International shipping and logistics market update - Week 34/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 34/2024.

International shipping and logistics market update - Week 34/2024

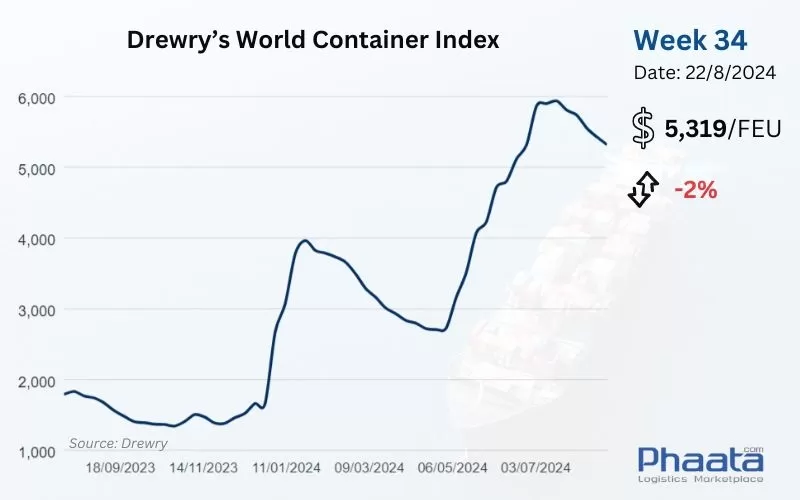

Drewry’s World Container Index for the week of 34/2024 continued to decrease by 2% compared to the previous week, to USD 5,319. This freight rate index is 274% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 34/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 34/2024 increased sharply to USD 6,793/FEU, equivalent to a 6.88% increase compared to the previous week, down 10.67% compared to the previous month, according to Xeneta data.

With additional vessels entering the trans-Pacific trade, the pressure on space on the Asia-US West Coast (USWC) trade has eased, particularly at ports in the Southwest Pacific.

Volumes remain strong, surpassing last year’s figures on trans-Pacific trades. We are seeing numerous delays around the Cape of Good Hope and port congestion in Asia and North America. Further delays and capacity challenges are expected on the route to the US East Coast (USEC) due to poor weather conditions around the Cape of Good Hope.

On a positive note, water levels in Panama’s Gatun Lake have recovered and local authorities have eased the Panama Canal’s weight restrictions.

Spot rates: Carriers implemented a general rate increase (GRI) in week 34, driving rates higher over the past week.

Fixed Rates: Discussions on the Peak Season Surcharge (PSS) are very tense at the moment, as the gap between spot and long-term fixed rates does not support price reductions, especially when considering the possibility of GRI implementation in August.

Important:

Canada’s two largest rail carriers – Canadian National Railway (CN) and Canadian Pacific Kansas City Limited (CPKC) – have suspended service as contract negotiations with workers have broken down. The suspension of rail operations follows months of intense negotiations between the rail carriers and 9,300 engineers, conductors, and station workers. Despite last-minute efforts to reach an agreement, the shutdown has been a major one.

The consequences are huge. Canadian Rail moves $1 worth of freight every day, and a shutdown could severely disrupt supply chains across North America. The ripple effect could affect industries from agriculture to manufacturing, impacting the US and Canadian economies as well.

Asia-US West Coast Freight rate | Week 34/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

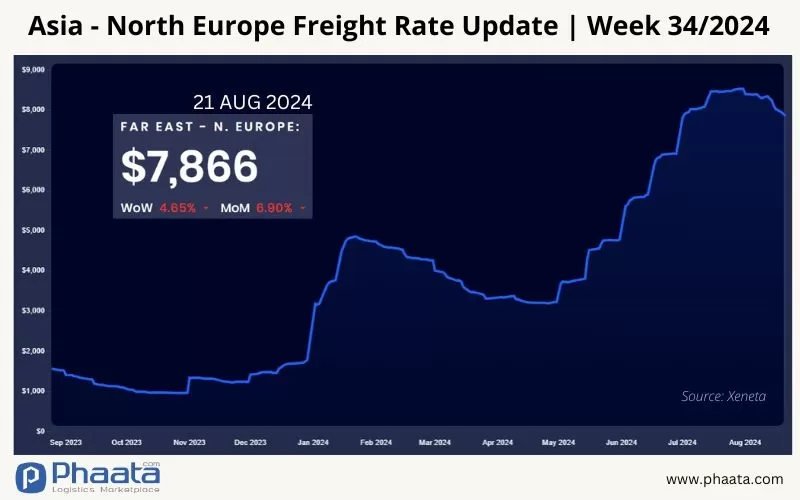

Freight rates from Asia to North Europe in week 34/2024 to $7,866/FEU, down 4.65% week-on-week and 6.90% month-on-month, according to Xeneta data.

Demand in the last week of August and early September slowed slightly compared to the June and July markets. Floating rates remain high and with many sailings canceled, availability of space is improving.

Demand remains strong and higher than last year on the Asia-Europe trade. Shipping lines are not yet fully able to meet current demand, while many sailings are scheduled to be cancelled in August. Many sailings are being cancelled for adjustments due to the Cape of Good Hope route and port congestion in Asia.

On spot rates: Prices started to decline in the second half of August. The downward trend is expected to continue into early September, although they are still relatively high. Carriers are being more proactive in adjusting prices to optimize capacity.

Long-term fixed rates: Space supply for fixed rate contracts remains very limited. Carriers are prioritizing long-term contract customers with regular bookings and introducing space cuts/restrictions in August.

Container Equipment Situation: Carriers have improved their empty container equipment availability, but some locations, with certain container types, such as 20’GP., are still in a state of shortage, especially for long-term fixed-rate contract customers. Shipping lines are prioritizing contracts with high rates.

Phaata advises shippers to proactively arrange bookings as soon as possible on this route.

Asia-Northern Europe Freight rate | Week 34/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia continued to decline in week 34/2024 decreased to USD 659/FEU, equivalent to a decrease of 1.05% compared to the previous week, down 7.83% compared to the previous month, according to Xeneta data.

Capacity has been reduced on routes from the US to the Indian subcontinent, Middle Eastern ports and Northern European ports, related to vessel shortages and cancelled sailings.

To ensure smooth export shipments, Phaata.com advises shippers to book 2 weeks in advance for coastal loading shipments and 3-4 weeks or more for inland rail loading shipments.

US West Coast - Asia Freight rate | Week 34/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 34/2024 decreased slightly, at 493 USD/FEU, equivalent to a decrease of 0.2% compared to the previous week, up 0.82% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 34/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Canadian Rail Strike Scheduled for This Thursday

- Drewry: Dry Container Production Surpasses All-Time High

- Retailer Inventories Surging Above Trend, Sea-Intelligence Reports

- Yang Ming Declares General Average After Fire on YM Mobility at Ningbo Port

- Maersk joins nuclear-powered container ship study

- ZIM Reports Strong Q2 2024 Results, Raises Full-Year Guidance

- Port of Hamburg handles 3.8 million TEUs in H1 2024

- International shipping and logistics market update - Week 33/2024

- SITC TRUCKING - Container transport service in the Northern region of Vietnam

- Pacific Lines updates domestic sailing schedules in Aug 2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)