data. Xeneta.

Empty containers at many railway stations in the US mainland are lacking due to a lack of imports into the Midwest. Shippers should make reservations 2-3 weeks in advance to ensure they have container equipment for export plans.

US West Coast - Asia Freight rate | Week 18/2024 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 18/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

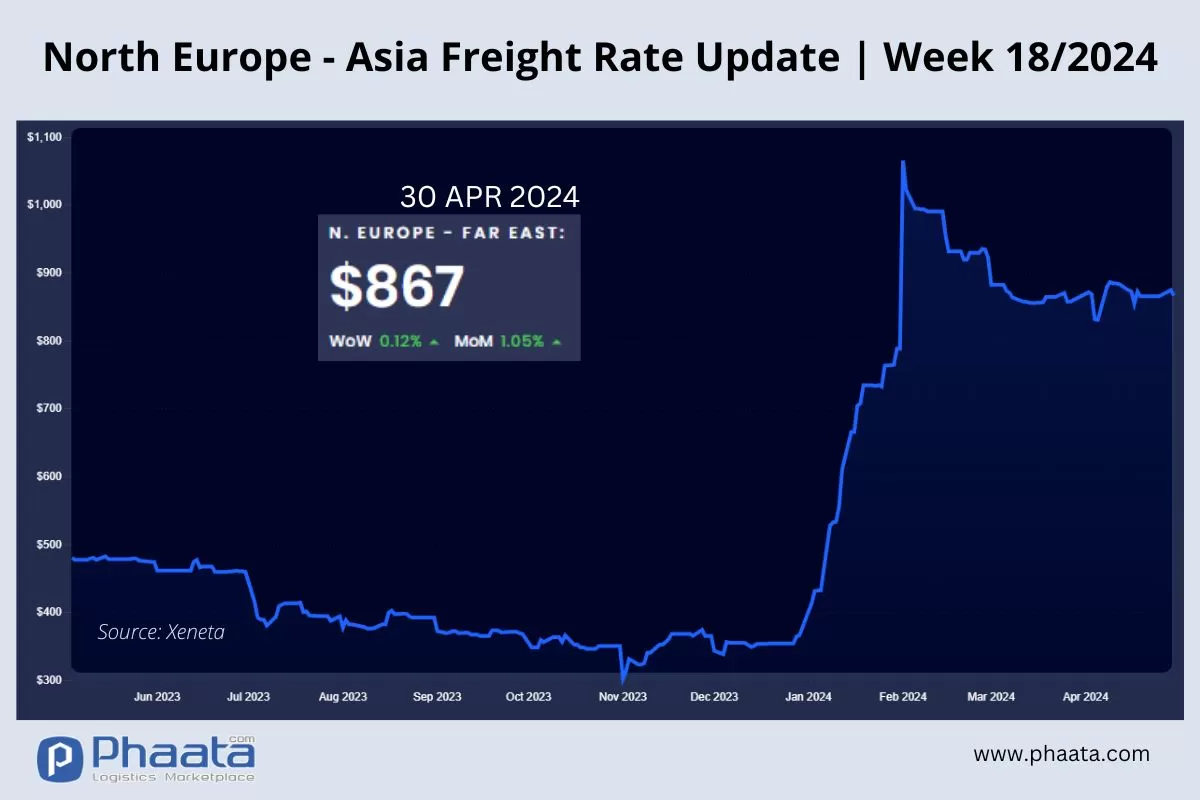

The freight rate from Northern Europe to Asia in the week 18/2024 increased slightly to 867 USD/FEU, equivalent to an increase of 0.12% compared to the previous week; and increased by 1.05% compared to the previous month.

Northern Europe - Asia Freight rate | Week 18/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 18/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- International shipping and logistics market update - Week 17/2024

- COSCO schedules: Vietnam - North America in May 2024

- SITC updates Vietnam-Intra Asia sailing schedules in May 2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)