International shipping and logistics market update - Week 42/2023

International logistics and container shipping market update on Asia, Europe and North America routes in the week of 42/2023.

International shipping and logistics market update - Week 42/2023

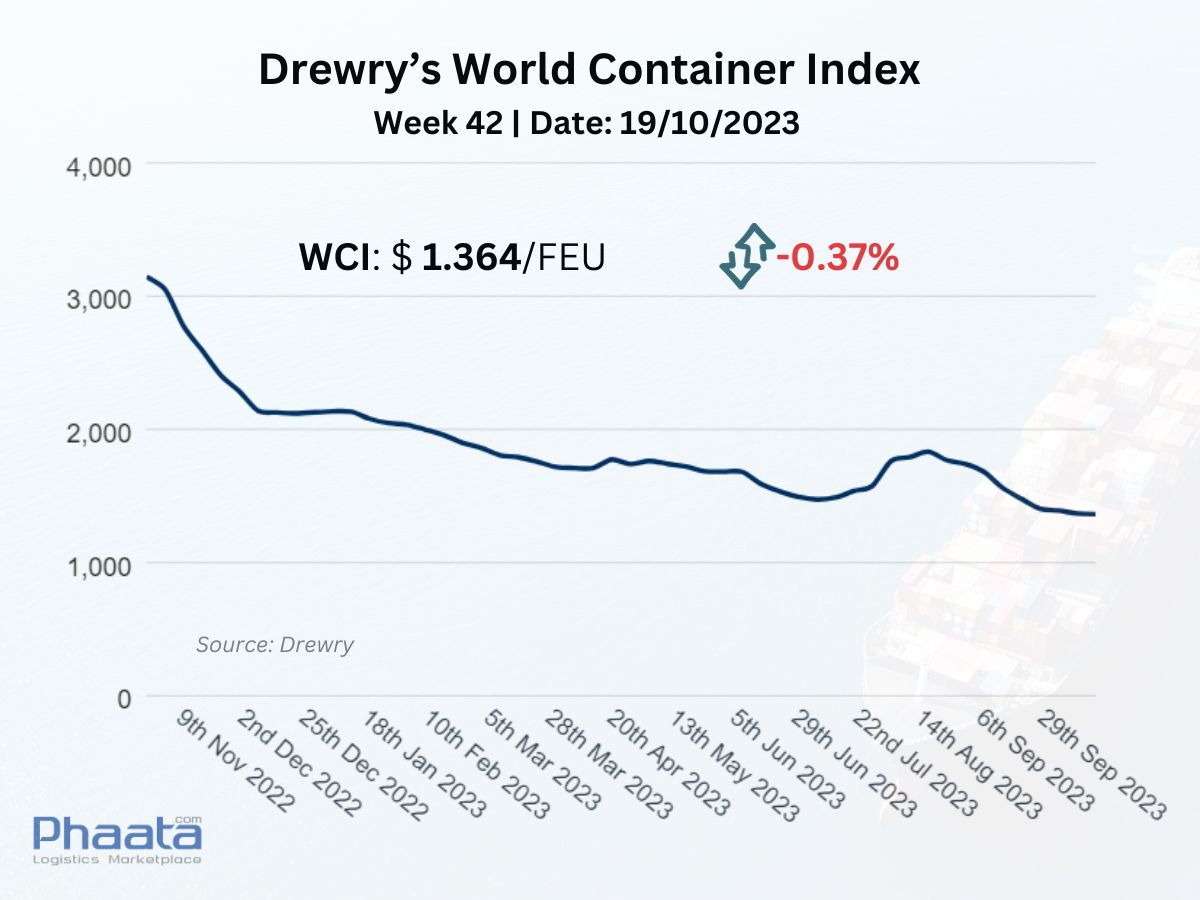

Drewry’s World Container Index was steady at $1,364 in week 42. The index was down 60% from the same week last year and was 4% below the 2019 average (previously pandemic) was 1,420 USD and was the lowest level in 3 years.

