International shipping and logistics market update - Week 51/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 51/2024.

International shipping and logistics market update - Week 51/2024

International shipping and logistics market update - Week 51/2024

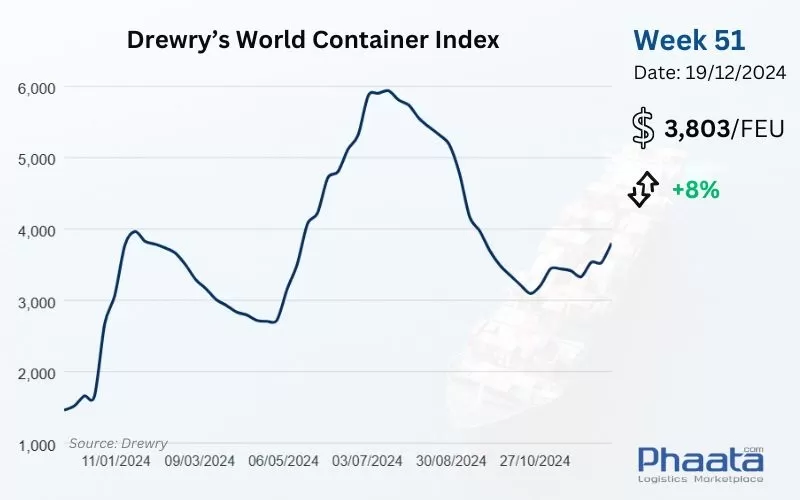

Drewry’s World Container Index for the week of 51/2024 increased sharply by 8% compared to the previous week, reaching USD 3,803/FEU. This freight rate index is 168% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 51/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 51/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 51/2024 increased sharply by 11% compared to the previous week, reaching USD 4,440/FEU; this price decreased by 8.42% compared to the previous month, according to Xeneta data.

Carriers have successfully implemented General Rate Increases (GRI) from December 15. In addition, some carriers have announced initial Peak Season Surcharges (PSS) with an increase planned for January 2025.

Lines are implementing cancellations, limiting supply to a moderate level in December 2024, with 92% capacity availability. In January 2025, capacity is expected to be 97%. Additional cancellations are likely to be announced in January and February due to the impact of Lunar New Year and network changes on the transpacific trade.

There are currently no significant EQ issues at Asian ports.

ILA negotiations and potential tariff actions remain the main pressures on rates and capacity on this trade.

Asia-US West Coast Freight rate | Week 51/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 51/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 51/2024 remained stable compared to the previous week, increasing slightly by 0.85% to USD 5,085/FEU. This is an increase of 22.21% compared to the previous month, according to Xeneta data.

Demand is increasing slightly and is expected to stabilize in the second half of December due to the holiday season in Europe. This helps keep freight rates stable and the Shanghai Container Freight Index (SCFI) fluctuates within a narrow range.

Equipment shortages are occurring sporadically at major ports in China but are still manageable. For shippers who need to secure space and an expected time of departure (ETD) can consider choosing the "premium" service of the shipping lines.

Asia-Northern Europe Freight rate | Week 51/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 51/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia in week 51/2024 increased by 2.07% compared to the previous week to USD 691/FEU. This price decreased by 1.57% compared to the previous month, according to Xeneta data.

US West Coast - Asia Freight rate | Week 50/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 51/2024 increased slightly to USD 346/FEU, up 0.58% compared to the previous week; this price decreased 1.42% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 51/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 51/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

See more:

- Fitch Upgrades Global Container Shipping Outlook

- Growing demand could drive up air freight costs for shippers by 2025

- Maersk: Lunar New Year, labor disputes and port congestion to challenge European shipping market in 2025

- Korean Air Completes Asiana Airlines Acquisition After Delays

- IATA: Air cargo volumes forecast to grow 5.8% in 2025

- Air Cargo Takes ‘Wait-and-See’ Approach to US Tariffs and Positive Demand Outlook for 2025

- Global Shipping Market Faces Growing Challenges

- Structure and market share of shipping alliances change in 2025

- ZIM Updates Trans-Pacific Network

- Asia-Europe Rates Rise with December GRIs

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)

.webp)

.webp)