Warning: Book now or it won't be available for sale during the Christmas season

Containers don't lie - and now they're telling the ugly story of the supply chain bottleneck that US importers are facing. Shippers need to be more careful and calculated to overcome the current congestion.

.jpg)

Brian Bourke, SEKO Logistics Growth Manager, said: “Obviously, there are options for shippers [transload/ocean charter and airfreight] but the real message is book now or Christmas may be canceled.”

To illustrate the impact of the congestion problem, American Shipper, along with ImportGenius, looked at Walmart's good summer imports to gauge the severity of the congestion. Three main categories have been divided: above-ground pools, swimwear and clothing.

Walmart is a prime example because of its diversification of port use and hundreds of distribution centers.

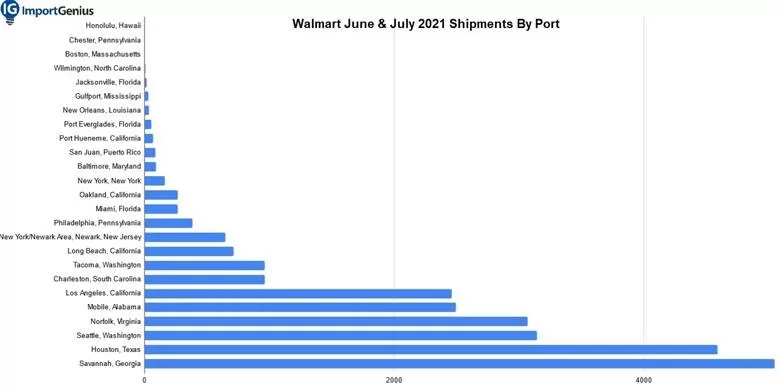

Walmart's shipments in Jun-July 2021 by ports

Bill Simon, former CEO of Walmart, told American Shipper, “One of the most important aspects of an effective supply chain is the ability to flex the system to adjust for potential disruptions. That’s what makes Walmart distribution world class. They have the ability to adjust, flex or reroute shipments from the port of origin all the way to the stores.”

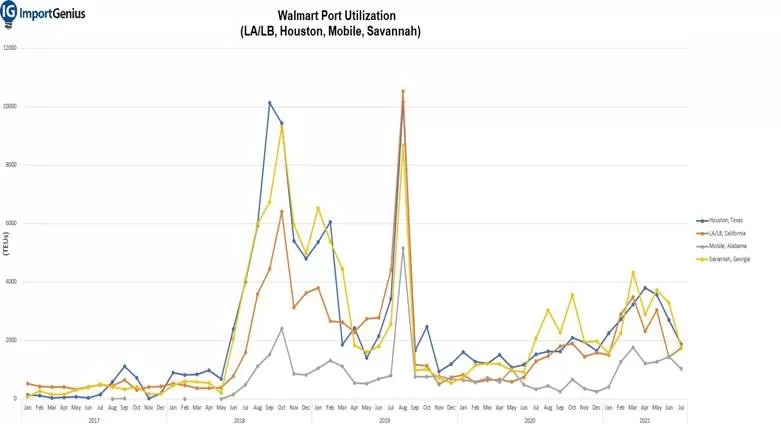

A timeline of Walmart port container throughput shows how the Los Angeles/Long Beach port complex has lost throughput over the years to competitors in the Gulf and East Coast regions.

Walmart port utilization

Simon explains that Walmart's summer items typically arrive at ports during the months of January through March. Products are then shipped and stored in distribution centers. The products then hit store shelves in April or May.

