International shipping and logistics market update - Week 38/2024

Update on international shipping and logistics markets for Asia, Europe and North America in Week 38/2024.

International shipping and logistics market update - Week 38/2024

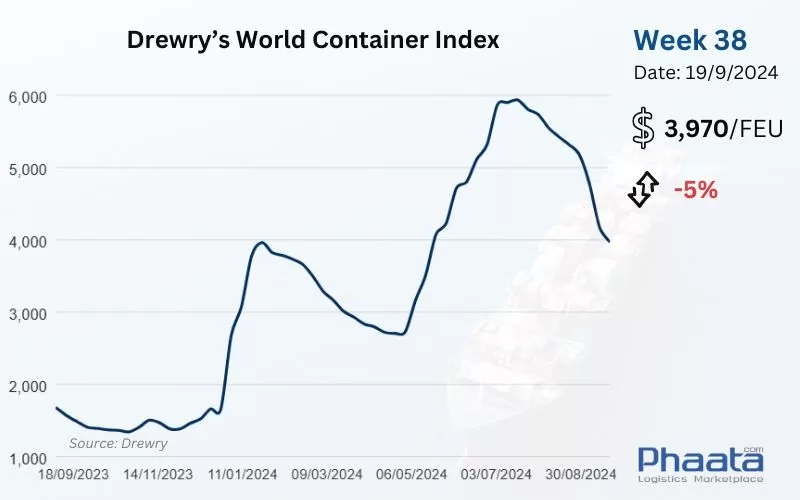

Drewry’s World Container Index for the week of 38/2024 continued to decline sharply by 5% compared to the previous week, to USD 3,970. This freight rate index is 180% higher than the average of 2019 before the pandemic (USD 1,420).

Drewry’s World Container Index Week 38/2024 (Photo: Phaata | Source: Drewry)

1. Asia - Northern America route

Ocean freight rates from Asia to the West Coast of North America in week 38/2024 to $6,128/FEU, down 3.11% week-on-week and 6.93% month-on-month, according to Xeneta data.

Many carriers have added capacity to ease backlogs caused by the surge in cargo volumes from May to July. However, current high inventory levels may reduce demand for additional cargo in the coming weeks, causing rates to decline.

As the market approaches Golden Week, there is still no sign of an increase in cargo volumes during this period. With the threat of a strike by the International Longshoremen’s Association (ILA), cargo is being diverted to the US West Coast as a contingency plan.

In addition, some carriers are considering surcharges at East Coast/Gulf Coast ports in mid-October if an ILA outage occurs. If an ILA outage occurs, it is expected that there will be carrier surcharges, disruptions, port congestion, and impacts on vessel deployment schedules at East Coast/Gulf Coast ports. Additionally, the market may see equipment shortages at the origin port, depending on the length of the outage.

Carriers are implementing plans to blank sailings that will impact Week 38 to Week 41 to adjust capacity on this trade in preparation for the upcoming Golden Week holiday in China. Expect changes to shipping schedules or transit times, especially for feeder connections, as blanked sailings may result in shipments being transferred to subsequent sailings.

Spot Rates: Temporary rates have been extended to the end of September, with some downward adjustments. Surcharges at East Coast/Gulf ports are likely to be applied by carriers in October, depending on the likelihood of ILA shutdowns after Golden Week.

Fixed Rates: Peak Season Surcharges (PSS) will remain in place until the end of September and will continue into October (through Golden Week).

