International shipping and logistics market update - Week 46/2023

International logistics and container shipping market update on Asia, Europe and North America routes in the week of 46/2023.

International shipping and logistics market update - Week 46/2023

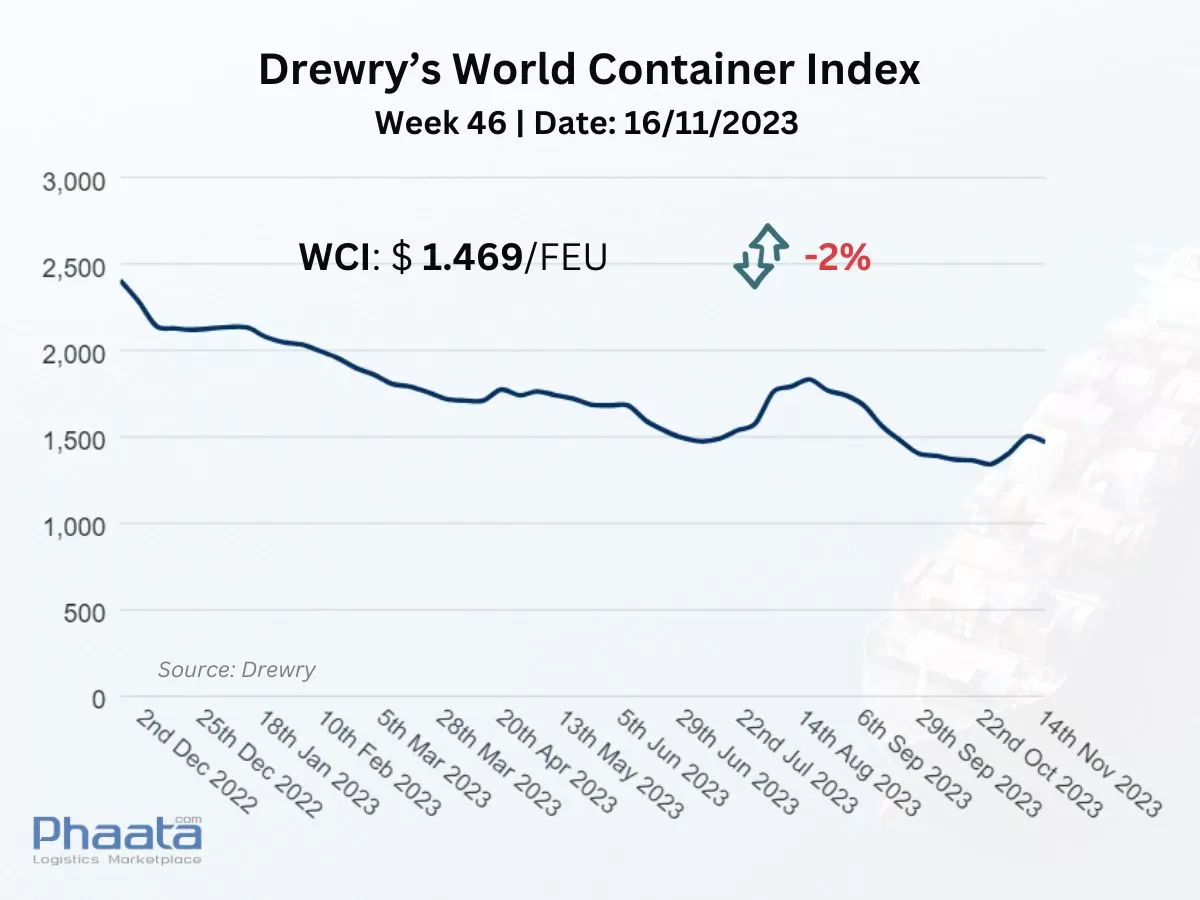

Drewry’s World Container Index for week 46 decreased to 1,469 USD, down 2% compared to the previous week. This rate index was down 43% compared to the same week last year and 3% higher than the 2019 average before the pandemic ($1,420).