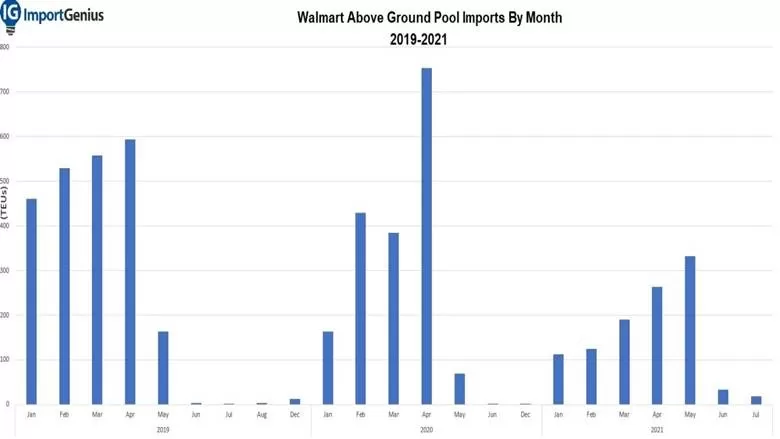

The chart that tracks shipments of floating pools for Walmart clearly shows container delays to ports. When you compare shipments from May to July 2021 with previous years, there is a marked increase.

Walmart above-ground pools imports by month in 2019-2021

According to US Customs data compiled by ImportGenius, Walmart received more than 18,000 above-ground floating pools between March and July, with 1,131 14-foot Summer Waves Elite frame pools being processed by customs by end of June 20.

“This delay is likely as a result of congestion related to the Yantian port closure,” explains William George, an analyst at ImportGenius.

Simon reviewed the data and told American Shipper, “The delayed pool shipments clearly look unusual. That much product arriving so late can only be caused by delays in manufacturing or shipping.”

Unfortunately, massive delays at ports are just one of many supply chain disruptions that shippers face.

Alan Baer, president of OL USA, explains: “Traditionally, we would have a shipment from China to a U.S. Midwest distribution center completed in 25 to 28 days". Now, the same delivery can take up to 50 to 70 days. Delivery time can be doubled, even tripled. This is unfortunate for importers. That extra time will be costly for mid-sized importers who are limited in the amount of time it takes to sell their products.

“The advantage Walmart has over its competitors is its scale,” added Baer. “Even with the pools arriving late, Walmart has the ability to reroute those pools to sell them in their Southern stores. But for the little pool guys who also have overdue deliveries, they don’t have that ability. If you are a pool seller in Columbus, Ohio, no one is going to buy that pool in August unless at a massive discount."

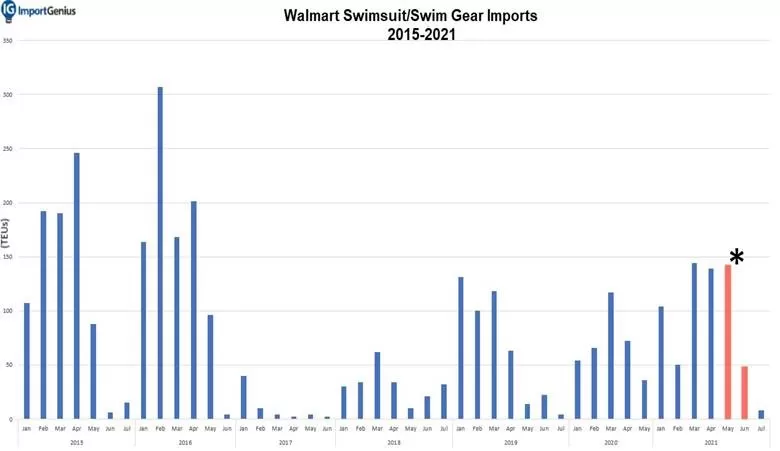

The same logistics strategy will also assist Walmart in the distribution and sale of late swimwear. Volumes in May and June 2021 have outstripped previous years during the same period.

Walmart's swimsuit imports in 2015-2021

“Walmart’s imports of swimsuits and swim gear from 2015-2020 show a clear, cyclical pattern of stocking for the summer season beginning in January and extending through April,” George said. “Their import volumes for May and June of 2021 are stark outliers and show that while Walmart managed to import a substantial amount of their intended inventory in this category on time, a combination of high demand and congestion impacted their ability to fully prepare for the summer in advance."

