International shipping and logistics market update - Week 51/2023

International logistics and container shipping market update on Asia, Europe and North America routes in the week of 51/2023.

International shipping and logistics market update - Week 51/2023

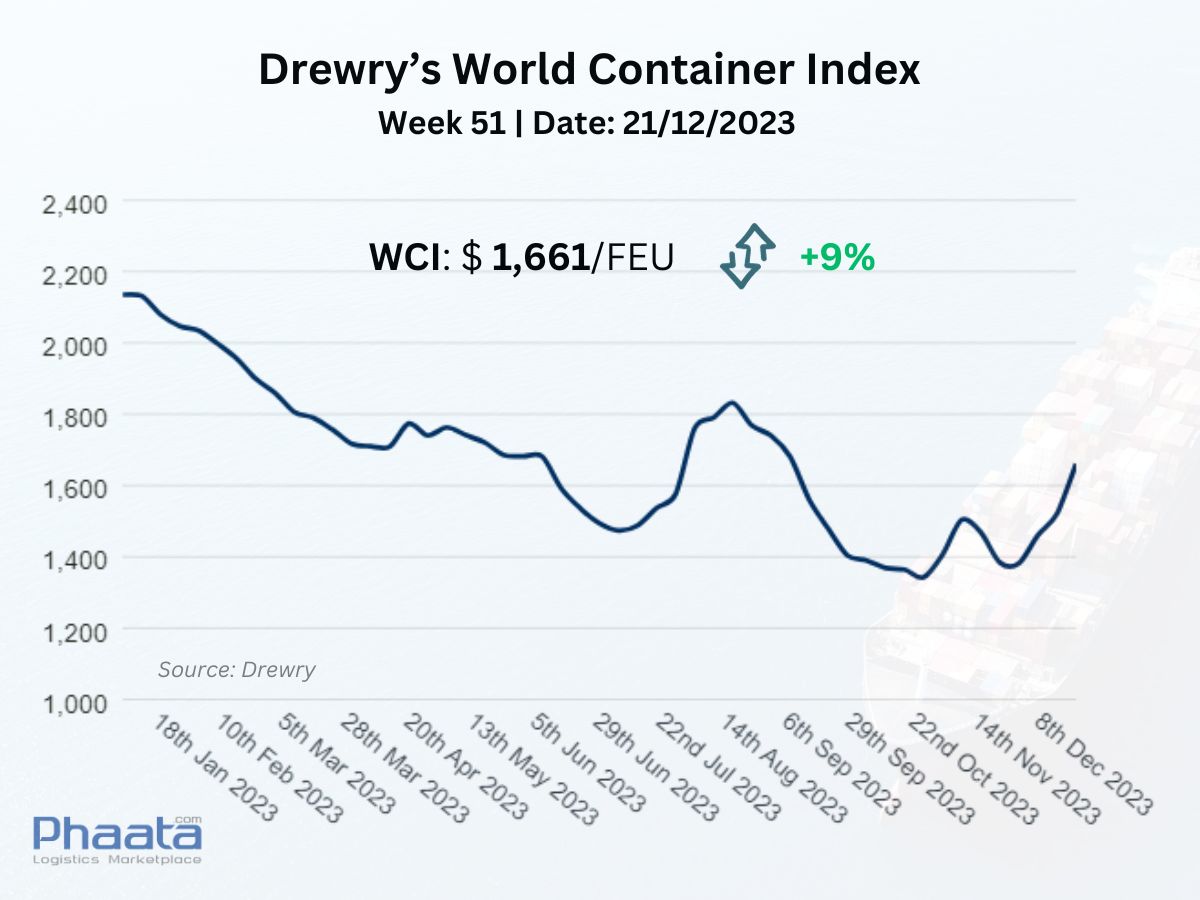

Drewry’s World Container Index for the week 51 continued to increase sharply by 9% compared to the previous week, to 1,661 USD. This price index decreased by 22% compared to the same week last year and was 17% higher than the 2019 average before the pandemic (1,420 USD).