Drewry’s World Container Index Week 42/2023 (Photo: Phaata | Source: Drewry)

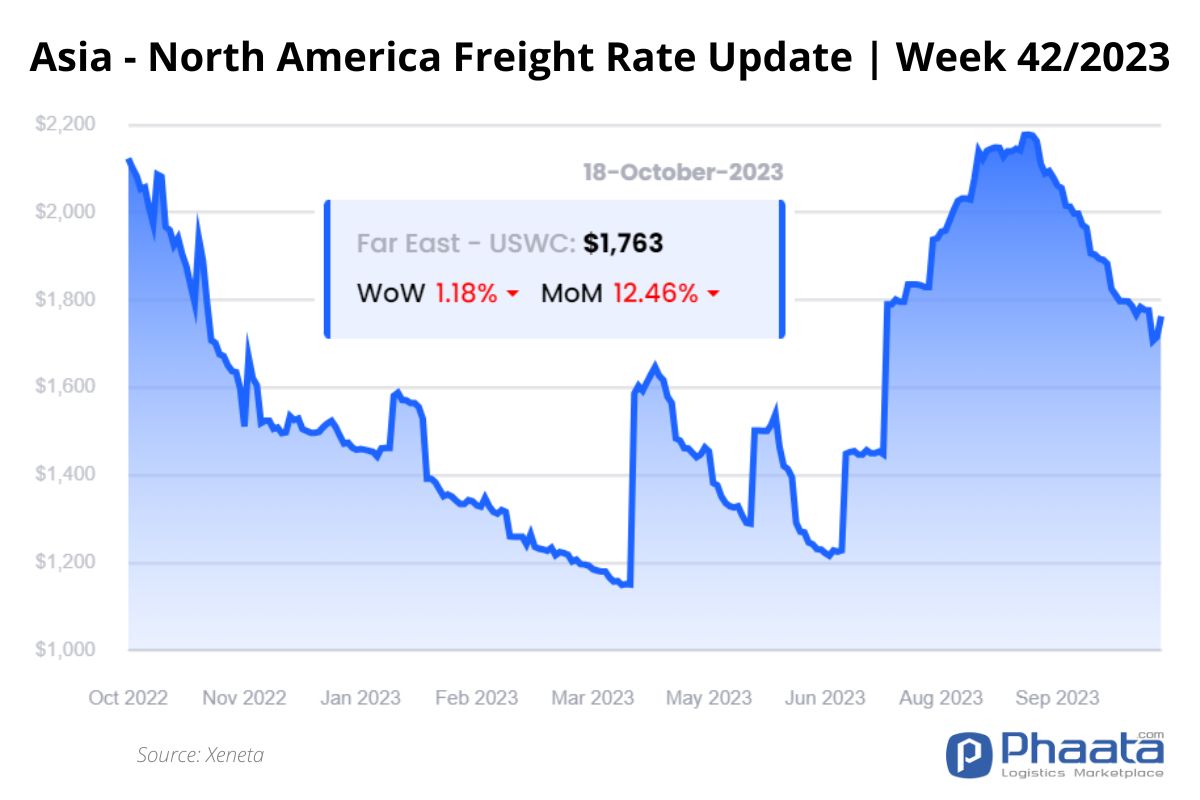

1. Asia - Northern America route

The freight rate from Asia to North America West Coast in the week 42/2023 decreased sharply to 1,763 USD/FEU, down 1.18% compared to the previous week and down 12.46% compared to the previous month, according to Xeneta data.

With weak demand and the impact of Golden Week in China, freight rates continue to trend downward. Capacity is expected to be cut by about 20-30% in October.

It is forecasted that in November the market will likely be better. Demand for export shipping from China just started to appear this week, bookings in the next 1-2 weeks will determine capacity for November.

Q4 forecast: Expect more no-shows, but overall capacity is similar to Q2/Q3 figures. Increased demand ahead of Lunar New Year is likely to begin in December.