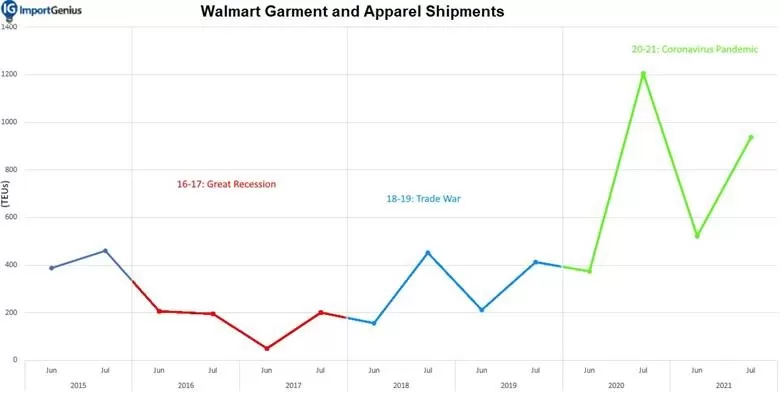

Clothing and apparel shipments were also at the highest level in Walmart's history. Some of the products listed on the bill of lading include pajamas, jogger pants, women's spandex trousers, and stretch-fit jeans for boys.

American Shipper reached out to Walmart for comment but received no response.

Walmart's garment and apparel shipments

C.H. Robinson, the largest carrier of non-vessel imports from China to the US, told American Shipper that its peak season output has begun early.

“We’ve been in the thick of an early peak shipping season for U.S. retailers since April.” Noah Hoffman, Robinson's retail specialist and vice president of North American Surface Transportation, explains. “Some of our 7,500 retail customers started placing orders back then to mitigate shipping delays from their manufacturers in Asia.”

Currently, all of the top 25 US retailers are pulling inventories forward and are ordering much larger quantities than usual in the hopes of at least a small portion of it, said Hoffman. Will arrive in time for the holidays.

“Our priority has been to help our customers replenish current stock, fill shelves for back-to-school shopping and bring in enough holiday inventory,” says Hoffman. “We’re leveraging our analytics and real-time visibility technology to help our customers prioritize their freight, spread shipments out and do mode conversions.”

A FedEx representative told American Shipper, “The ocean freight holiday peak shipping season started ramping up in June this year, about two months earlier than usual. We continue to see more and more U.S. retail importers advancing purchase orders and factory production by as much as six to eight weeks.”

SEKO Logistics sent out an advisory to customers urging Midwest and East Coast shippers to ship their containers no later than August 21 so they are on store shelves by November 1.

“We shared key dates to make sure they are aware that time is running out to get stock in store in the U.S. and Europe in time for Christmas,” said SEKO’s Bourke. “According to the checklist, from a shipping perspective, the dates are three to four weeks earlier than would be expected in a more normal market and some eight weeks earlier from a capacity booking perspective.”

SEKO is not alone in this warning.

In an email to clients, Monroe Consulting's Jon Monroe warned of a repeat of what some shippers witnessed during the previous year's holiday season - which was Christmas in January.

There is a case where a company imports products with a total shipping time (until the goods arrive at the warehouse) exceeding 100 days. This may seem extreme, but it's true. View your orders and calculate order time from the date of goods preparation to the date of arrival at the distribution center.

“It takes you weeks to prebook, weeks to get on a vessel, weeks to get to the terminal after waiting for a berth and if it is an interior point Intermodal shipment, it could possibly take many weeks to get to the destination. If your destination is Chicago, it takes weeks to get your cargo off the terminal.”

In the logistics commentary supporting a survey conducted by the National Retail Federation (NRF) in the US in June, which asked members about ongoing congestion issues, also like peak season.

“A majority of the members who responded noted that they have added more than three weeks to their supply chains,” explains Jon Gold, NRF Vice President of Supply Chain and Customs Policy. “Over 70% of respondents indicated that they would be moving up shipments for peak season to July, August and September, with August potentially being the busiest month".

“We need to find solutions now to address the issues in the short-term but also create more resilient supply chains for the future. The port congestion issues that we are facing are systemic and were here before the pandemic.”

Read more:

Source: Phaata.com (According to Freightwaves)

Phaata.com - The first international logistics marketplace in Vietnam

► Where Shippers & Forwarders connected fast!

.webp)

.webp)