East Coast Congestion Eases as Strike Backlog Clears

Congestion at US East Coast ports is easing following the ILA strike, while trans-Pacific ocean and air freight rates remain high, Freightos reports.

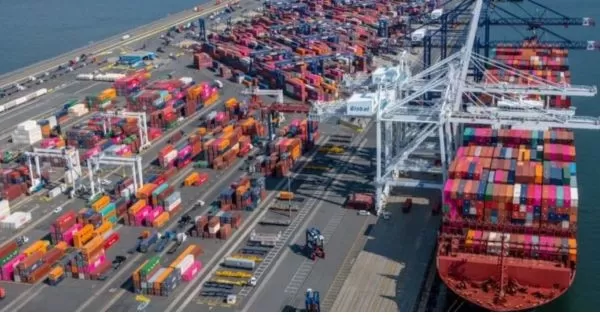

Port of New York & New Jersey (Source: PortBreakingWaves)

Hurricane Milton battered Florida’s west coast last week. Power outages forced the Port of Tampa Bay to close until Monday, while ports in Miami and Jacksonville were back online before the end of last week.

The port of Savannah, which is still dealing with backlogs from Hurricane Helene in September, will need another two weeks to fully restore traffic as the three-day ILA strike has increased the number of vessels waiting. Vessels are waiting more than two days for a slot in Savannah, with other major East Coast ports reporting wait times of one to four days at some berths due to the strike, suggesting significant but not catastrophic congestion as the backlog clears.

Some carriers have announced blank sailings to deal with the congestion, but may also be adjusting capacity to accommodate lower volumes after the peak season.

Transpacific rates are now 30% below their July peak, and with the peak season ending early, we should expect rates to continue to fall. Rates of $5,500/FEU to the West Coast and $6,700/FEU to the East Coast are still several thousand dollars higher than normal even for the peak season, and are also about $1,000/FEU above the Red Sea-adjusted floor reached in April. As long as the Red Sea diversion continues to take up industry capacity, rates are unlikely to fall much further than they were in April.

The Asia-Europe and Mediterranean trades – which, due to longer transit times for vessels sailing around the Cape of Good Hope, have to move peak season cargo out of Asia ahead of Golden Week to get cargo in time for Q4 consumer events – appear to be seeing much weaker demand than the trans-Pacific trade. Rates on these trades fell further last week, and were around $3,600/FEU to Europe and $4,000/FEU to the Mediterranean, almost at April levels.

In air freight, Freightos Air Index data shows that trans-Pacific air freight rates rose to $7.07/kg with some sea-to-air switching at the start of the ILA strike, falling back to $5.43/kg last week. But even at $5-$6/kg, rates are still well above normal levels even before the Q4 peak air season as e-commerce volumes from China continue to surge.

The import of low-cost goods directly to consumers via high-cost air freight is largely facilitated by the de minimis exception, which exempts small imports from customs duties and stringent and costly declaration requirements.

In September, the White House announced plans to significantly reduce access to the “de minimis” exemption [meaning “too small to bother,” which allows packages worth less than $800 to enter the US duty-free], with a primary target being e-commerce imports from China.

Actual rule changes are a long way off, and final versions could be quite different from those proposed. With no action since September, e-commerce air freight volumes are expected to increase along with other cargo categories in the coming months and into early December, making space more crowded and pushing freight rates higher.

However, if significant changes to the “de minimis” exemption are eventually approved, they could lead to a change in strategy by e-commerce platforms such as Temu and Shein, and potentially a shift away from or reduction in the use of air freight for these types of cargo.

Read more:

- Shippers advised to delay airfreight tenders until after turbulent peak season ends

- Air freight rates remain high despite falling demand during Golden Week

- International shipping and logistics market update - Week 41/2024

- Sea-Intelligence forecasts 10-17% capacity cut due to US East Coast port strike

- Marketing Solution: Advertise Shipping Schedules with Phaata Logistics Marketplace

- Hurricane Milton: Florida Ports Close; South Carolina Restricts Shipping

- Ocean freight rates fall and air freight rates rise as ILA strike ends

Source: Phaata.com (via ContainerNews/Freightos)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)