Asia-US West Coast Freight rate | Week 38/2024 (Image: Phaata.com)

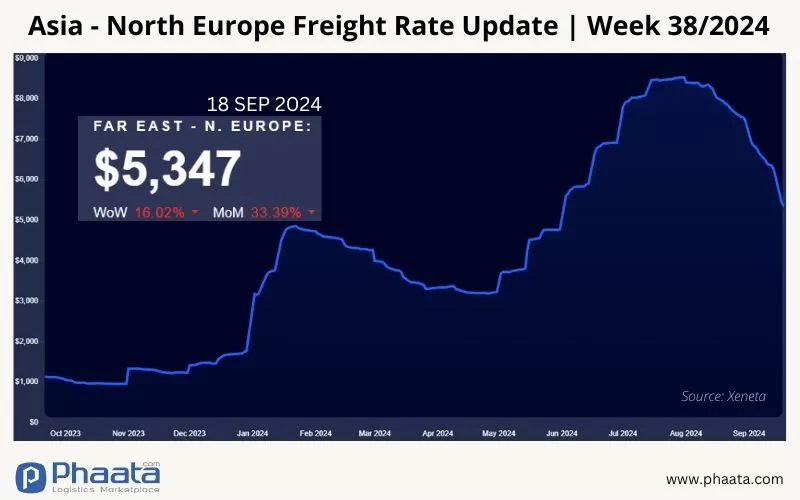

2. Asia - Northern Europe route:

Freight rates from Asia to North Europe in week 38/2024 to USD 5,347/FEU, equivalent to a decrease of 16.02% compared to the previous week, down 33.39% compared to the previous month, according to Xeneta data.

Declining demand, along with many canceled sailings, reduced operations in late August. Shipping vessels were used relatively efficiently with a fairly high occupancy rate. However, in September, with many vessels returning to Asia, the market will have more capacity than in August. Shipping lines are currently pushing to fill vessels by increasing cargo volumes. Cargo volumes in the last week of September may increase slightly, but we do not expect any problems with space.

Freight rates have fallen further in the second half of September, but remain higher than in early 2024. Carriers are being more proactive in adjusting rates to optimize vessel utilization. The SCFI fell another $618/TEU last week; over the past three weeks, the SCFI has also fallen from $4,400/TEU to $2,841/TEU.

Shippers on long-term contracts are still facing limited space availability and equipment priority.

Carriers are cautiously reopening negotiations. Container equipment shortages are improving, but some ports of origin (POLs) with low direct calls still anticipate potential equipment shortages for certain container types, such as 20’GP and 45’HC.

Asia-Northern Europe Freight rate | Week 38/2024 (Image: Phaata.com)

3. Northern America - Asia route:

Freight rates from North America (West Coast) to Asia continued to decline in week 38/2024 dropped sharply to USD 646/FEU, equivalent to a decrease of 7.05% compared to the previous week, down 5.69% compared to the previous month, according to Xeneta data.

Capacity has been reduced on routes from the US to the Indian subcontinent, Middle Eastern ports and Northern European ports, related to vessel shortages and cancelled sailings.

In October, freight rates are forecast to increase on major routes from US East Coast and Gulf Coast ports.

To ensure smooth export shipments, Phaata.com advises shippers to book 2 weeks in advance for coastal loading shipments and 3-4 weeks or more for inland rail loading shipments.

US West Coast - Asia Freight rate | Week 38/2024 (Image: Phaata.com)

4. Northern Europe-Asia route:

Freight rates from North Europe to Asia continued to decline slightly in the week of 38/2024 increased slightly to USD 469/FEU, equivalent to an increase of 0.64% compared to the previous week, down 5.44% compared to the previous month, according to Xeneta data.

Northern Europe - Asia Freight rate | Week 38/2024 (Image: Phaata.com)

Find Freight rates here.

Find Logistics Companies here.

Read more:

- Etihad Cargo and SF Airlines deepen partnership

- Maersk: Container Demand Remains Strong in Q4/2024

- DSV Acquires DB Schenker, Becomes World's Largest Freight Forwarder

- PSA Mumbai Crosses 200,000 TEUs in August

- Port of New Orleans Back in Business After Hurricane Francine

- Container rates post biggest weekly drop since May 2020

- International shipping and logistics market update - Week 37/2024

Source: Phaata.com

Phaata.com - Vietnam's First International Logistics Marketplace

► Find Better Freight Rates & Logistics Services!

.webp)

.webp)