Asia- US West Coast Freight rate | Week 42/2023 (Image: Phaata.com)

Asia- US West Coast Freight rate | Week 42/2023 (Image: Phaata.com)

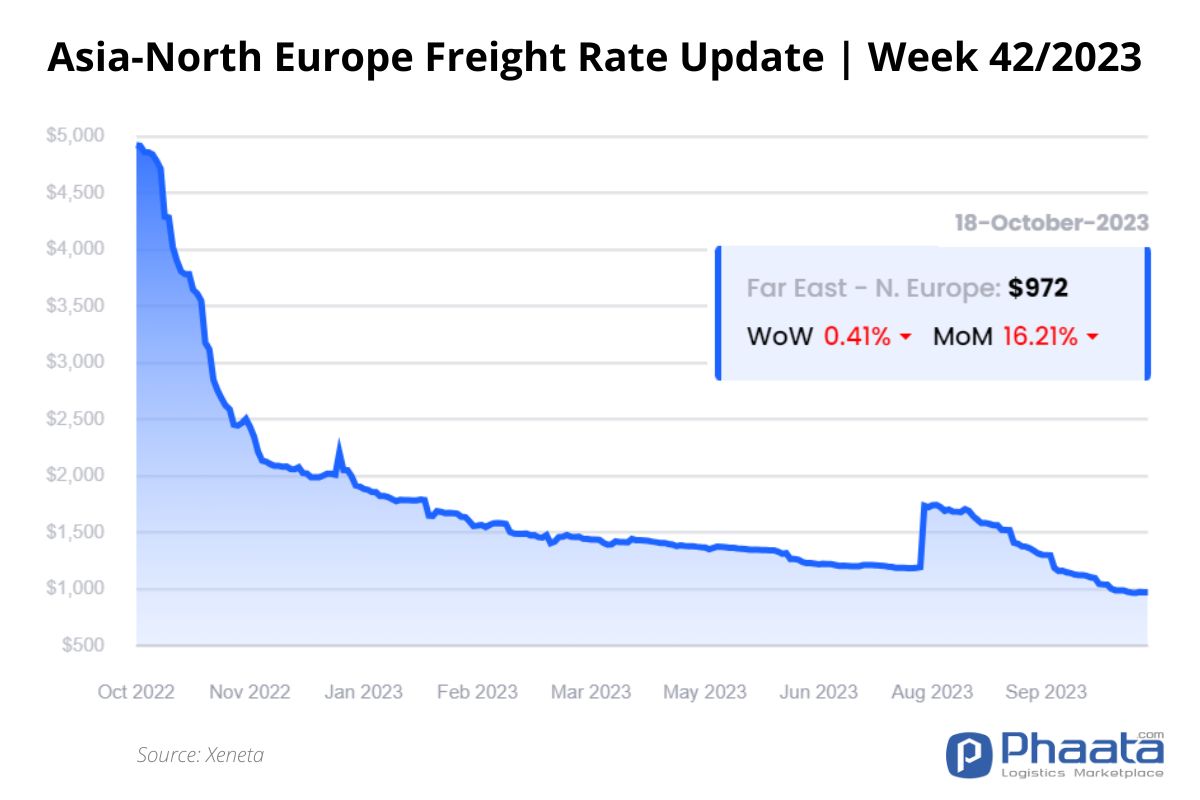

2. Asia - Northern Europe route:

The ocean freight from Asia to Northern Europe in the week of 42/2023 continued to decrease slightly to 972 USD/FEU, down 0.41% compared to the previous week and down 16.21% compared to the previous month, according to Xeneta data.

Market demand on the Asia-Northern Europe route has not yet shown positive signs. Carriers are planning another round of GRI from November 1, aiming to push market rates back up to cover operating costs.

The Ocean Alliance has announced five additional no-show plans for November, aimed at supporting carriers to successfully apply GRI.