Drewry’s World Container Index Week 46/2023 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 46/2023 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

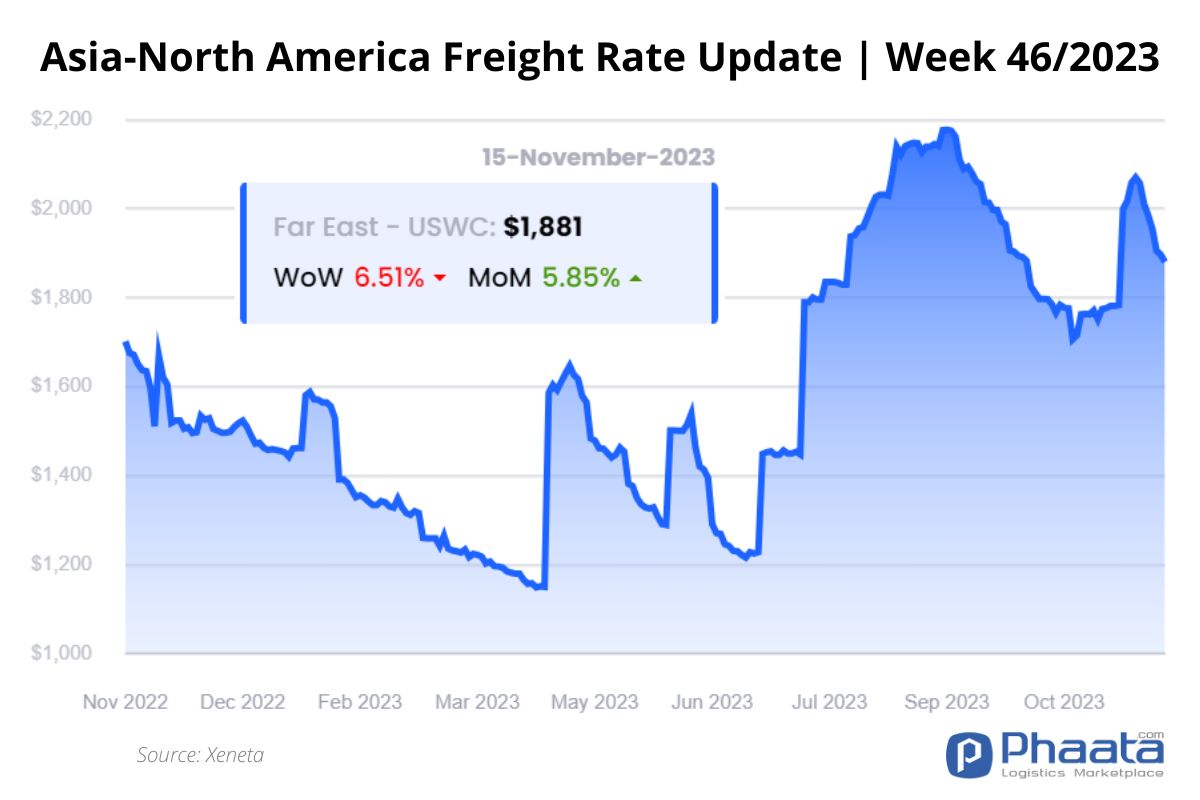

The freight rate from Asia to North America West Coast in the week 46/2023 decreased sharply to 1,881 USD/FEU, down 6.51% compared to the previous week and up 5.85% compared to the previous month, according to Xeneta data.

Q4 forecast: Expect more no-shows, but overall capacity is similar to Q2/Q3 figures. Increased demand ahead of Lunar New Year is likely to begin in December.

Asia- US West Coast Freight rate | Week 46/2023 (Image: Phaata.com)

Asia- US West Coast Freight rate | Week 46/2023 (Image: Phaata.com)

