International shipping and logistics market - Week 24/2022

International logistics and container shipping market on Asia, Europe and North America routes in the week of 24/2022.

International shipping and logistics market update for the week of 24/2022

1. Asia - North America route

Shanghai has reopened after two months of lockdown and restrictions related to Covid-19. Production and shipping activities can resume as usual, Shipping activities have recovered, however volume and time to recover after two months of Covid-19 blockade is still unclear.

Demand remains weak on the Asia-North America route, as there is still uncertainty about whether shipments will spike and a sharp increase in peak season is expected.

For goods that are already in stock, US importers can take advantage of existing market space along with better spot rates.

Labor negotiations by the International Labor and Warehouse Federation of America (ILWU) and the Pacific Maritime Association (PMA) are set to begin and stakeholders await news on possible effects.

- Freight rates: Rates continue to decrease on the Asia-North America route as demand remains low compared to the supply capacity of carriers. Rates fell in many areas, especially entering US West Coast (USWC) ports. According to Xeneta, the freight rate from Asia to the West Coast of North America this week was at $7,971/FEU, down 0.21% from last week and down 6.9% from last month.

- Space: Most are available

- Empty container equipment: Improved

Recommendation: Shippers should continue to book at least 2 weeks before estimated time of departure (ETD) for the best chance; Consider switching from a standard service to a premium guaranteed service. Monitor and check closely with suppliers to capture any Covid-19 related impacts or changes on their production and forecasts quickly to adjust accordingly fast.

Freight rates Asia- US West Coast | Week 24/22 (Image: Phaata.com)

2. Asia - Europe route:

After Shanghai reopens, cargo volume on the Asia-Europe route is increasing again but the recovery is not yet a sudden spike.

Q3 is expected to pick up strongly with a peak in the summer. However, there are many macro uncertainties such as the Ukraine conflict, high inflation across Europe, and falling consumer confidence.

Severe congestion at European ports is delaying return trips to Asia, leading to more delays and cancellations.

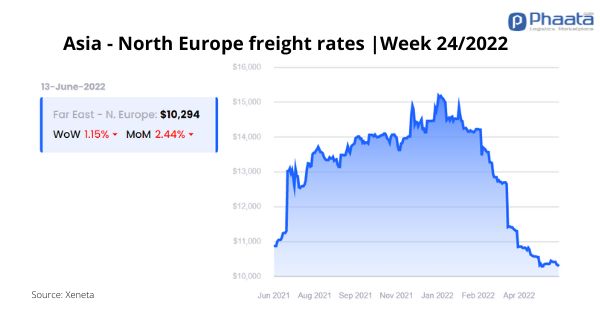

- Freight rates: Freight rates tend to increase in June due to more limited space. Rates from Asia to Northern Europe were at $10,294/FEU, down 1.15% from last week and down 2.44% month on month, according to Xeneta data.

- Space: The space is starting to fill up again.

- Empty Container equipment: There has been improvement but there is still a shortage in many Asian countries.

Recommendation: Shippers should make reservations at least 2 weeks before estimated time of departure (ETD). Consider choosing a guaranteed service and have the flexibility to choose replacement equipment when needed.

Freight rates Asia-Europe | Week 24/22 (Image: Phaata.com)

3. North America - Asia route:

Vessel arrivals and capacity availability remained stable for all US West Coast ports.

More sailings are expected to be blanked due to the large number of sailings waiting in Shanghai.

The East Coast region continues to see challenges with vessel congestion and a number of shipping lines having dropped out of the Charleston and Savannah ports.

- Ocean freight: According to Xeneta, freight rates from North America to Asia this week remained unchanged, remaining at $1,099/FEU, down 3.17% from the previous month. Shipping lines have announced the application of a limited GRI general price increase surcharge for June and July.

- Space: Stable for West Coast ports, and has improved in US East Coast ports.

- Empty container equipment: The shortage of container equipment is still causing difficulties for goods transported from within the US, especially at major ports.

Recommendation: Shippers make reservations at least 4 weeks or more before estimated time of departure (ETD).

Freight rates US West Coast - Asia | Week 24/22

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Shippers fear rising shipping costs due to carbon tax

- Shanghai may be locked down again due to the Covid outbreak

- FMC announces to fine Hapag-Lloyd shipping line with the amount of 2 million USD

Source: Phaata.com

Phaata.com - Vietnam's First Global Logistics Marketplace

► Find better Freight rates & Logistics services!

.webp)

.webp)