On the Asia - Mediterranean route: In addition to the Northern Europe route, GRI is also expected to be applied to the Western Mediterranean route. Currently, the situation of oversupply on this route still occurs. It is expected that the market will decline further if the current blanked sailings do not bring positive results.

Asia-Northern Europe Freight rate | Week 42/2023 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 42/2023 (Image: Phaata.com)

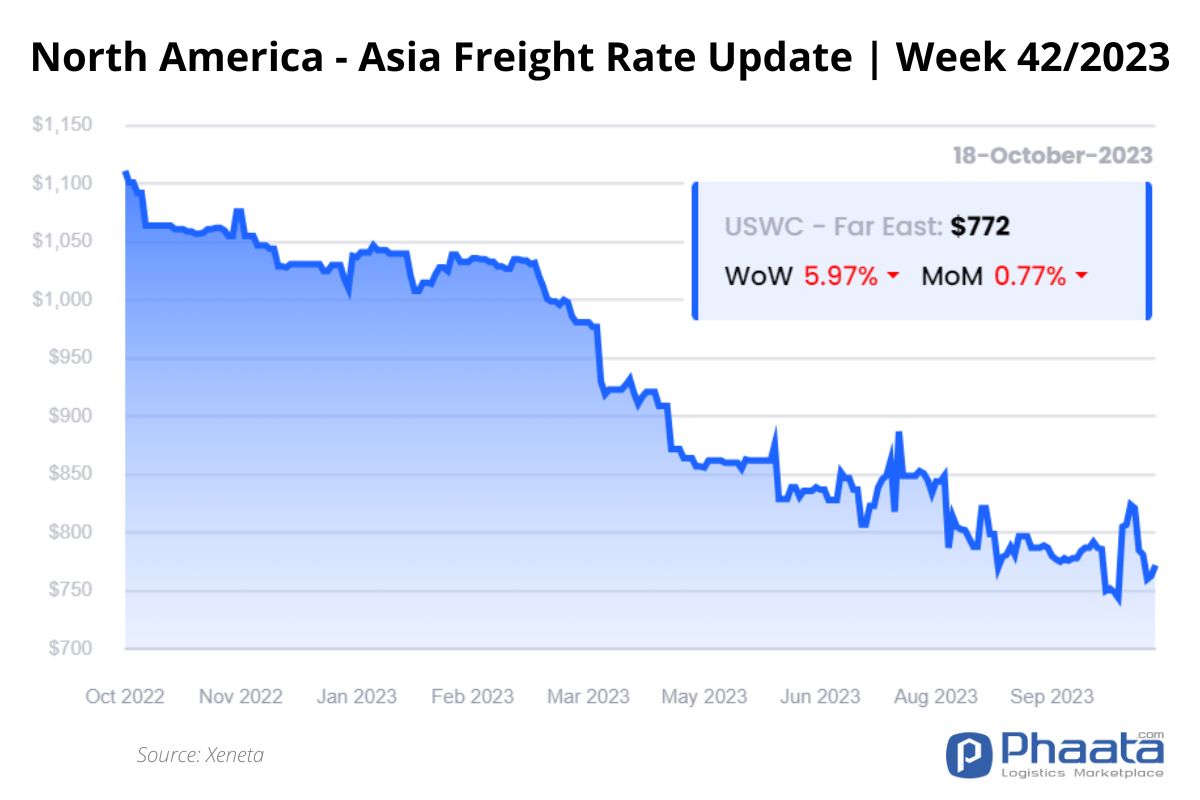

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week of 42/2023 decreased by 5.97% compared to the previous week, down to 772 USD/FEU. This price decreased by 0.77% compared to the previous month.

Overall demand remains weak and is forecast to last until the end of the first quarter of 2024. Fierce competition is taking place among carriers. Freight rates continue to be offered by shipping companies at attractive rates to fill ships while capacity is still surplus.

