Rising Risks to Global Trade from Panama and Suez Canal Disruptions

Drought in Panama and Houthi Attacks Threaten Christmas Supply Chains

Panama Canal (Source: Panama Canal Authority edited by Phaata)

Disruptions at both the Panama and Suez canals, two vital arteries for global trade, are threatening global supply chains ahead of Christmas.

Shipowners and importers of goods have warned that drought at the Panama Canal and a series of attacks on container ships 11,500 miles away near the Suez Canal risk limiting shipping capacity ahead of the holiday season.

“There are supplies that just won’t be here in time for this Christmas,” said Marco Forgione, director-general of the Institute of Export and International Trade, which represents importers across the UK.

Forgione said that after months of being stuck in the Panama Canal area, consumer electronics such as iPhones “may not be readily available” to be delivered on time, and other importers are struggling to get Christmas decorations in time. He said that if the attacks near the Suez Canal linked to the war in Yemen worsen, the combination of the two worst-case scenarios at the two vital canals would be a “catastrophic.”

According to trade analysis firm MDS Transmodal, in the third quarter of this year, more than half of containerized freight (by volume) between Asia and North America will go through either the Panama or Suez Canal.

The Panama Canal Authority said that October was the driest month in the Panama Canal area since 1950, in part due to the El Niño weather pattern that has been affecting temperatures and rainfall around the globe. The port authority has reduced the number of vessels going through the canal, and by February it will only be limited to 18 vessels per day.

“That drought in the Panama Canal is a serious concern,” said Rolf Habben Jansen, CEO of Hapag-Lloyd (Germany), the world’s fifth-largest container carrier.

According to MarineTraffic, there were 167 vessels allowed through the Panama Canal in the first week of December this year, compared with 238 vessels last year. According to the canal authority, vessels not booked in advance must wait an average of 12.2 days to pass through the 50-mile-long canal from the Pacific to the Atlantic, with some vessels waiting up to two weeks or more.

Facing the growing delays, Hapag-Lloyd and other carriers have been forced to switch to longer and more expensive sailing routes, with the German carrier announcing it will divert at least 42 vessels from the Panama route to run through the Suez Canal to transport goods between Asia and the East Coast of the United States.

However, a series of surprise attacks on ships by Houthi forces based in Yemen have raised concerns in the global shipping industry, even though the Houthis say they are only targeting ships with Israeli links.

“How do they know who is the ultimate shipowner?” questioned a businessman from a European trade body. “They could think: ‘That ship is going to Israel. So we will take a pop at it.’"

He added: “The Panama Canal is effectively closed. If the same thing were to happen to Suez, how would you get grain [around the world]? That is when shipping rates start going up.”

Habben Jensen said that Hapag-Lloyd currently has no ships with any Israeli links going through the affected area. But he added: “We watch that situation closely and if needed, we will not hesitate to divert ships.”

He added: “If the passage through the Suez would become more difficult [as well], that could cause serious disruption.”

There have already been early signs of the disruption driving up shipping costs, with many carriers imposing surcharges of hundreds of dollars per container on exporters shipping goods on the Panama route, as the cost of using the canal in short notice can run into the millions of dollars per vessel transit. Hapag-Lloyd also announced last week a coming “war risk surcharge” of up to $80 for all shipments to and from Israel.

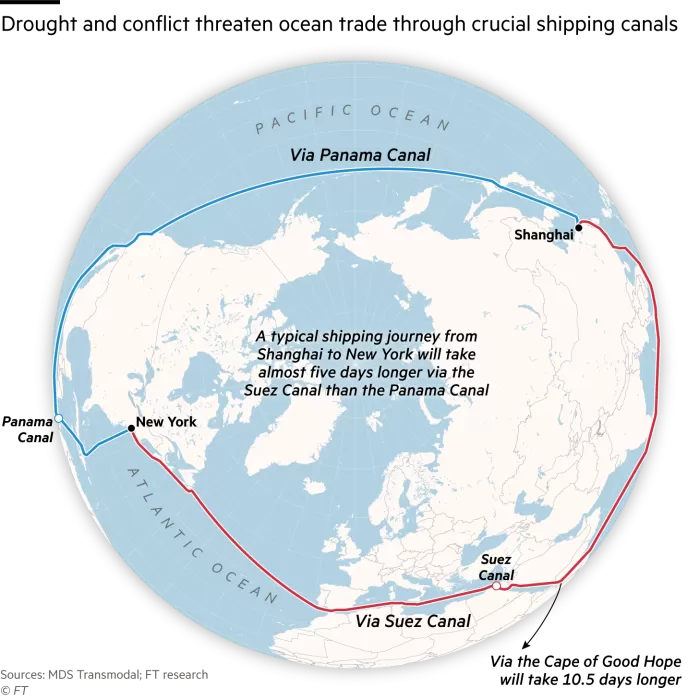

According to MDS Transmodal, switching the sailing from Panama to Suez would add five days to the journey between New York and Shanghai for vessels traveling at a speed of 16 knots per hour. If more carriers/owners avoid the Suez Canal and go around the longer route around Africa’s Cape of Good Hope, the journey for ships could be extended by six days.

Forgione said the disruption has raised further questions about the resilience of global trade, and he suggested considering alternative sources of production and other modes of transportation such as air freight.

“Government and business need to be looking at what a resilient supply chain looks like . . . There is little that can be done for this Christmas. [But] if nothing is done, I think there is a [risk of] shortages through the course of next year.”

Source: Phaata.com (According to FT)

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)