Drewry’s World Container Index Week 51/2023 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 51/2023 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

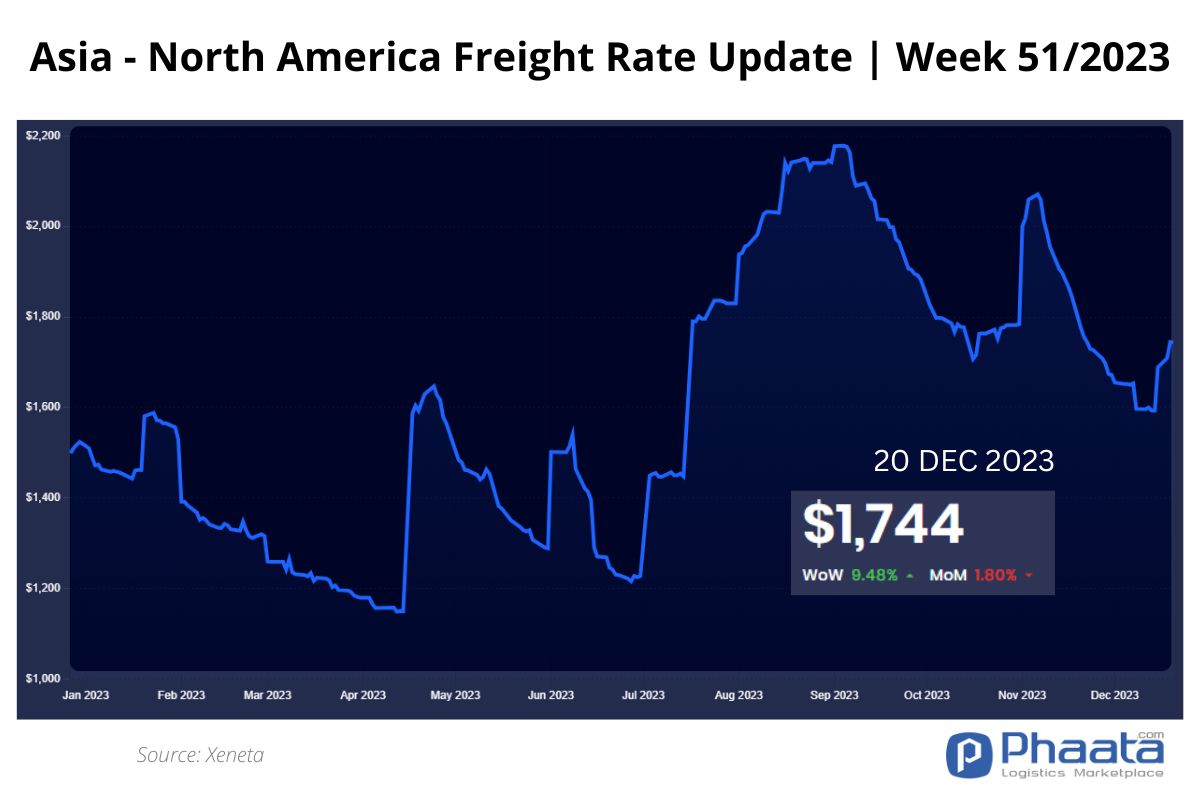

The freight rate from Asia to North America West Coast in the week 51/2023 increased sharply to 1,744 USD/FEU, up 9.48% compared to the previous week and down 1.8% compared to the previous month, according to Xeneta data.

Q4 forecast: It is expected that many sailings will be missed, but overall capacity is similar to Q2/Q3 figures. Increased demand ahead of Lunar New Year is likely to begin in December.

Prolonged drought is causing more restrictions on container ship traffic through the Panama Canal. There are 32 transits per day, down from the normal 36, and the canal is planning to gradually reduce that number weekly to an expected 18 per day before February 1. While container traffic has so far not been affected, further reductions will likely start to have an impact. Carriers are evaluating the possibility of adding more ships to Suez-bound routes. Alternative routes could be via the Suez Canal or via the U.S. West Coast by rail. Carriers are also implementing weight restrictions of 8 tons on average for containers moving through the canal. Traveling through Panama remains the fastest route to the U.S. East Coast.