2. Asia - Northern Europe route:

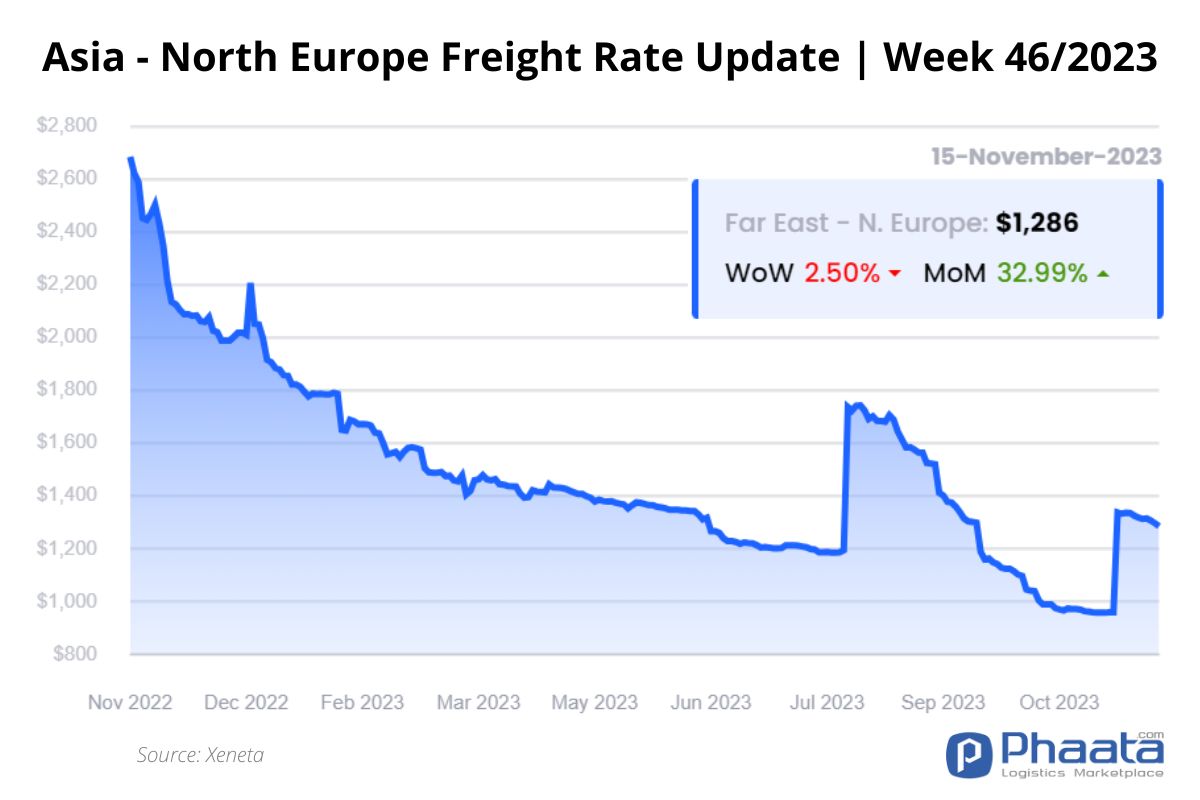

The ocean freight from Asia to Northern Europe in the week of 46/2023 decreased to 1.2869 USD/FEU, down 2.5% from the previous week and up 32.99% from the previous month, according to Xeneta data.

GRI in November was initially applied at 1650-1800 USD, but rates are expected to decline rapidly. The EU shipping market remains stable but capacity will be slightly affected due to changes/suspension of vessel deployment in Southeast Asia; It is predicted that fares will decrease in the near future.

The Ocean Alliance announced three more sailing cancellations in the past week. Meanwhile, THE Alliance has announced the suspension of FE5 services from week 46 until further notice (but adding Cai Mep port in Vietnam to FE3 services); Shipping line CMA announced to remove Cai Mep port on FAL3 service from week 48.

In addition, market capacity is expected to remain down more than 20% throughout November due to further impact from the capacity reduction program from the 2M Alliance. More vessel cancellations are expected from the Ocean Alliance and 2M.

Similar to the Northern Europe route, GRI on the Asia-Mediterranean route starts at $2,000 and will most likely end up with a $200-300 increase over current GRI levels. Currently, no further sailing cancellation plans have been announced.

Asia-Northern Europe Freight rate | Week 46/2023 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 46/2023 (Image: Phaata.com)

3. Northern America - Asia route:

The freight rates from North America (West Coast) to Asia in the week of week 46/2023 increased by 2.84% compared to the previous week, to 761 USD/FEU. This price decreased by 2.56% compared to the previous month.

