International shipping and logistics market update - Week 28/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 28/2024.

International shipping and logistics market update - Week 28/2024

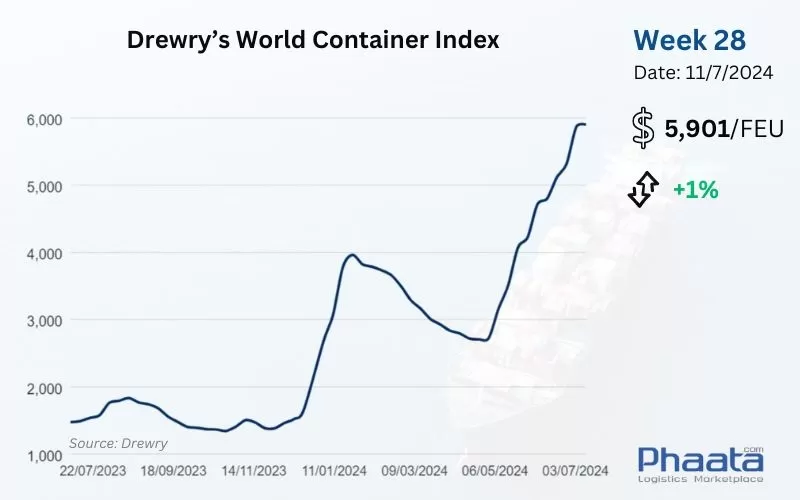

Drewry’s World Container Index for the week of 28/2024 increased slightly by 1% compared to the previous week, to 5,901 USD. This freight rate index increased 297% compared to the same week last year and was 315% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 28/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America continued to increase to $7,893/FEU in week 28/2024, equivalent to a 2.83% increase compared to the previous week and a 33.19% increase compared to the previous month, according to Xeneta data.

The market is entering the peak season, demand is still strong and is estimated to exceed last year's cargo volume on transpacific routes. Shipping lines have successfully implemented a General Rate Increase (GRI) in early July for spot rates on all ports of origin from Asia to North America.

For spot rates, shipping lines have successfully implemented the General Rate Increase (GRI) for July on all gateways in Asia based on the peak conditions we are seeing this month. Shipping lines have adjusted rates to the East Coast twice as much as to the West Coast (WC) to manage the massive booking intake. Phaata.com forecasts that rates will be extended into the second half of July.

For fixed rates of long-term contracts, carriers apply Peak Season Surcharge (PSS) from July 1st. The price increase in early July marked another increase in sea freight rates. Phaata.com forecasts that rates will be extended into the second half of July.

There are many blank sailings due to the impact of routes passing through the Cape of Good Hope and port congestion in Asia and North America. Many premium services from shipping lines guarantee fast service and ensure equipment and space on board, while other carriers try to reduce the backlog in Asia with additional loaders. With additional loaders to the Pacific Southwest (PSW), the situation is improving week by week, while the East Coast (EC) remains heavily overbooked.

Services from Asia to North America have been nearly full in July. Routes from Vietnam and South/East China (Yantian/Shanghai/Ningbo) to the US are particularly scarce.

Shippers are expected to have a very difficult peak season and are trying to overcome the uncertainties.

Asia-US West Coast Freight rate | Week 28/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 28/2024 continued to increase slightly to $8,047/FEU, equivalent to a 1.44% increase compared to the previous week and a 37.91% increase compared to the previous month, according to Xeneta data.

Spot rates increased very strongly again at the beginning of July, with an increase of $1,500-2,000/40' container. The capacity of shipping lines cannot fully meet the current shipping demand, while many ships are expected to be canceled in July and August.

Demand continues to increase strongly and freight rates increase sharply again. The increase in shipping demand is not only driven by consumer demand but also by importers adjusting to increase inventory due to longer than expected delivery times. Shippers are expected to continue shipping as soon as possible to avoid further delays.

Equipment shortages and port congestion in Asia are improving, but on-time performance is still less than 50% (according to the latest Sea-Intelligence report). There are 10 blank sailings announced for the Asia-North Europe route in the second half of July and August.

Floating rates increased again in the second half of July (by $500-800 per 40-foot container). Vessels remain full as capacity cuts and bookings take effect, and customers are still looking for earlier bookings to mitigate cargo delays.

Premium service options are still available to ensure that goods are loaded on earlier departures with higher equipment priority, which can mitigate the risk of delays or no equipment.

Asia-Northern Europe Freight rate | Week 28/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia in week 28/2024 decreased to $736/FEU, equivalent to a slight decrease of 0.94% compared to the previous week, and an increase of 5.29% compared to the previous month, according to Xeneta data.

Ocean freight rates for Q3 are trending up on US export routes due to rising demand in global container markets.

Congestion at critical transshipment hubs is reducing effective capacity for US exporters.

To ensure smooth exports, Phaata.com recommends booking 3-4 weeks in advance for shipments loading at a coastal port, and 4+ weeks in advance for shipments loading at an inland rail point.

US West Coast - Asia Freight rate | Week 28/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia in week 28/2024 continued to decrease to $495/FEU, equivalent to a 1.98% decrease compared to the previous week, and a 20.67% decrease compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 28/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Sea-Intelligence identifies growth of non-alliance services

- CMA CGM ship lost 44 containers off coast of South Africa

- SITC VIETNAM – LEADING NEW TRENDS

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)