Red Sea Crisis: Freight rates from Far East to US may have peaked

The crisis in the Red Sea has caused sea freight rates from the Far East to the US to increase by more than 150%, but with recent developments, shippers may feel some relief from the increase.

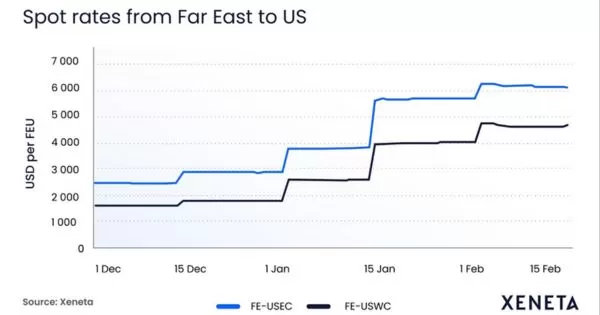

Latest data released by consulting firm Xeneta shows that spot rates may have peaked after rates for routes from the Far East to the US have decreased slightly since the last session. General Rate Increases (GRI) adjustment in early February 2024.

Specifically, for the route to the East Coast, the freight price has decreased slightly from 6,260 USD/FEU (40ft container) on February 1 to 6,100 USD on February 15. Freight rates to the West Coast have also decreased from US$4,730/FEU to US$4,680 during the same period.

Xeneta – the leading freight and market intelligence consultant in the ocean and air freight industries – has compiled more than 400 million data points from the industry community and initial results suggest the market will continue to ease in the coming days.

Although US importers will certainly be happier as the market shows signs of cooling, the impact from the Red Sea crisis is not over, with spot rates for the East Coast route still increasing by 145%. Compared to December 14, 2023, for routes to the West Coast, the level is even higher, 185%.

Ms. Emily Stausbøll, analyst at Xeneta Market commented: “Unlike during Covid-19 when disruption continued to wreak havoc, shippers and carriers now know what they are dealing with in terms of ships being diverted around Africa to avoid the Suez Canal. Rates are still elevated so the impact of this crisis is far from over - and the situation can still change at any moment - but perhaps some semblance of order has been restored".

The market is in a sprint phase before negotiating contracts with US shippers

The TPM24 shipping industry summit taking place in Long Beach California in early March will serve as the opening shot for negotiations between shipping lines and US shippers on new contracts, so The next few weeks will be a difficult time for the market.

“Carriers will be doing everything within their power to keep rates elevated for when they enter negotiations with US shippers for new contracts,” Ms. Stausbøll predicted."

“However, Xeneta data suggests this will prove difficult and it is likely rates will decrease further in the next 10 days, as we have already seen happen on trades from the Far East into Europe.

“If carriers are looking for reasons for optimism, it may be found in the ending of Lunar New Year celebrations, which will see an increase in volumes out of the Far East and the potential for upward pressure on rates."

“Either way, the next few weeks is crunch time for both ocean freight carriers and shippers and could define their fortunes for the rest of 2024.”

Source: Phaata.com (According to ContainerNews)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)