US West Coast - Asia Freight rate | Week 42/2023 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 42/2023 (Image: Phaata.com)

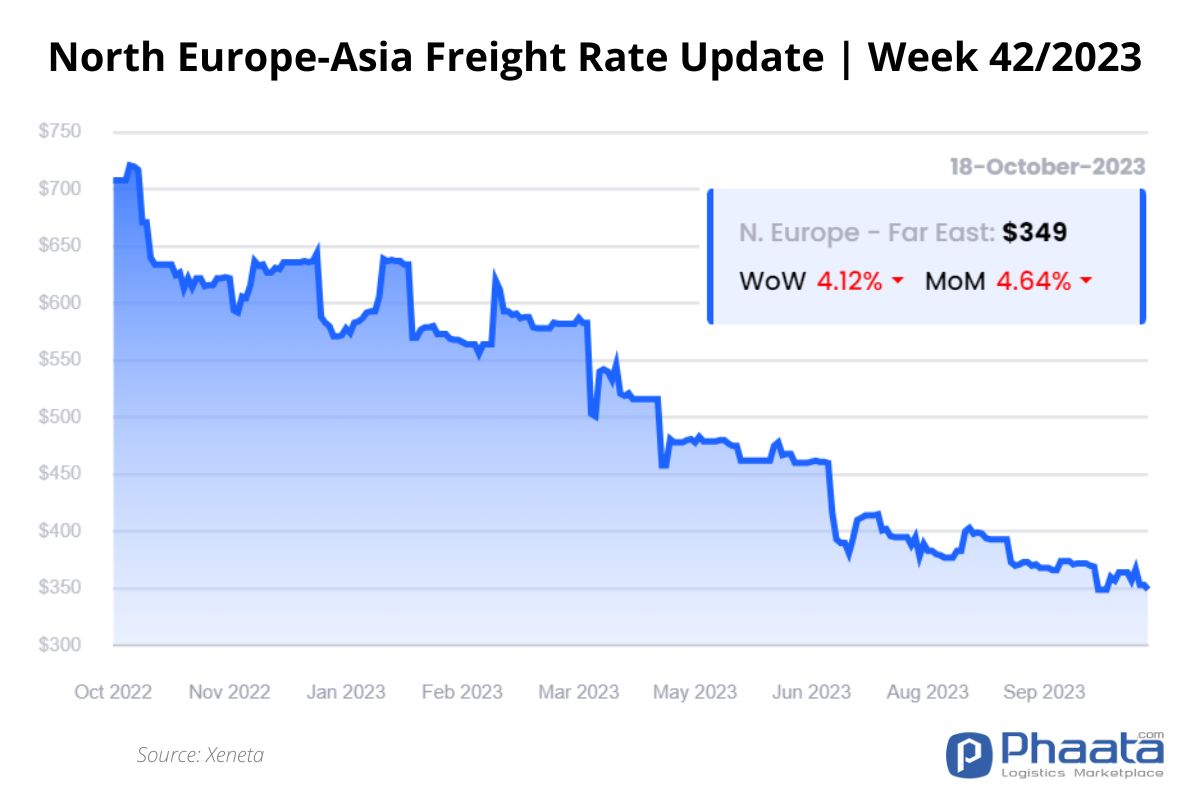

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week of 42/2023 decreased by 4.12% compared to the previous week, down to 349 USD/FEU. This price decreased by 4.64% compared to the previous month.

Northern Europe - Asia Freight rate | Week 42/2023 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 42/2023 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Barcelona Port's Container Traffic Drops in First Half of 2023

- Blank Sailings Boost Ningbo Containerized Freight Index

- Carrier Profits Have Little Impact on Inflation

- Sea-Intelligence: Global container demand 6-7% below GDP since 2019

- Exports to the US from Asia grow in September

- International shipping and logistics market update - Week 41/2023

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Connect Shippers & Logistics Companies Faster!

.webp)

.webp)

.webp)

.webp)