International shipping and logistics market update - Week 30/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 30/2024.

International shipping and logistics market update - Week 30/2024

International shipping and logistics market update - Week 30/2024

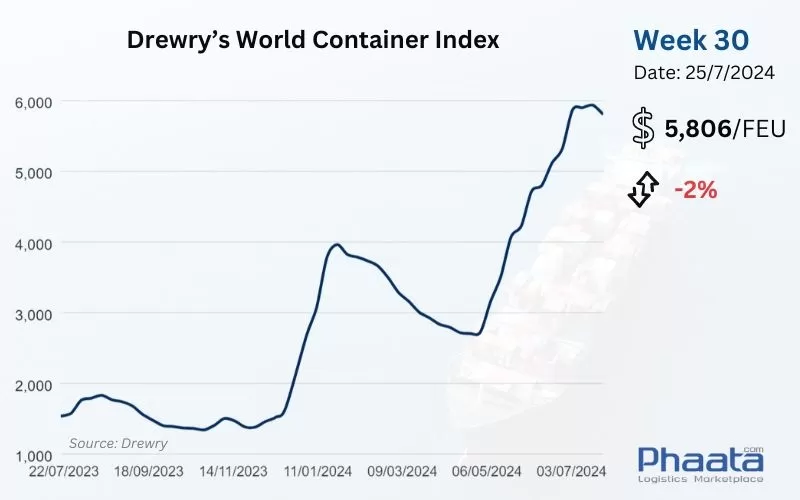

Drewry’s World Container Index for the week of 30/2024 decreased by 2% compared to the previous week to USD 5,806. This freight rate index increased by 268% compared to the same week last year and was 309% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 30/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 30/2024 fell to $7,135/FEU, down 7.89% week-on-week and up 2.29% month-on-month, according to Xeneta data.

As additional vessels were added to the trans-Pacific trade, space pressure on the Asia-US West Coast (USWC) trade has eased, particularly at ports in the Pacific Southwest (PSW).

Volumes remain strong, surpassing last year’s numbers on the trans-Pacific trades. We are seeing delays due to routes around the Cape of Good Hope and port congestion in Asia and North America. Further delays and capacity challenges are expected on the US East Coast (USEC) route due to poor weather conditions around the Cape of Good Hope.

For spot rates: Carriers have started to reduce rates on both the US East Coast and US West Coast routes to balance supply and demand. Of these, rates to the US West Coast have seen the largest reductions.

For long-term fixed rates: Carriers have not changed the Peak Season Surcharge (PSS) so far, as the gap between long-term fixed rates and spot rates remains too large.

Services from Asia to North America were close to full capacity in July. Space was tight on routes from Vietnam and South/East China (Yantian/Shanghai/Ningbo) to the US.

Many premium services from carriers are offering expedited service and securing equipment and space, while others are trying to reduce backlogs in Asia with additional sailings. With additional sailings to the Pacific Southwest (PSW), the situation is improving week by week, while the East Coast (EC) remains severely congested.

Shippers are expected to have a very difficult peak season and are trying to overcome the uncertainties.

Asia-US West Coast Freight rate | Week 30/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 30/2024 were almost flat, rising slightly to $8,475/FEU, up 0.02% week-on-week, up 22.67% month-on-month, according to Xeneta data.

Demand remains strong and higher than last year on the Asia-Europe trade. Shipping lines are not yet fully compliant with current demand, while many sailings are scheduled to be cancelled in July and August. Many sailings are being cancelled due to route adjustments around the Cape of Good Hope and port congestion in Asia. Some additional vessels are being added to the Asia-Europe route via the Cape of Good Hope in the second half of July.

For spot rates: Shipping lines have started to increase rates and are offering more spaces to match supply and demand.

For long-term fixed rates: Slot availability on fixed rate contracts remains very limited. Many carriers stopped offering new long-term fixed rate offers in May. Carriers are prioritizing long-term contract customers with frequent bookings and introducing space cuts/restrictions in August.

Container Equipment Situation: Carriers have improved their empty container equipment supply, but there is still a shortage, especially for long-term fixed rate contract customers. Carriers are prioritizing contracts with higher rates.

Asia-Northern Europe Freight rate | Week 30/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia continued to decline in week 30/2024 to USD 685/FEU, down 4.06% from the previous week, up 1.78% from the previous month, according to Xeneta data.

Congestion at key hubs is reducing effective capacity for US exporters.

To ensure smooth export shipments, Phaata.com recommends booking 3-4 weeks in advance for coastal port-loading shipments and 4 weeks or more for inland rail-loading shipments.

US West Coast - Asia Freight rate | Week 30/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 30/2024 to USD 482/FEU, equivalent to down 1.03% week-on-week, down 23.13% month-on-month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 30/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 30/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Container traffic through Valenciaport increases sharply in first half of 2024

- Sea-Intelligence sees container shipping lines as 'bullish' for the peak season

- Red Sea crisis reaches peak impact on container shipping

- Ocean freight rates ease due to capacity increase and peak season pressure easing

- International shipping and logistics market update - Week 29/2024

- SITC VIETNAM – LEADING NEW TRENDS

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)