International shipping and logistics market update - Week 37/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 37/2024.

International shipping and logistics market update - Week 37/2024

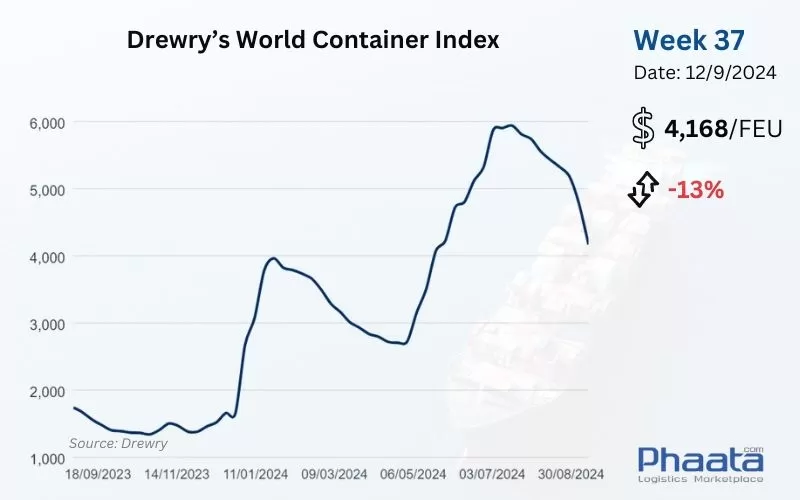

Drewry’s World Container Index for the week of 37/2024 continued to decline sharply by 13% compared to the previous week, to USD 4,168. This freight rate index is 193% higher than the pre-pandemic average of 2019 ($ 1,420).

Drewry’s World Container Index Week 37/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 37/2024 continued to decline to USD 6,325/FEU, equivalent to a decrease of 2% compared to the previous week, down 1.4% compared to the previous month, according to Xeneta data.

Many carriers adding capacity to ease backlogs caused by the surge in cargo volumes from May to July. However, current inventory levels may reduce the need for additional cargo in the coming weeks,

There are numerous cancellations on routes to the Cape of Good Hope (COGH) and port congestion in Asia and North America. Further delays and capacity challenges are expected on the US East Coast due to adverse weather conditions around COGH.

Water levels in Panama’s Gatun Lake have recovered and local authorities have eased weight restrictions on the Panama Canal.

Carriers are implementing cancellation plans that will impact Week 38 to Week 41 to adjust capacity on the route in preparation for the upcoming Golden Week holiday in China. Expect changes to shipping schedules or transit times, especially for feeder connections, as cancellations may result in shipments being transferred to subsequent sailings.

Spot Rates: Carriers have withdrawn the September 1 General Rate Increase (GRI) from August 31. As a result, rates from the end of August have been extended.

Fixed Rates: Peak Season Surcharge (PSS) discussions remain unchanged. However, if the spot rate market continues to weaken, there could be volatility in the fixed rate market.

Asia-US West Coast Freight rate | Week 37/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 37/2024 to USD 6,367/FEU, equivalent to a decrease of 6.59% compared to the previous week, down 23.3% compared to the previous month, according to Xeneta data.

The demand is falling, along with many blank sailings, which reduced operations in late August. Shipping vessels are being used relatively efficiently with a fairly high filling rate. However, in September, with many vessels returning to Asia, the market will have more capacity than in August. Shipping lines are now pushing to fill vessels by increasing cargo volumes.

Spot rates fell further in the first half of September, but are still higher than in early 2024, after the Lunar New Year. Carriers are now taking a more proactive approach to adjusting rates to optimize vessel utilization.

The use of long-term contract rates still faces constraints from carriers regarding slot and equipment priorities. Equipment shortages are improving, with some ports of loading (POLs) with fewer vessels calling still experiencing potential shortages of container types, particularly 20'GP and 45'HC.

Asia-Northern Europe Freight rate | Week 37/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia continued to decline in week 37/2024 to USD 695/FEU, equivalent to an increase of 2.96% compared to the previous week, up 5.3% compared to the previous month, according to Xeneta data.

Capacity has been reduced on routes from the US to the Indian subcontinent, Middle Eastern ports and Northern European ports, related to vessel shortages and cancelled sailings.

To ensure smooth export shipments, Phaata.com advises shippers to book 2 weeks in advance for coastal loading shipments and 3-4 weeks or more for inland rail loading shipments.

US West Coast - Asia Freight rate | Week 37/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 37/2024 dropped sharply to $466/FEU, down 5.09% from the previous week and 5.48% from the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 37/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- COSCO schedules: Vietnam - North America in Sep 2024

- SITC updates Vietnam-Intra Asia sailing schedules in Sep 2024

- Pacific Lines updates domestic sailing schedules in Sep 2024

- US Container Ports Expect to Continue Busy in September

- Shippers Look for Alternatives as East Coast Port Strike Looms

- COSCO and TCL Announce Warehousing Partnership in North America

- HMM follows MSC and CMA CGM in moving to used containerships

- Hong Kong Container Volumes Fall in H1

- International shipping and logistics market update - Week 36/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)