International shipping and logistics market update - Week 32/2024

International logistics and container shipping market update on Asia, Europe and North America routes in the week 32/2024.

International shipping and logistics market update - Week 32/2024

Drewry’s World Container Index for the week of 32/2024 continued to decrease by 3% compared to the previous week, to USD 5,551. This freight rate index is 291% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 32/2024 (Photo: Phaata | Source: Drewry)

Drewry’s World Container Index Week 32/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

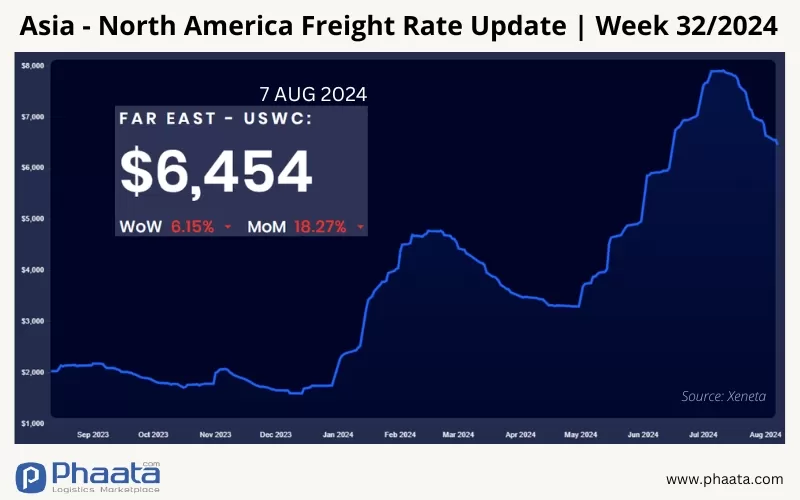

Ocean freight rates from Asia to the West Coast of North America in week 32/2024 to USD 6,454/FEU, down 6.15% week-on-week and 18.27% month-on-month, according to Xeneta data.

With additional vessels entering the trans-Pacific trade, the pressure on space on the Asia-US West Coast (USWC) trade has eased, particularly at ports in the Southwest Pacific.

Volumes remain strong, surpassing last year’s figures on trans-Pacific trades. We are seeing numerous delays around the Cape of Good Hope and port congestion in Asia and North America. Further delays and capacity challenges are expected on the route to the US East Coast (USEC) due to poor weather conditions around the Cape of Good Hope.

On a positive note, water levels in Panama’s Gatun Lake have recovered and local authorities have eased the Panama Canal’s weight restrictions.

Spot rates: Carriers continue to reduce spot rates to all East Coast, West Coast and Gulf regions to balance supply and demand. However, a General Rate Increase (GRI) has been announced by the shipping lines for the second half of August.

Fixed Rates: Discussions on the Peak Season Surcharge (PSS) are very tense at the moment, as the gap between spot and long-term fixed rates does not support price reductions, especially when considering the possibility of GRI implementation in August.

Important: Nearly 10,000 Canadian railway workers represented by the Teamsters Union may strike as early as next week, pending a decision by the Canadian Labour Relations Board (CIRB) on Friday, August 9. The dispute involves Canadian National Railway Company (CN) and Canadian Pacific Kansas City Limited (CPKC), over issues related to working conditions, wages and fatigue management. A strike or lockout could have a major impact on both import and export activities in Canada. Importers and exporters who want to ship goods will need to use other modes of transport to move their goods. CIRB will determine which, if any, essential services will be required to move if the shutdown goes into effect. Both CN and CPKC are committed to reaching a negotiated agreement to prevent any shutdowns.

Asia-US West Coast Freight rate | Week 32/2024 (Image: Phaata.com)

Asia-US West Coast Freight rate | Week 32/2024 (Image: Phaata.com)

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 32/2024 decreased slightly to $8,387/FEU, down 1.70% from the previous week, up 4.52% from the previous month, according to Xeneta data.

THE Alliance has announced three more cancellations in September due to vessel delays, continuing to impact available capacity in the market.

Demand in the last week of August and early September has slowed slightly compared to the June and July markets. Spot rates remain high and with many sailings cancelled, slot availability remains tight.

Demand remains strong and higher than last year on the Asia-Europe trade. Lines are not yet fully compliant with current shipping demand, while there are still several sailings scheduled for cancellation in August. Many sailings are being cancelled to accommodate route adjustments around the Cape of Good Hope and port congestion in Asia. A number of additional vessels have been added to the Asia-Europe trade via the Cape of Good Hope in the second half of July.

On spot rates: Lines have started to increase rates and are offering more slots to match supply and demand.

Long-term fixed rates: Space availability for fixed rate contracts remains very limited. Many carriers stopped offering new long-term fixed rate offers in May. Carriers are prioritizing long-term customers with regular bookings and are introducing space cuts/restrictions in August.

Container Equipment Situation: Carriers have improved their empty container equipment availability, but some locations, with certain container types, such as 20’GP., are still in a state of shortage, especially for long-term fixed-rate contract customers. Shipping lines are prioritizing contracts with high rates.

Phaata advises shippers to proactively arrange bookings as soon as possible on this route.

Asia-Northern Europe Freight rate | Week 32/2024 (Image: Phaata.com)

Asia-Northern Europe Freight rate | Week 32/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia continued to decline in week 32/2024 decreased to USD 660/FEU, equivalent to a decrease of 3.93% compared to the previous week, down 11.65% compared to the previous month, according to Xeneta data.

Capacity has been reduced on routes from the US to the Indian subcontinent, Middle Eastern ports and Northern European ports, related to vessel shortages and cancelled sailings.

To ensure smooth export shipments, Phaata.com advises shippers to book 2 weeks in advance for coastal loading shipments and 3-4 weeks or more for inland rail loading shipments.

US West Coast - Asia Freight rate | Week 32/2024 (Image: Phaata.com)

US West Coast - Asia Freight rate | Week 32/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 32/2024 increased slightly, at 493 USD/FEU, equivalent to an increase of 2.07% compared to the previous week, down 0.60% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 32/2024 (Image: Phaata.com)

Northern Europe - Asia Freight rate | Week 32/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Container Explodes on Yang Ming Ship in Ningbo Port

- Sea-Intelligence Sees No Signs of Sudden US Spending Boom

- Euroseas Reports Positive First Half Results

- Asia - North America West Coast Freight Rates Fall on Weak Demand and Capacity Increase

- Ocean Freight Rates Forecast to Fall in 2025

- Maritime disruptions push Danaos' chartering revenue to $3.2 billion

- New Shipbuilding Orders at Chinese Shipyards Up 43% in H1

- Maersk raises full-year 2024 profit forecast

- International shipping and logistics market update - Week 31/2024

- SITC updates Vietnam-Intra Asia sailing schedules in Aug 2024

- COSCO schedules: Vietnam - North America in Aug 2024

- Pacific Lines updates domestic sailing schedules in Aug 2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)