DSV Acquires DB Schenker, Becomes World's Largest Freight Forwarder

DSV will become the world's largest freight forwarder after completing its €14.3bn acquisition of DB Schenker.

Photo: DB Schenker

DSV has confirmed reports that it has signed a deal to take over German logistics giant DB Schenker. This would create the world's largest freight forwarder.

In an update issued on 13 September, the Danish forwarder said it had agreed to buy DB Schenker from state-owned railway company Deutsch Bahn for €14.3bn – its biggest deal to date.

The deal is subject to approval from the Supervisory Board of Deutsche Bahn and the German Federal Ministry for Digital and Transport, which is expected to take place in the coming weeks.

The acquisition is also subject to obtaining the usual regulatory approvals, which are expected to be secured in the second quarter of 2025.

DSV expects to finance the transaction through a combination of equity financing of approximately €4-5 billion and debt financing.

Until the transaction closes, DSV and Schenker will remain separate companies conducting business as usual.

“The acquisition of Schenker will strengthen DSV’s global network and capabilities. In addition to greater reach and better opportunities to serve its customers, the acquisition strengthens DSV’s platform for growth and the development of a more sustainable and digital transport and logistics industry,” DSV said in a press release.

Together, DSV and Schenker would have an expected turnover of around €39.3 billion (based on 2023 figures) and a combined workforce of around 147,000 employees in more than 90 countries.

The leading trade union Ver.di has expressed concern that the takeover could lead to job losses in Germany. It preferred a bid from a private equity group led by CVC.

However, DSV said it would invest €1 billion in its German operations over the next three to five years and that various central functions would remain in the country, including the current headquarters in Essen.

DSV has also made social commitments to German employees at Schenker that will apply for up to two years after the closure. Collective agreements and individual working conditions for German employees on the closing date will “generally remain in place” for the two-year period.

“The investments will contribute to long-term growth and job creation, as well as promoting modern and attractive workplaces. It is anticipated that five years from now, the combined organisation will have more employees in Germany than Schenker and DSV have today,” said DSV.

Jens Lund, group CEO at DSV, said: “This is a transformative event in DSV’s history, and we are very excited to join forces with Schenker. With the acquisition we bring together two strong companies, creating a world-leading transport and logistics powerhouse that will benefit our employees, customers and shareholders.”

“By adding Schenker’s competencies and expertise to our existing network, we improve our competitiveness across all three divisions: Air & Sea, Road, and Solutions. As well as enhancing our commercial platform across DSV, the acquisition will provide our customers with even higher service levels, innovative and seamless solutions and flexibility to their supply chains.”

Schenker CEO Jochen Thewes added: “The recent years have been the most successful in our company’s history and we have proven that DB Schenker is fit for the future. We are excited about the future prospects of the combined business. Together with DSV, our goal is to transform the industry and build a truly global market leader with joint European roots for the best of our employees and our customers.”

The two companies said they are a strong match with many similarities in their business models and services and the deal will create a range of service offerings for customers across verticals.

Integration planning will be a joint effort between DSV and Schenker, with specific plans to be developed between the signing and closing of the transaction.

“DSV is committed to a smooth transition that prioritises the continuity of service excellence for all Schenker customers and with careful consideration for employees and stakeholders,” the forwarder said. “DSV recognises the importance of combining the operations seamlessly and is dedicated to upholding the high standards both companies are known for.”

A new market leader

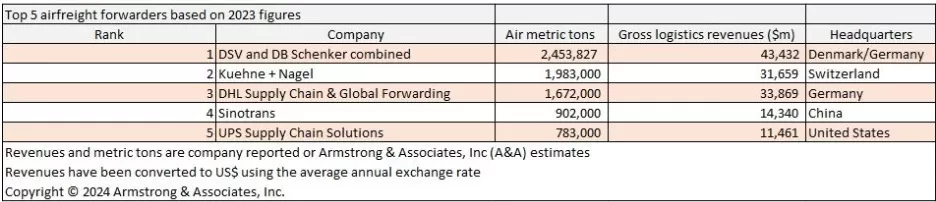

The deal will create the world’s largest freight forwarder by both volume and revenue.

DSV generated $22.3 billion in revenue last year, according to consultants Armstrong and Associates, and DB Schenker $22.1 billion.

This will bring the companies combined revenues of $43.4 billion, dwarfing DHL Global Forwarding and Supply Chain’s $33.9 billion and Kuehne + Nagel’s $31.7 billion.

In terms of air freight volumes, the deal would also create a market leader with volumes (based on 2023 figures) of around 3 million tonnes – well above the 2 million tonnes of current market leader K+N.

However, some of this volume will inevitably be lost as DSV looks to improve margins and loses regular customers who seek to reduce risk by spreading volumes across forwarders.

Meanwhile, competition authorities may require the sale of some parts of the business as part of the approval.

The deal would be the latest in a series of acquisitions over the past decade that have seen DSV rapidly grow into a market leader. Recent deals include the takeovers of Panalpina, UTi and Agility Global Integrated Logistics (GIL).

When the company announced its takeover of UTi in 2015, DSV was ranked as the world's 16th largest air freight forwarder. The deal pushed the company into eighth place, while the Panalpina deal moved it into the top five and GIL into the top three.

DSV has generally completed the integration of its acquisitions more quickly than expected.

Deutsche Bahn announced that DB Schenker would be put up for sale in December 2023 after taking a year to consider its options.

The freight forwarding giant is being sold by Deutsche Bahn as it looks to reduce debt.

Source: Phaata.com (via AircargoNews)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)