Overall demand remains weak and is forecast to last until the end of the first quarter of 2024. Fierce competition is taking place among carriers. Freight rates continue to be offered by shipping companies at attractive rates to fill ships while capacity is still surplus.

US West Coast - Asia Freight rate | Week 46/2023 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 46/2023 (Image: Phaata.com)

4. Northern Europe-Asia route:

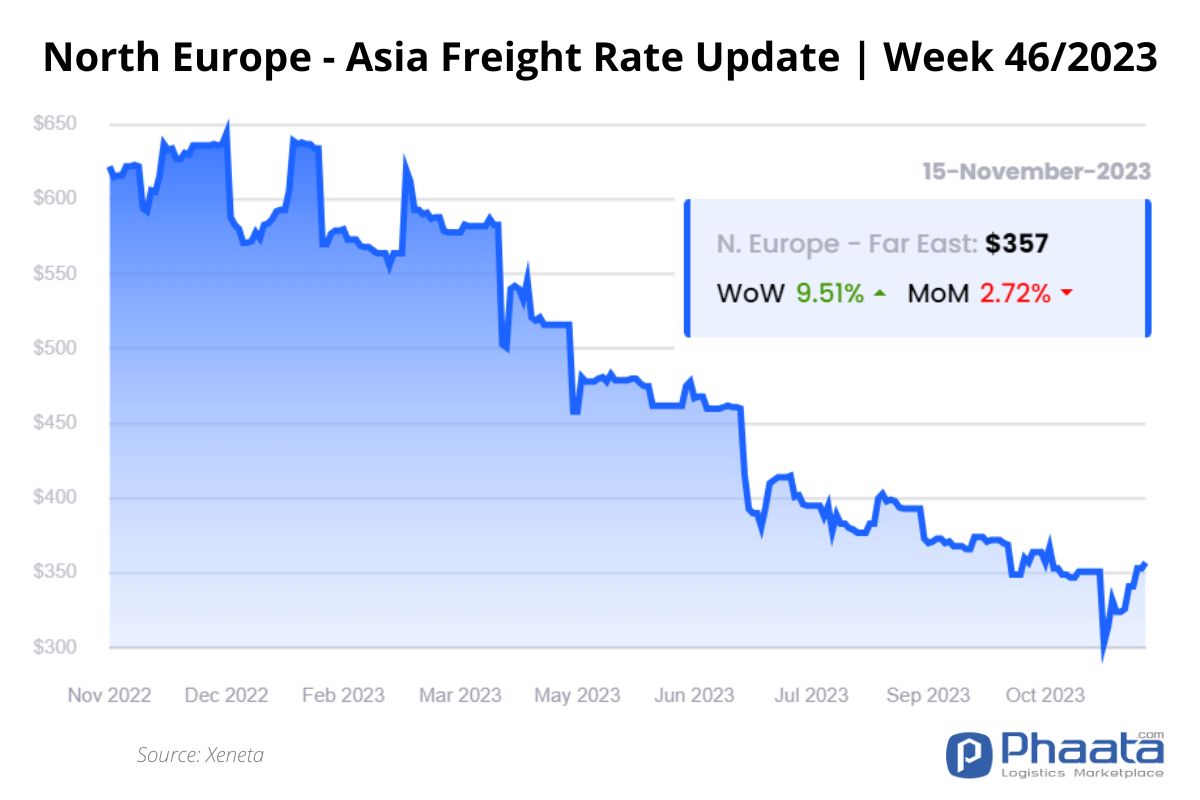

The freight rate from Northern Europe to Asia in the week of 46/2023 increased sharply by 9.51% compared to the previous week, to 357 USD/FEU. This price decreased by 2.72% compared to the previous month.

Northern Europe - Asia Freight rate | Week 46/2023 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 46/2023 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Hapag-Lloyd announces simultaneous rate increase on many routes in December

- ZIM reports loss of more than 2.2 billion USD in third quarter of 2023

- Container rates on the US route dropped as shipping lines added more capacity

- Number of ships waiting to pass through the Panama Canal increasing

- Falling container freight rates dragged down CMA CGM's third quarter financial results

- International shipping and logistics market update - Week 45/2023

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)