Asia- US West Coast Freight rate | Week 51/2023 (Image: Phaata.com)

Asia- US West Coast Freight rate | Week 51/2023 (Image: Phaata.com)

2. Asia - Northern Europe route:

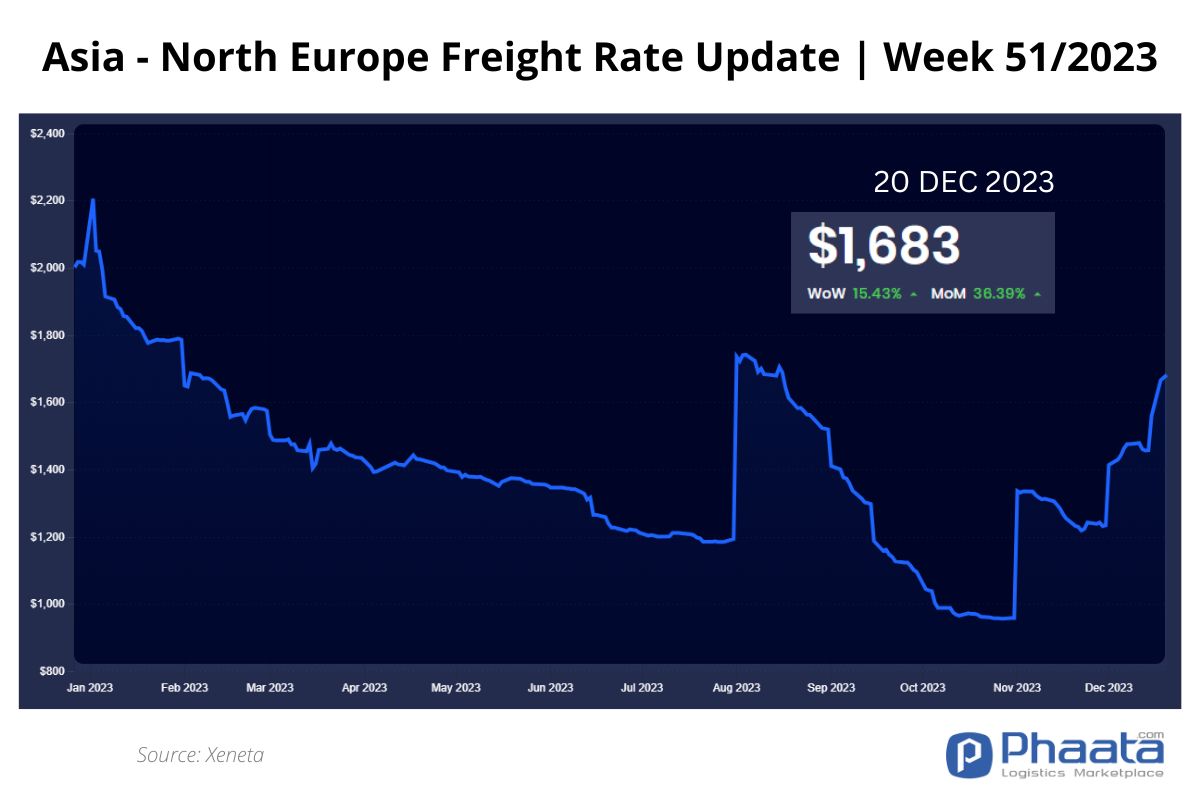

The rate for container shipping from Asia to Northern Europe rose slightly to $1,236 per FEU in week 51/2023 increased sharply to 1,683 USD/FEU, up 15.43% over the previous week and up 36.39% over the previous month, according to Xeneta data.

Market demand is increasing in December and all ships are fully loaded.

Spot freight rates in the first half of January increased sharply as the threat from the Red Sea forced most shipping lines to reroute ships from the Suez Canal to the Cape of Good Hope. This significantly increases shipping costs and is expected to increase total shipping time by 1-4 weeks depending on the vessel's destination. We predict that this increase in spot rates will not easily stop even after the Lunar New Year. The shortage of container equipment can also be seen as a direct impact on the potential for upcoming price increases. Due to all of the above combined factors, along with the growing gap between spot rates and long-term contract rates, bookings are further restricted by service providers. . A significant peak season surcharge (PSS) is expected before Lunar New Year.

This past week, the ONE Orpheus (FP1 service providing services on the Asia-North Europe route) collided with a bridge during transit in the Suez Canal. Temporary repairs have been completed and the ship will depart Port Said and is expected to arrive in Rotterdam on 26 December.

Mediterranean route: Similar to the Northern Europe route, the GRI on the Mediterranean route effective from early January is very high (same reason as the Northern Europe route) and it is expected that the Peak Season Surcharge (PSS) will be available soon deployed.

