Transpacific Container Demand Surges in Early 2024

According to Lynerlytica, westbound container volumes on the transpacific trade lane have surged by 16.9% in January 2024.

The latest report from Lynerlytica shows that westbound container volumes on the transpacific trade lane have rebounded by 16.9% in January 2024. Full-year volumes are expected to record positive growth again after falling by 15.1% last year.

The logistics consultancy firm said that transpacific carriers have been able to capitalize on the strong cargo rebound with freight rates more than 200% higher compared to last year.

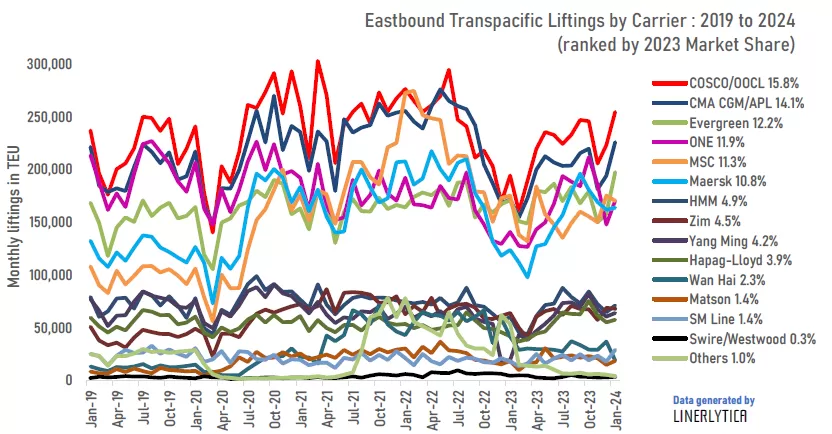

The top three container lines, COSCO, CMA CGM, and Evergreen, have managed to maintain their positions in the first month of the year. All three are members of the OCEAN Alliance, which is poised to strengthen its dominance on the transpacific trade with the imminent split of the 2M alliance and the departure of Hapag-Lloyd from THE Alliance in 2025.

Lynerlytica reported that the bullish market sentiment has not been dampened by the Lunar New Year break, with carriers still retaining most of their recent rate gains, defying predictions of a post-holiday correction.

"Capacity is expected to remain tight in March due to the extended Red Sea diversions, with charter rates continuing to firm due to limited vessel availability. Unlike previous years when the idle fleet rises due to the post-holiday blanked sailings, carriers are able to keep their fleet fully employed with ships returning via the Cape delaying their arrivals to Asia in order to avoid the immediate post-holiday window," Linerlytica said in the report.

According to the consultancy firm, the rebound in transpacific demand is also another reason for optimism, which will keep the overall capacity tight at least for as long as the Red Sea diversions persist.

Read more:

- Port of Savannah Handles Nearly 430,000 TEUs in January 2024

- International shipping and logistics market update - Week 7/2024

Source: Phaata.com (According to ContainerNews)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)