Asia-Northern Europe Freight rate | Week 51/2023 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 51/2023 (Image: Phaata.com)

3. Northern America - Asia route:

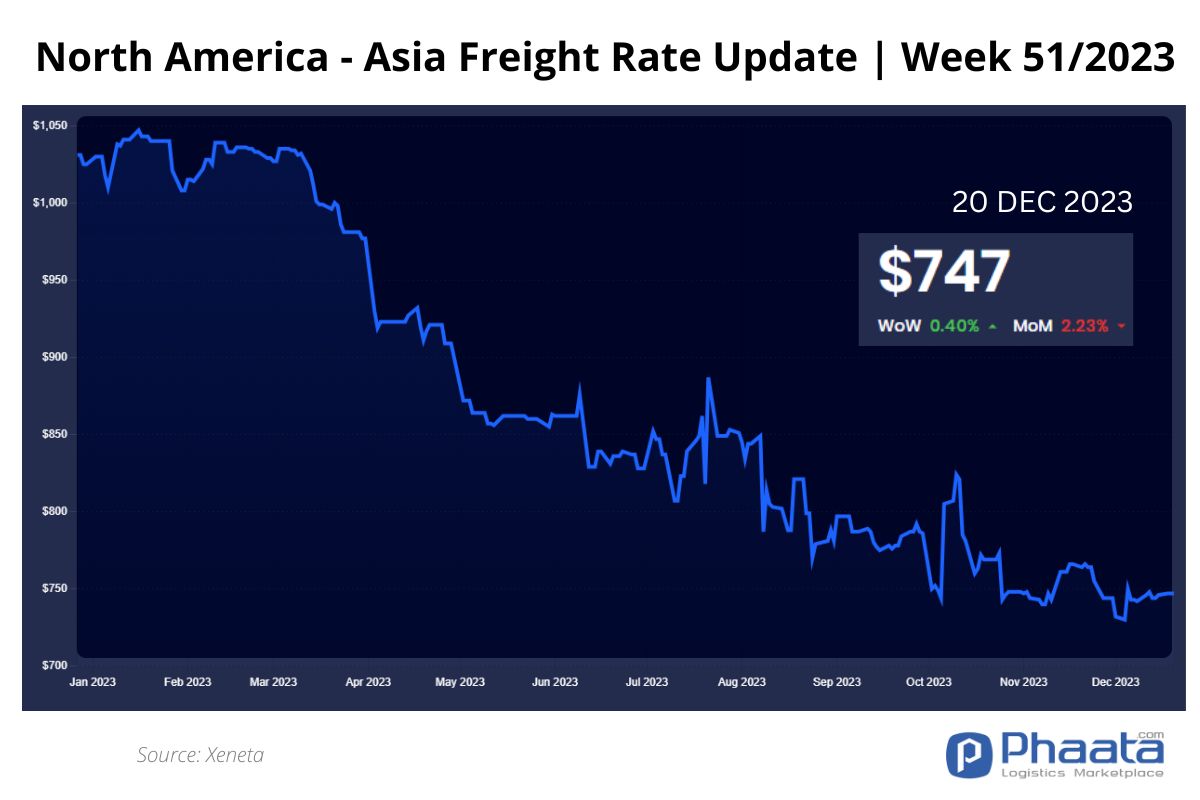

The freight rates from North America (West Coast) to Asia in the week 51/2023 increased slightly by 0.4% compared to the previous week, to 747 USD/FEU. This price decreased by 2.23% compared to the previous month.

Empty containers at many railway stations in the US mainland are lacking due to a lack of imports into the Midwest. Shippers should make reservations 2-3 weeks in advance to ensure they have container equipment for export plans.

Overall demand remains weak and is forecast to last until the end of the first quarter of 2024. Fierce competition is taking place among carriers. Freight rates continue to be offered by shipping companies at attractive rates to fill ships while capacity is still surplus.

US West Coast - Asia Freight rate | Week 51/2023 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 51/2023 (Image: Phaata.com)

4. Northern Europe-Asia route:

The freight rate from Northern Europe to Asia in the week of 51/2023 increased by 1.43% compared to the previous week, to 355 USD/FEU. This price decreased by 3.79% compared to the previous month.

Northern Europe - Asia Freight rate | Week 51/2023 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 51/2023 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Red Sea Crisis: Container Shipping Rates Skyrocket, Consumers Expected to Feel the Impact

- Risk of supply chain crisis from Suez Canal

- International shipping and logistics market update - Week 50/2023

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)